In this blog we will be discussing on how the various financial benefits received during 2020 Covid pandemic from Government of Canada will be taxed in the hands of individuals. Canada Emergency Response Benefit (CERB) and Canada Recovery Benefit...

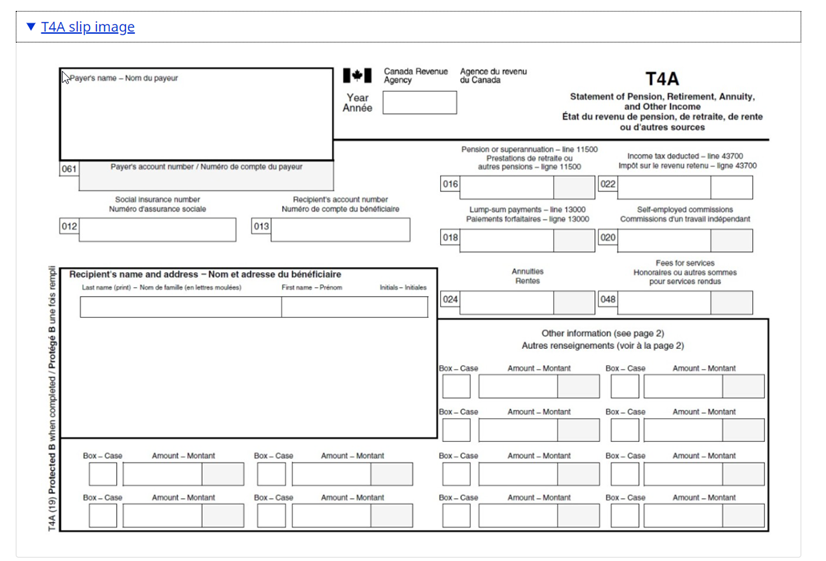

In this blog we will be discussing on how the various financial benefits received during 2020 Covid pandemic from Government of Canada will be taxed in the hands of individuals. Canada Emergency Response Benefit (CERB) and Canada Recovery Benefit (CRB) have become important income support to employed and self-employed individuals who are directly affected financially during Covid-19 pandemic. If you qualified for CERB starting back in March, it meant ongoing payments of $2,000 a month up to a maximum of $14,000 in 2020. However, there was a lot of confusion surrounding CERB and many of us did not realize that those benefits would be taxable. Fast forward to October and CERB has now ended. The Federal Government has now transitioned people who are still eligible to receive either EI(Employment Insurance) or CRB (Canada Recovery Benefit), both of which are taxable as well. This means that if you qualified for CERB and / or CRB payments or if you had a combination of CERB, CRB or EI income, when you file taxes for 2020, you are probably going to owe money to CRA. So, what does this mean for Canadians who are relying on any of these benefits and how much can you expect to pay in taxes next year? If you have received CERB and CRB for 2020, then you will be receiving next year a T4A slip from Government of Canada. The T4A slip will show the total amount of Covid benefits that you have received in this year. This tax slip T4A will be available for you online in your CRA account and it will look like this:

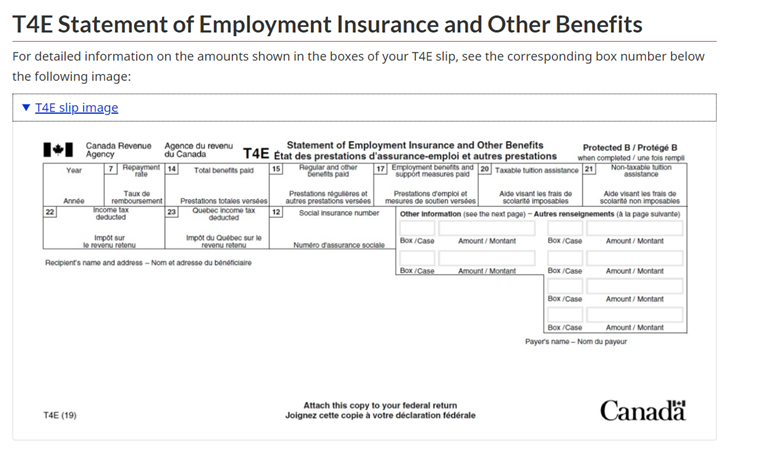

If you receive EI, then you will receive a T4E slip that will look like this:

Both the slips T4A and T4E show the total amount of money that was paid to you (CERB/CRB/EI) and the amount of income tax deducted on those income streams. For CERB, the total amount of income tax deducted on Box 022 will be $0, because the Government has paid the full benefit without holding any taxes on income which means that you would have to pay tax on the total amount received. This is opposite to a situation where a salaried employee would receive net income every pay period after withholding taxes have been deducted by employer. Unlike CERB, where full payment was given to taxpayers, CRB – Canada Recovery Benefit payments are given to taxpayers after 10% tax withheld at source. Therefore, for CRB, the actual payment received for a 2-week period is $900 ($1000 – CRB Gross amount less $100 (10% tax withheld at source). So, the question arises in the minds of taxpayers as to how much could their tax bill be next year?

The tax owed depends on how much money you received this year whether it was just from CERB and CRB, or a combination of COVID benefits and some income from employment. If you received the full CERB & CRB this year, then you have collected a total of $20,000 in benefits. If you live in Ontario, then your taxes owing would be approximately $781 if you did not earn any other income this year.

Where you would notice a difference though is if you also worked for the part of the year. If you were also employed for the part of 2020, then you have also contributed to your tax payment towards employment income earned(Income Tax, CPP, EI). The greater the employment income during the year, the more tax credits are lost when filing taxes and therefore, lesser the refund and vice versa. The tax payment remitted to the government on your employment income, income tax to be paid on the benefits received will decide the amount of tax bill for 2020.

How can you prepare for your 2020 taxes?

We recommend setting aside 20% of your CERB payment as a future tax obligation. It is always a great news if you owe less than anticipated tax payable, no tax payable or even a refund. Adopting this strategy will help you plan for your 2020 taxes, so you are not taken by surprise at the time of tax filing. Another step you can take to help prepare for any tax bill you might owe, is to prepare your tax return as soon as the forms become available in 2021. Although the taxes will not actually be due until the end of April, you will have more time to set funds aside. If you are feeling overwhelmed, a tax professional might be able to provide proactive advice about tax deductions and credits that may offer more efficiencies toward your estimated tax bill.

At?Bajwa CPA, we are knowledgeable about the complexities of the Canadian Tax System and provide professional tax services in GTA. We work year-round to minimize your tax burden and provide personalized accounting, taxation, and tax planning services to help you make smart tax decisions. We believe that client success is our success. ?Bajwa CPA?professionally?experienced team of?Mississauga Tax Services?can develop made-to-order tax planning strategies and click a link to learn more about?Bajwa CPA?tax planning services. Contact us today for any of your tax and accounting needs.

Disclaimer

The information provided in this blog post is intended to provide general information. You should consult with a tax professional to full determine the scope of your situation, Vaishali Bajwa and Bajwa CPA Professional Corporation shall not be held liable from usage of the information provided on this page.

ABOUT THE AUTHOR

Vaishali Bajwa

CPA, CGA

Vaishali Bajwa CPA, CGA is the founder of Bajwa CPA Professional Corporation who has years of extensive professional experience in public practice working with highly satisfied business and individual clients to ensure their taxes are minimized and accounting needs are fulfilled. Bajwa CPA mission is to provide valuable tax planning, accounting, and income tax preparation services in the Greater Toronto Area.

The post 2020 Personal Tax Return – What your tax bill could look like next year if you received CERB and CRB appeared first on Bajwa CPA Professional Corporation.