In the bustling world of business, financial statement profits may grab the headlines, but it's cash flow that keeps the lights on. It's the lifeblood of a company, ensuring you have the resources to pay bills, invest in growth,...

In the bustling world of business, financial statement profits may grab the headlines, but it's cash flow that keeps the lights on. It's the lifeblood of a company, ensuring you have the resources to pay bills, invest in growth, and ultimately, stay afloat. Accrual accounting is important for many reasons when analyzing the performance of your business but your income statement profit is not the same as your cash flow.

Let’s take a deeper dive into what “cash flow” is, how to calculate it, and why you should be looking at the past and future.

Unpacking the Basics: What is Cash Flow?

Put simply, cash flow measures the movement of money in and out of your business. It's not just about profit; it's a real-time snapshot of your financial health. Think of it like a river: cash inflows represent the water flowing in (sales, investments, etc.), while outflows are the water flowing out (expenses, loan payments, etc.). The key is to maintain a healthy balance, ensuring that enough water enters to keep the river flowing.

Navigating the Cash Flow Landscape: 3 Types of Cash Flow

Not all cash flows are created equal. Here are the three main categories of cash flow on the Statement of Cash Flow that you need to understand:

Operating Cash Flow: This measures the cash generated by your core business activities, including sales, operating expenses, and inventory changes. It's your bread and butter, the lifeblood that keeps your day-to-day operations running smoothly. This is the easiest type to understand as it closely resembles the income statement.

Investing Cash Flow: This reflects the cash movement associated with your investments, such as purchasing new equipment, acquiring other businesses, or investing in financial instruments. It represents your growth and expansion potential.

Financing Cash Flow: This tracks the cash you receive or pay from lenders and investors. Think of it as the oxygen that fuels your expansion, but be mindful of overdependence, as excessive debt can be a burden.

Formula Focus: Calculating Operating Cash Flow Step-by-Step

Ready to roll up your sleeves and get down to the nitty-gritty? Here's how to calculate your operating cash flow, the most crucial of the bunch:

Gather Your Tools: You'll need your income statement (profit and loss statement) and balance sheet. These financial documents provide the raw data for your calculations.

Start with Net Income: Locate your net income on the income statement. This is your starting point, the profit your business generates through its operations.

Adjust for Non-Cash Expenses: Depreciation and amortization are expenses that don't involve actual cash outflow. Add them back to your net income to get a more accurate picture of your cash flow.

Manage Working Capital Changes: Track the change in your current assets and liabilities (inventory, accounts receivable, accounts payable) between two periods. An increase in liabilities or decrease in assets represents a cash inflow, while the opposite indicates a cash outflow. Factor this change into your calculations.

Tally the Tolls: Add up all your operating expenses, including rent, salaries, utilities, and other cash outflows.

Unveiling the Truth: The grand finale! Subtract your total operating expenses and working capital changes from the adjusted net income. The resulting figure? Your glorious operating cash flow!

Example Time: Putting Theory into Practice

Let's say your company, "Acme Widgets," had a net income of $10,000 last month. You also had $2,000 of depreciation and an increase in accounts payable of $1,500. On the other hand, your operating expenses totaled $8,000. Plugging these figures into our formula, we get:

Operating Cash Flow = $10,000 (Net Income) + $2,000 (Depreciation) + $1,500 (Change in Accounts Payable) - $8,000 (Operating Expenses)

Operating Cash Flow = $5,500

Congratulations, Acme Widgets! You have a positive operating cash flow of $5,500. This means your business is generating enough cash to cover its expenses and even have some left over for reinvestment or debt repayment.

Although you may not need to look at the detail of your Operating Cash Flow movement or the other two categories, you should always have a good read on the bottom of the Statement of Cash Flow that shows your net cash movement for the period.

Looking Into the Future: 13-week Cash Forecast

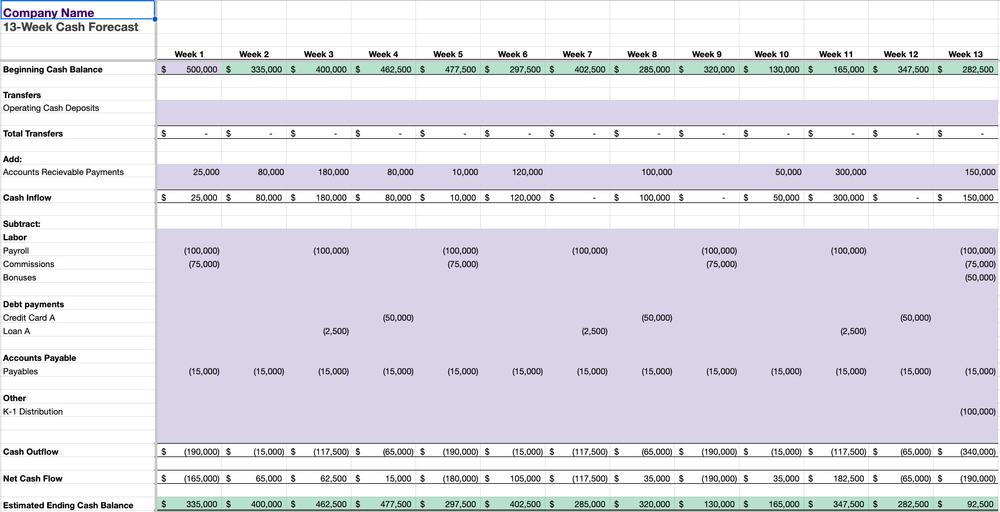

Now that you’ve mastered the statement of cash flow by understanding its calculation, different types, and significance, it’s time to move on from a statement that looks at the past to a tool that looks 90 days into the future: the 13-week cash forecast.

