As the holiday season approaches and the calendar inches closer to the New Year, we understand that the jolly spirit may be tempered by the looming pressure of Self Assessment tax preparation. The days are ticking away, and before...

As the holiday season approaches and the calendar inches closer to the New Year, we understand that the jolly spirit may be tempered by the looming pressure of Self Assessment tax preparation. The days are ticking away, and before you know it, January will be knocking at the door with a pile of unfinished tasks waiting to be tackled.

But fear not! QXAS, your ultimate partner in tax outsourcing services, is here to guide you with tailored support, ensuring a smooth start to the upcoming tax season.

Outsourcing Tax Preparation to QXAS: Step-by-Step Guide

Step 1: Selecting an Engagement Model

QXAS offers not one, but two flexible engagement models to suit your unique needs. Whether you prefer a Per Tax Return model or a Per Resource model, the choice is yours. The Per Tax Return model allows you to pay based on the number of returns processed, while the Per Resource model provides the flexibility of hiring a dedicated professional (FTE/PTE) or a team for a fixed cost.

Step 2: Shortlisting Candidate Resumes

Our team at QXAS takes the hassle out of the hiring process by presenting you with a curated selection of experienced tax professionals. Say goodbye to tedious hours spent sifting through resumes; we’ve got that covered. Our candidates are handpicked to meet your specific requirements, ensuring a perfect match for your firm’s needs.

Step 3: Conducting One-on-One Virtual Interviews

Connect with your potential team members through virtual interviews, getting a firsthand feel of their expertise, skills, and cultural fit with your firm. It’s a chance for you to assess and select the professionals who align with your vision and standards. The QXAS team facilitates seamless virtual interviews, taking the tedium out of outsourcing and tax and making the process efficient and effective.

Step 4: Onboarding

Once you’ve selected your tax preparation dream team, the onboarding process begins. We handle the paperwork, introductions, and training, ensuring your new team is up to speed and ready to hit the ground running. Our goal is to make the transition as smooth as possible, so you can focus on what matters most – the success of your firm.

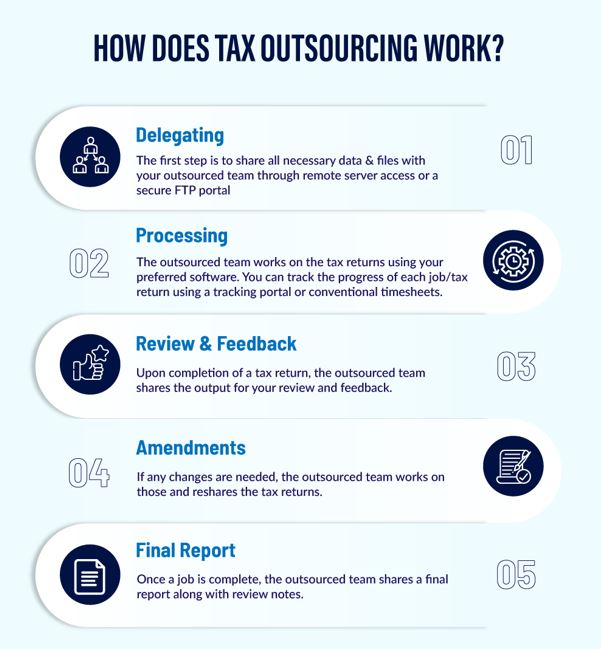

How Does Tax Outsourcing at QXAS Work?

Task Monitoring and Feedback

Worried about losing control over your projects? Fear not! QXAS empowers you with the QXAS Tracker App, allowing you to monitor the progress of each job in real-time. Stay informed about project milestones, deadlines, and deliverables, ensuring transparency and accountability at every step. Regular feedback meetings further enhance communication and collaboration, fostering a partnership that goes beyond mere outsourcing.

Whether you are in the office or on a holiday break, rest assured that our dedicated team will work efficiently to help you meet deadlines. Our dedication, competence, and robust communication systems have led 200+ accounting firms to trust us for tax outsourcing services in the UK over the years.

Frequently Asked Questions (FAQs)

1. How Can I Improve This Self Assessment Tax Season?

Improve your Self Assessment tax season by outsourcing tax preparation to QXAS. Our expert services streamline the process, ensuring accuracy and efficiency, allowing you to focus on your core business activities.

2. Can I Get Any Discounts on Tax Preparation Support?

Yes, we are currently offering specialised pricing for tax outsourcing services starting at just £40* until December 2023. The pricing depends on the complexity of your tax returns. We also provide volume-based discounts.

What Our Clients Say About Us

Final Thoughts

As we near the end of December, time is of the essence. The holiday season is a reminder that the clock is ticking, urging you to make strategic decisions for the year ahead. By outsourcing tax preparation services to QXAS, you not only gain a reliable partner but also buy back precious time to focus on the growth and success of your firm.

Make this holiday season truly joyful by gifting yourself the peace of mind that comes with a well-prepared tax season. Take the first step towards a stress-free January – outsource with QXAS today.

Wishing you a prosperous and worry-free holiday season.

Getting Started With Us

Getting started with us is as easy as ordering your next meal. Simply call us at +44 208 146 0808 or drop a line at qxas@qxglobalgroup.com and our team will set up a meeting for you. Communicate your needs to our expert and they’ll guide you through the entire process.

Prefer a face-to-face meeting? Our expert, Pramith Naidu, VP – Client Relations, is available for in-person meetings in London. Book his calendar here.

We hope you enjoyed reading this blog. If you want our team to help you resolve talent gaps, reduce costs and transform your business operations, just book a call.

Book a Free Consultation

The post Year-End Lifesaver: Step-by-Step Guide for Outsourcing Tax Preparation Services to QXAS first appeared on QXAS UK.