Airbnb and other short term rental platforms have begun enforcing Massachusetts occupancy tax laws and a lot of people have been asking us questions. So here are the basic ideas and what you need to know to go about...

Airbnb and other short term rental platforms have begun enforcing Massachusetts occupancy tax laws and a lot of people have been asking us questions. So here are the basic ideas and what you need to know to go about your rental property business in Massachusetts.

What happened?

In January, Govenor Charlie Baker passed a law applying hotel occupancy taxes to short term rentals. The law also allowed local governments (e.g. cities) to impose community impact taxes so you can ask your local government why they are doing this to you as an “operator” of a short term rental.

What does that mean?

It means that your short term rental could be up to 17% more expensive than the one across the state line. Obviously, this will be offset if the other state has the same or similar taxes.

What does this look like?

It means that AirBnb or VRBO will charge the tax to your customer (a.k.a withhold) and remit the tax in an electronic file for credit to the registration number that they have asked you to provide. If you are operating your rental off of something like craigslist or other way, you may have to collect and submit your own returns to both the commonwealth and the locality.

How do I get the number / Register?

You get the number on MassTaxConnect https://mtc.dor.state.ma.us/mtc/_/

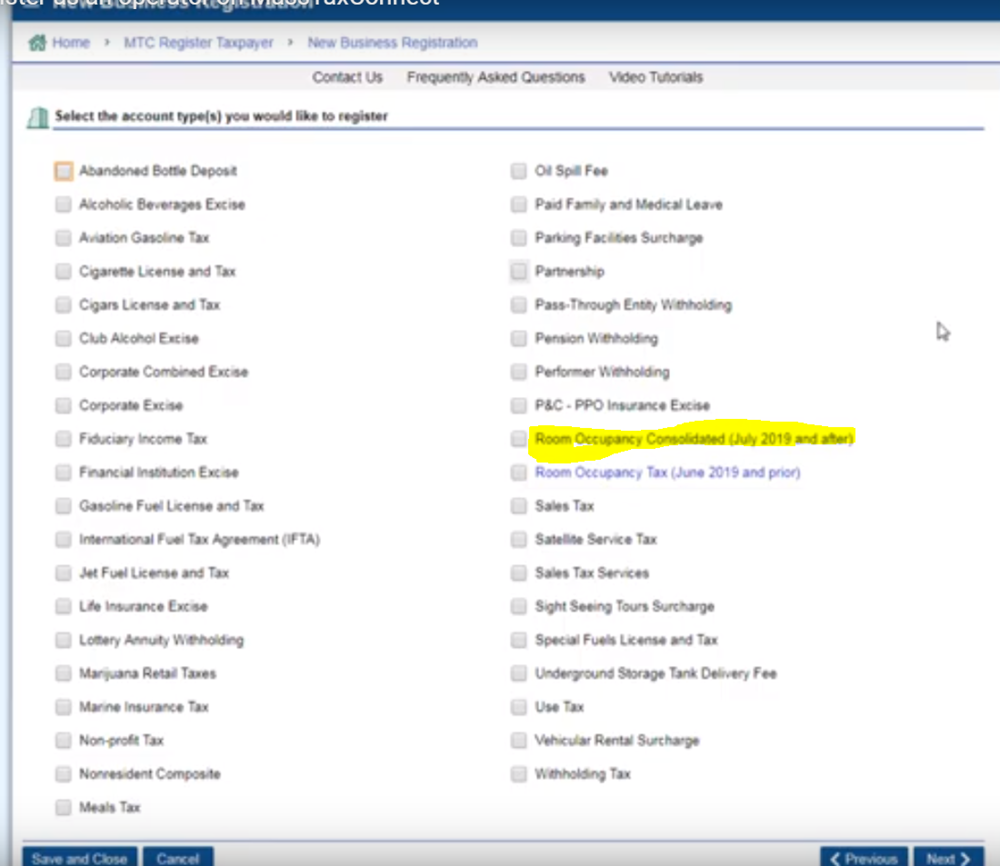

by registering for a new tax account type

The account type that you will be adding is

“Room Occupancy Consolidated -(July 2019 or after) “

NAICS Code should be 72119

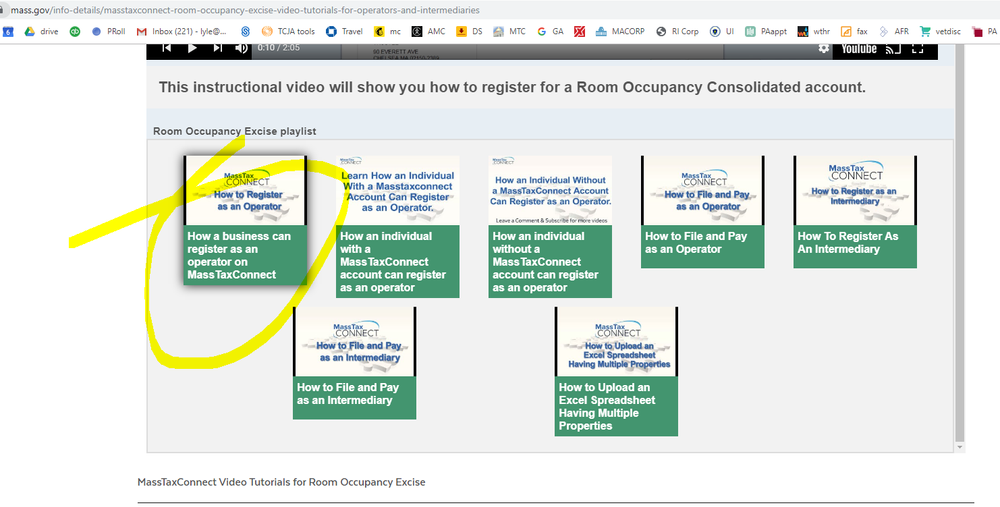

Here are some videos complete with an entertaining accent.

your locality may have other requirements so call your city tax collector.

Am I already registered? Is it in my SSN or EIN?

Use your SSN unless your property is in another entity (Corporation, Partnership, LLC with an EIN). You would know if it was, if not book an appointment with us with the link below.

You should be able to use your personal MassTaxConnect Login and Password. the videos suggest that you will see (screenshot showing) “I want to” - “Add an account type”. Unfortunately, we did not see the option under the Personal only account that one of our employees uses. So, yes, it looks like something may have changed since the videos were published.

I tried to register as an individual but I did not see the “add account” option.

Do not feel bad, this maddening even happened to us as well. We recommend registering as a business using the entity type “Sole Proprietor” , your own name as the business name, and your SSN as the tax ID. see this video to register as a business and it is well tailored to get you through the harder questions.

The account type that you will be adding is

“Room Occupancy Consolidated -(July 2019 or after) “

NAICS Code should be 72119

Be aware that this will create a new mass tax connect login so you will have one as an individual for personal income tax payments and one as a business.

Why is Masstaxconnect UX/UI is astonishingly bad?

Yes, it is certainly a work still in progress.

OK, I got the registration number after my application was processed, now what?

Do I need to file returns or pay anything?

If you are using an “intermediary” like AirBnb or VRBO they will pay and file for you.

However, if you are doing things like craigslist or, we dont know, running down Beacon St. with flyers and a sandwich board taking checks for your south shore condo there is another step. You will need to charge the tax to your customers and then submit it by filing an Occupancy tax return on Masstaxconnect.

If you need help, book 30 minutes with Lyle online and we can do a Zoom Meeting to walk through it together.

https://www.preparedaccounting.com/schedule-consultation