The cash forecast is usually just a simple spreadsheet that has 13 columns and as many rows as needed to show the various ways cash is coming in (e.g. payments of sales invoices by your customers or investor deposits) and going out (e.g. credit card statement payments or payroll). The bottom row will calculate your expected ending cash balance for the week which carries forward to the top of next week’s column.

Project out everything you can think of for those next 13 weeks and update it weekly. The smaller the business, the more accurate you can be due to the simplicity of cash spend. The larger or more complex your business spending becomes, the harder it will be to be “accurate” as you’ll need to be thinking about becoming close versus exact.

You can download a copy of our basic 13-week cash forecast template to get you started below.

Add line items to increase the level of granularity needed.

Click to launch template and download your copy.

A 13-week cash forecast serves several key purposes in a business:

1. Short-Term Visibility: Compared to traditional annual or quarterly financial forecasts, a 13-week plan provides a much closer look at your immediate cash requirements. This allows you to:

Identify potential cash shortages: By predicting weekly cash inflows and outflows, you can identify periods when you might fall short, giving you time to take corrective action.

Monitor working capital: You can track the movement of your current assets and liabilities, ensuring you have enough resources to cover your short-term obligations.

Make informed tactical decisions: This detailed forecast empowers you to make informed choices about things like inventory management, pricing strategies, and temporary financing needs.

2. Improved Decision-Making: With a clear understanding of your upcoming cash flow, you can make better decisions across different areas of your business, including:

Inventory management: Knowing your anticipated sales helps you optimize inventory levels to avoid both overstocking and stockouts.

Pricing strategies: You can adjust your pricing based on anticipated demand and trending cash flow needs.

Negotiating Vendor Payment Terms: Leverage the forecast to negotiate extended payment terms with vendors, improving your short-term cash flow position.

Marketing and Sales Campaign Timing: Align marketing and sales campaigns with anticipated cash inflows to maximize impact and prevent overspending during tight cash flow periods.

Loan negotiations: When facing a cash crunch, a 13-week forecast provides a stronger basis for negotiating favorable loan terms with lenders.

3. Early Warning System: A 13-week forecast acts as an early warning system, allowing you to:

Identify potential problems: By proactively anticipating cash flow challenges, you can take steps to mitigate them before they become major issues.

Adapt quickly to changes: The short-term focus allows you to adjust your plans and strategies quickly based on changes in market conditions or unexpected events.

Prevent financial distress: By addressing potential cash shortfalls early, you can avoid financial distress and ensure the smooth operation of your business.

4. Communication and Transparency: A 13-week forecast fosters transparency within your organization by:

Keeping stakeholders informed: This detailed plan keeps key stakeholders like investors and board members informed about your near-term financial outlook.

Facilitating collaboration: By sharing the forecast with various departments, you can encourage collaboration to identify potential risks and optimize cash flow strategies.

Building trust: Regularly presenting a clear and accurate forecast builds trust with stakeholders and demonstrates your commitment to financial responsibility.

A 13-week cash forecast is a valuable tool for any business seeking to improve its financial stability, make informed decisions, and navigate the ever-changing business landscape. By implementing this practice and reviewing your forecast regularly, you can position your business for success and ensure you have the cash flow to achieve your financial goals.

Tools and Resources

Leveraging the right tools can significantly simplify your cash flow management:

Accounting Software: Invest in accounting software that offers built-in cash flow reporting and forecasting features. This automates calculations and provides real-time insights into your financial health.

Spreadsheets: Utilize spreadsheet templates specifically designed for cash flow analysis. These can be customized to fit your specific needs and provide a visual representation of your cash inflows and outflows.

Outsourced Accountants: For complex financial decisions or intricate cash flow challenges, seek guidance from professional, outsourced accounting teams like Basis 365 Accounting. Our expertise can help you develop strategies tailored to your unique situation.

Remember, cash flow management is not a one-time event; it's an ongoing process that requires continuous monitoring and adjustment. By diligently tracking your cash flow, implementing effective strategies, and utilizing the right tools, you can transform this critical metric into a powerful driver of your business success.

Bonus Tips: Enhanced Cash Flow Management:

Offer recurring subscription plans to customers for predictable income streams.

Negotiate favorable terms with vendors, such as bulk discounts or extended payment periods.

Explore alternative financing options, such as factoring or short-term loans, to address temporary cash flow gaps.

Educate your employees on the importance of cash flow and encourage them to identify areas for cost reduction.

Stay informed about industry trends and economic factors that could impact your cash flow.

By implementing these tips and continuously refining your cash flow management practices, you can ensure your business operates smoothly, navigates challenges effectively, and ultimately, thrives in the dynamic world. Remember, cash flow is not just a number; it's the lifeblood of your business, and understanding it is the key to unlocking sustainable growth and success!