Before you start reading this text, ask yourself: “How much financial data do I need to process each month, each week, or at a single time?” And the next question: “How much of that data is outdated?” Traditional accounting...

Before you start reading this text, ask yourself:

“How much financial data do I need to process each month, each week, or at a single time?”

And the next question:

“How much of that data is outdated?”

Traditional accounting methods, often reactive and historical in nature, are being superseded by an innovative approach that emphasizes real-time data analysis and decision-making. Known as continuous accounting, this approach is reshaping the operations of modern finance teams, moving them away from traditional period-end processes and towards the embrace of real-time financial intelligence.

Continuous accounting builds upon traditional accounting principles but elevates them to a new level by leveraging technology and automation. This technological advancement enables faster processing, facilitating real-time data analysis and reducing the reliance on manual processes. Consequently, finance teams can operate with greater accuracy and efficiency, becoming more agile, data-driven, and proactive in their decision-making strategies.

However, this is just the beginning of the story. In the following sections, we will delve deeper into the concept of continuous accounting, discuss why it is becoming the new norm in modern finance, and explore the compelling reasons why your business should consider adopting it.

What is Continuous Accounting?

Traditional accounting practices involve waiting until the end of a reporting period to analyze financial data and make decisions. This old practice is not aligned with the fast-paced business world, where real-time insights are crucial for making informed, strategic decisions.

Continuous accounting is a modern approach to managing financial records and processes that integrates the recording, processing, and analyzing of financial data continuously throughout an accounting period. It stands in contrast to the traditional batch processing method, where financial activities are compiled, processed, and reported at fixed intervals, typically at the end of a month, quarter, or year.

Continuous accounting eliminates the traditional periods or ‘close windows’ that require tedious manual labor. Instead, it enables finance teams to continuously update their records and generate accurate financial statements and reports in real-time. This approach involves real-time processing of financial transactions, continuous monitoring and analysis of financial data, and the incorporation of technology-driven tools such as artificial intelligence (AI), robotic process automation (RPA), and machine learning (ML).

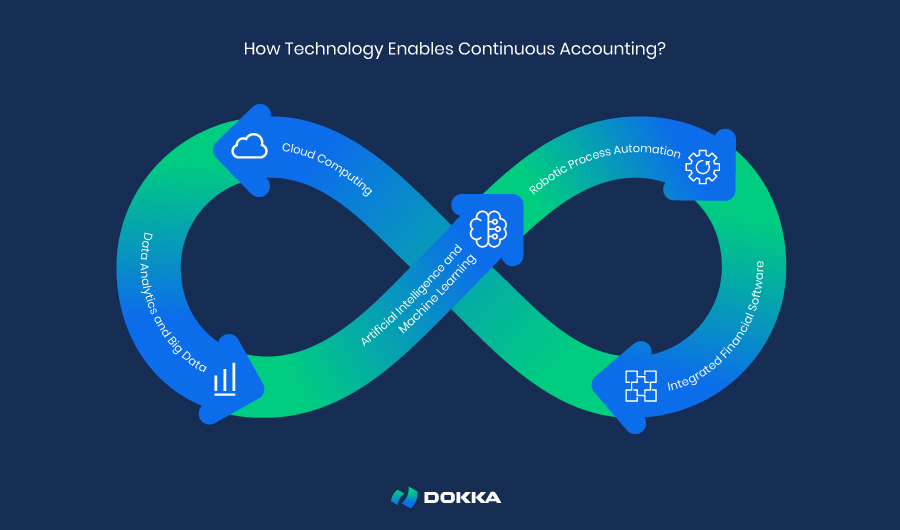

How Technology Enables Continuous Accounting?

With the abundance of financial data generated by businesses, traditional manual processes are no longer sufficient to keep pace with the complexity of modern finance operations. Technology provides a solution by automating many time-consuming tasks, allowing finance teams to focus on higher-value analytical work.

Key technological enablers that are the cornerstone of continuous accounting include:

Cloud Computing: Enables secure, scalable, and accessible storage and processing of vast amounts of financial data from a central location (or a hub). This allows for real-time data analysis and collaboration among finance teams, regardless of their geographical location. Data Analytics and Big Data: Facilitates the analysis of large datasets to derive meaningful insights and trends, including predictive analytics, anomaly detection, and fraud detection. Artificial Intelligence (AI) and Machine Learning (ML): AI and ML are revolutionizing the way financial data is collected, analyzed, and reported. They provide intelligent algorithms that can process large amounts of data in real-time, identify patterns and anomalies, and generate accurate reports much faster than humans. Robotic Process Automation (RPA): RPA plays a crucial role in enabling continuous accounting. By automating repetitive and manual tasks, it increases efficiency, reduces errors, and frees up resources for more analytical work. Integrated Accounting Software: Modern software solutions combine Enterprise Resource Planning (ERP) systems with purpose-built accounting operating systems to offer an integrated platform for managing all financial processes. These systems are next-generation of accounting automation. They streamline data flow, eliminate data silos, and provide real-time access to accurate financial data.These technological advancements have transformed continuous accounting into a practical reality, allowing finance teams to operate with greater agility and accuracy. By harnessing automation, continuous accounting turns financial management into a more strategic, efficient, and forward-looking practice.

