The business of CPAs is blossoming in the USA, the UK, and several other parts of the world due to increasing statutory requirements, the emphasis on data-driven business decision-making, better resource management, and other aspects. As the trends have...

The business of CPAs is blossoming in the USA, the UK, and several other parts of the world due to increasing statutory requirements, the emphasis on data-driven business decision-making, better resource management, and other aspects. As the trends have been changing over the past few years, small to large-scale businesses have realized the worth of outsourced accounting to a reliable CPA firm or an offshore accounting company. Even CPAs have started outsourcing accounting jobs to offshore companies to augment their ROI model.†

Businesses have realized that accounting is not just a bookkeeping job. It is much more than that. Business accounting and finance management covers all the following and many other aspects:†

Processing records, documents, pay slips, etc. from distinct sources† Handling paperwork along with digitized solutions Following constantly changing statutory regulations related to taxation, accounting, etc., and applying them in the practice† Calculate and make accurate deductions for employees and file details to the government on time† Create an income tax return and file it as per the deadline† And many more†There is a lot of hassle to manage all accounting jobs and it needs real experience and expertise. Businesses have experienced that an offshore accounting company can yield better returns compared to doing everything in-house.†

To evaluate the effectiveness of accounting outsourcing services, here are some interesting industry statistics:†

The total outsourcing market in the USA for the Finance and Accounting market is estimated to reach 68.8 billion US dollars (source). 37% of businesses, especially small businesses, put accounting as one of the top business operations to outsource. The global market of finance and accounting outsourcing will reach 53.40 Billion US Dollars by 2026. The CAGR rate over the analysis period is 5.9%.From small businesses to large-scale enterprises in countries like the USA and the UK prefer outsourcing accounting and finance services to a reliable offshore accounting company because of a plethora of advantages this model has compared to conventional in-house accounting.

Must Read: Why Business Owners Should Hire Remote Accountants for Accounting Operations

Case Study of a CPA Firm in the USA†

A mid-sized CPA firm has outperformed its competitors with its excellent outsourcing accounting services for many years. However, constant pressure from peers, friction due to manpower attrition, and similar other factors were slowing down the growth rate of the firm. To meet the increasing business demand and continue growing with a positive ROI rate, the CPA firm chose to outsource the accounting jobs to a leading offshore accounting company based in India. The CPA firm started experiencing high customer value management and boosted returns on money by reducing operational expenses, removing the need for an in-house team and tool management, and completely channelizing energy in handling customers.??†

Top Reasons to Outsource Your Accounting Project to an Offshore Company in India†

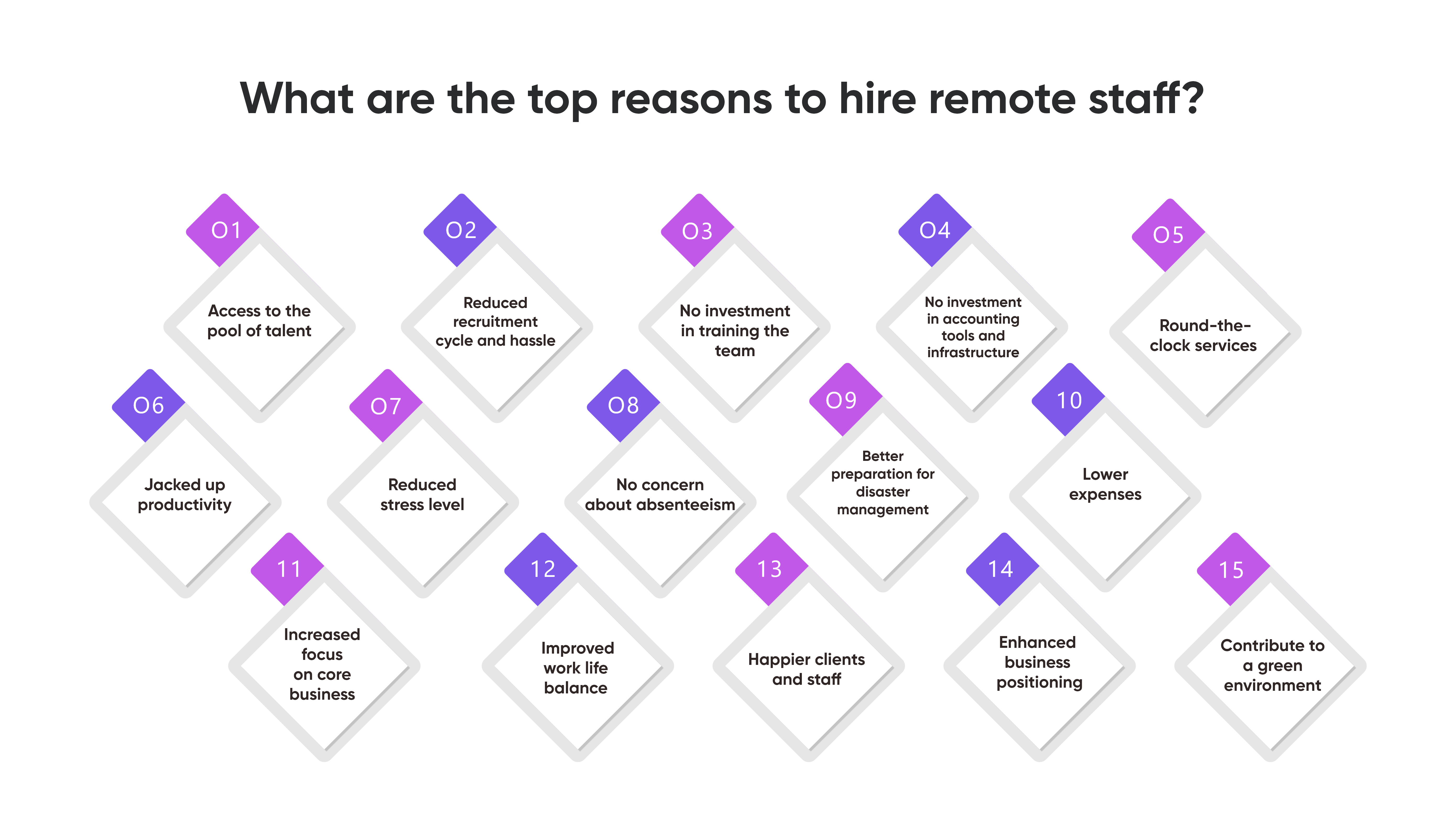

Whether you are thinking of outsourcing your own accounting jobs or if you are running a CPA firm and willing to outsource the accounting books of your clients to an offshore accounting company, there are several advantages to pull. If there is something stopping you from taking this vital decision, here are the top ten reasons to outsource your complete accounting job.†

1. Channelize resources on core strength†

1. Channelize resources on core strength†

The foremost aim of any business is to persistently offer delightful customer services to improve customer loyalty and rapidly grow the customer base by onboarding new clients. By outsourcing your accounting jobs to an offshore accounting company, you can be stress-free from the intricacies related to accounting, statutory compliances, human resource management, etc. Your all resources can be channelized to work in the direction of your core vision and mission. You can put more effort into marketing, customer care, and similar jobs to grow at the fastest rate while all accounting jobs are handled by your partner company.†

2. Lower expenses†

One of the major reasons to use outsourcing services from a reliable offshore accounting company is to save funds by eliminating an in-house team of accounting experts. You will not need to pay for any of the following:†

Fixed wages† Statutory investments like health insurance, provident funds, etc.† Physical office with furniture, electricity, internet, and other infrastructural elements† Accounting tools and software†The fee for outsourcing accounting services is likely to be 10x times lower than the expenses you need to bear by setting up an in-house team of accountants.†

Must Read:†Top 10 Best Tax Preparation Software for CPAs and Accounting Firms in the USA

3. Expertise and Experience†

A company that offers outsourced accounting and other finance management services often invests in hiring a highly skilled team of CPAs and certified accounting experts. These companies also invest in upgrading the skills and knowledge of these experts by investing in the best tools, training, and more. Thus, a CPA firm receives access to the most talented and experienced experts to handle their jobs, which would boost profit making.†

4. Scalability†

Outsourcing accounting jobs to the most professional firm helps in gaining exceptional scalability. You donít need to scout accounting professionals as your business grows. The offshore accounting company will have a team of versatile accountants and CPAs that are ready to work for you at much lower hourly rates than the in-house team. Moreover, you can onboard these experts within the least turnaround time. This not only provides excellent scalability, but it also provides a great morale boost to rapidly grow and increase revenue generation as you have a team of experts backing you to handle any volume of finance management jobs.†

5. Access to Advanced Technology†

A company offering offshore services often works with a wide variety of tools and software platforms. Along with having access to all popular and not so popular tools within their firm to delight customers, these agencies also work with local software and tools available at client premises even if they work remotely.†

In summation, these agencies have proficiency in working with all major tools to provide efficient jobs. Furthermore, they easily adapt new tools and technology in the shortest learning curve to provide seamless services to clients. That means you not only receive excellent output but also ongoing recommendations by having a highly tech-savvy team onboard by partnering with an offshore accounting company.†

6. Better Risk Management†

When you run a business, there are several risks associated with each business function. In terms of accounting any misplaced records or errors can lead to financial losses, plus reputation damage. You may also face legal penalties for these mistakes. Another risk associated with running a business is losing your best finance management expert or a majority of accounting professionals working for you in-house. This can be a major risk because your work would suffer until you hire a replacement. But recruitment of skilled experts is a time consuming job.†

By using services from an offshore accounting company, you will alleviate all these risks because you will always have a team working with the utmost efficiency and accuracy. Moreover, a replacement for any accounting expert leaving the firm will be available immediately so work never suffers.†