Why You Should Embrace Continuous Accounting

Continuous accounting is gaining momentum as the preferred approach to modern finance for several compelling reasons. Its benefits extend beyond just speeding up the financial close process; they also improve overall finance operations and decision-making.

Here are the key reasons why continuous accounting is becoming the new standard for modern finance:

Real-Time Insight: Continuous accounting enables real-time financial insight. Traditional accounting methods often result in a lag between financial activities and their reflection in financial statements. Continuous accounting bridges this gap. Greater Accuracy: By automating many of the repetitive tasks associated with traditional accounting, continuous accounting reduces human error. Automation ensures entries are consistent and accurate, leading to more reliable financial data. Increased Efficiency: Continuous accounting streamlines processes, reducing the time and effort required for month-end and year-end closings. This efficiency allows finance teams to focus on more strategic tasks, such as analysis and forecasting. Better Compliance: With continuous accounting, companies can maintain a more consistent and transparent record-keeping process. This consistency is crucial for compliance with various financial regulations and standards. Strategic Decision Making: Continuous accounting provides a steady stream of financial data, which can be used for more strategic planning and forecasting. The ability to quickly adapt and plan based on current financial data is invaluable in a rapidly changing business environment. Employee Satisfaction: Continuous accounting also positively impacts the workforce. By reducing the workload and stress associated with traditional accounting cycles, it can lead to higher employee satisfaction and retention. Employees are less likely to be bogged down by repetitive tasks and can engage in more meaningful work. Enhanced Confidence: Timely and accurate financial reporting enhances the confidence of investors, lenders, and other stakeholders. Continuous accounting ensures that these parties have access to the most current financial information, which can positively affect the company’s reputation and trustworthiness. Scalability: As businesses grow, their financial processes need to scale with them. Continuous accounting, being more automated and streamlined, scales more effectively than traditional accounting methods.In conclusion, the advantages of continuous accounting are unmistakable, signaling its emergence as the future of modern finance. For businesses aiming to stay ahead in the competitive landscape and secure long-term success, adopting continuous accounting is a wise decision.

How To Get Started With Continuous Accounting

Implementing continuous accounting in a company is a transformative process that demands strategic planning and a step-by-step approach, and it’s easy to get lost in a process. If you don’t know how to get started, consider the following steps:

Identify Key Processes Invest in Technology Redesign Processes Train Employees Monitor and Evaluate1. Identify Key Processes

The first crucial step in implementing continuous accounting is pinpointing which accounting tasks can benefit most from automation. Typically, this includes routine processes like journal entries, reconciliations, and intercompany transactions, which are often time-consuming and prone to errors. Analyze your current accounting workflow to identify inefficiencies and areas ripe for streamlining. Deciding which processes to automate first should be based on their impact on efficiency and the ease of transition.

2. Invest in Technology

Continuous accounting relies heavily on advanced technology. Investment in automation tools and cloud-based software tailored to your company’s specific needs is essential. It’s vital to ensure that new technology integrates well with existing systems to ensure seamless data flow and avoid disruption. Moreover, choosing technology that can scale with your business growth is crucial for long-term success.

3. Redesign Processes

Transitioning to continuous accounting means moving away from periodic reporting to a more dynamic process, necessitating a complete redesign of traditional accounting methods. Implementing automated workflows reduces manual efforts and improves accuracy. This includes tasks like data entry, transaction matching, and report generation. Moreover, shifting towards real-time financial reporting requires adjustments in data collection and analysis methods to provide more timely insights for decision-making.

4. Train Employees

Developing training programs tailored to your team’s needs is crucial in ensuring they understand both the new technology and the principles of continuous accounting. Providing continuous learning opportunities and support helps employees stay updated with the latest technology and practices. Encouraging an adaptive mindset among employees is also essential to effectively embrace the new system and practices.

5. Monitor and Evaluate

Establishing clear metrics to measure the success of the continuous accounting implementation is vital. Conduct regular review sessions to assess progress against these metrics and be prepared to make adjustments based on feedback and performance data. Continuous accounting is about constant improvement and adaptation to evolving business needs.

The post Continuous Accounting: The New Standard for Modern Finance appeared first on DOKKA.