Must Read:†Remote Accounting Services: Driving Growth and Profitability for Businesses

7. Increased Efficiency†

The companies offering outsourced accounting services use a combination of the best tools, technology, and talent to ensure their clients receive the most accurate and efficient outcomes. You can stay rest assured that you will always receive efficient and on-time services.†

8. Improved Reporting†

Reporting is one of the vital jobs in efficient finance management. The top outsourced CPA firms offering the best accounting outsourcing services focus on clean and insightful reporting. You will receive the most accurate, professional, and efficient reports that go through a thorough quality check process from an offshore accounting †company. Unlike an in-house team scenario, you will also not suffer from delays because of absenteeism as the offshore agencies will always have enough manpower to deliver on time.†

9. Trusted Team†

Management of business accounts and financial jobs is a critical function and is associated with major risk because money and reputation are involved. Cases of internal data theft, financial fraud, and similar risks are evident in companies.†

The offshore accounting company can let you stay worry free about these types of risks. They will not only have a highly trusted team, but they will also have strict policies to control this type of incident. Many companies also work in their own system and environment to avoid fraudulent activities and data theft risks.

10. Improved Cash Flow Management†

A healthy management of cash flow in any business defines definitive success. To take the necessary actions to keep flowing cash flow cycle seamlessly, it is necessary to improve accounts receivable and accounts payable. Outsourced accounting will ensure on-time and accurate bookkeeping, reporting, and forecasting to help businesses improve cash flow and reap the best business benefits, including high profit.†

The best countries to outsource accounting jobs†

Most countries prefer to outsource their accounting and finance management jobs to an India-based offshore accounting company. Most of these firms are reliable and have a highly experienced and certified team to provide exceptional services. Other than India, there are some more countries that provide outsourcing accounting services. This list includes China, the Philippines, Malaysia, and a few other Asian countries.†

India is the most preferred choice because the companies charge lower hourly rates and provide the best services to customers. Moreover, India has youth as a major asset to work round the clock and provide efficient services.†

Must Read:†Top 5 Outsourced Bookkeeping Companies for CPA Firms to Streamline Your CPA Practice

Top Qualities to Look for in an Offshore Accounting Company†

Reliability†

The first thing to look for before selecting a partner for accounting outsourcing is the reliability of the company. You must check how many years the company has been operational. You can also check certifications and awards held by the agency for assessment of reliability.†

Team†

The offshore accounting company must have highly skilled and certified CPAs and accounting experts. Along with having enough manpower, the company must have diversified talent and experience to ensure they can provide the best and most affordable outsourcing accounting services.†

Communication and interpersonal skills†

A majority of countries offering offshore accounting are not English speaking countries. Thus, it is necessary to partner with an offshore accounting company that has a highly proficient team. They must have a good command over the English language to understand your requirements and demands and deliver satisfactory services.†

Problem solving attitude†

Usually, companies offer outsourced accounting work in different time zones than the businesses. Moreover, taxation situations, employee absenteeism, and several other challenges can come across an offshore accounting company that handles your finances. They must have a problem solving attitude and skills to manage these challenges seamlessly and not pass any stress to you.†

Government support and law†

It is necessary to work with an offshore accounting company that resides in a country that has friendly laws for companies that outsource business to the nation. Thus, always check how strongly the legislation supports businesses that provide revenue generating and employment opportunities to the country and how it saves your interest. This will give double surety of better risk management.†

Wrap-up†

Wrap-up†

Accounting outsourcing has become a new trendsetter in countries like the USA, the UK, and more because of a plethora of benefits associated with it. A reliable agency will ensure that you receive the most efficient services, exactly on time, and with the least involvement from you. You also save a lot of funds and can easily streamline processes by outsourcing this service to the best offshore accounting company.†

There are some really outstanding companies working in this offshore business and providing extraordinary services to their customers at much lower rates. Moreover, many countries like India have friendly laws to support this ecosystem and save the interest of both partners, which creates a mutual ground for business.†

Outsourcing this job to a reliable offshore accounting company ensures that a business can put all its resources and efforts into other vital business jobs like customer retention, increased sales rate, enhanced valuation, and more. There are several positive driving factors that put jobs of accounts and finance management in the list of topmost outsourced jobs in the world even by small businesses.††

Have these thoughts changed your mind?†

Are you thinking of taking advantage of this trendsetter?††

We, CapActix, are one of the top companies in the industry of offshore accounting. We have been helping CPAs and accounting firms in the USA, the UK, and several other countries with our efficient and accurate accounting services. We have a range of offerings that suits the different needs of businesses and CPAs in the USA and worldwide. If you are interested in learning more about how we can help you boost the review of your firm with our accounting outsourcing services, then get in touch with us via Email biz@capactix.com or call us at +1 201-778-0509.††

The post 10 Reasons to Boost Your Revenue and Efficiency with Accounting Outsourcing Services appeared first on CapActix.