Is this the end of Globalisation and Interdependence? What it Means for Australia’s Future. The world has been thrown into turmoil by the brutal Russian invasion of Ukraine. Every day as the Russians retreat, the bodies of men women...

Photo: ABC.

Photo: ABC.

Is this the end of Globalisation and Interdependence? What it Means for Australia’s Future.

The world has been thrown into turmoil by the brutal Russian invasion of Ukraine. Every day as the Russians retreat, the bodies of men women and children, summarily executed, are found in mass graves or buried in back yards. Men with their hands bound, women raped; by the day it looks less like war and more like genocide. Europe is in shock because it cannot survive without Russian gas (LNG), coal and oil. Europe is Russia’s biggest customer for fossil fuels.

In an attempt to frustrate Russia’s invasion the world has placed sanctions on Russian exports of everything except fossil fuels. The world has frozen the accounts of Russian banks and all currency transactions. All Russian imports and exports have been stopped. The international community has frozen or repossessed the property of all the Russian billionaire oligarchs and their families, together with the assets of Russian politician’s and their families.

Russia is threatening to cut off gas (LNG) supplies to Europe unless they are paid in Russian roubles instead of Euros and Europe has said no, the contracts are in Euros. Europe knows the gas won’t be turned off because Russia needs the money.

Since the invasion began EU countries have paid the Russians €35 billion for gas compared to €1 billion it has given to Ukraine to defend itself. There is ample evidence that many countries in the EU are finding their own way, not Brussels way in this crisis and there are concerns that this show of independence may reduce the long-term value of the EU as a political force.

So much for interdependence and globalisation, particularly in Europe. It should keep national leaders awake at night struggling with the distressing realisation that they are funding the Russian invasion of Ukraine and so funding the killing of men, women and children, and at the same time they are sending rockets, missiles, ammunition and other articles of war to Ukraine, so they can kill Russians. How mad can the world get when you cannot manage your life without imports from your enemies?

The inflationary spiral, which had already started in America and Europe before Russia invaded Ukraine, is now spreading around the world.

Whether the Secretary General of the United Nations, António Guterres likes it or not, the world is now increasingly reliant on, and is demanding more fossil fuels for power generation, home heating and to keep factories producing.

With the sanctions against Russia biting hard countries in Europe are placing orders for Australian coal as they calculate the cost of reopening mothballed coal-fired power stations, and maybe wondering how they can thank an unrecognised Nostradamus for his or her foresight.

Trump at G7 Photo: Guardian

Trump at G7 Photo: Guardian

Europe must now find new supplies of gas (LNG) to replace the 60% of its needs that it sourced from Russia before the war.

Europe probably remembers but would prefer to forget that just a few years ago at a G7 Conference when President Trump placed sanctions on Gaz Prom to prevent them completing the Nord Stream 2 pipeline because he considered it a threat to Europe’s security, he offered to supply the EU with all the gas it wanted. Europe and particularly Merkel the German Chancellor, refused his offer and went along with Russia, hoping Trump would not be reelected and Nord Stream 2 would be completed.

The G7 ignored that under Trump America had become not only self-sufficient in oil and LNG the first time since 1952, it had also become a net exporter and by increasing America’s output Trump had lowered the global price of crude oil, which had benefited millions of consumers around the world including those in the G7.

Europe got what they wished for,Trump wasn’t re-elected. One of the first things President Biden did on taking office was reverse Trump’s policies. He curtailed the production of LNG in America (the confusion is they call petrol, gas in America) he also removed the Trump sanctions on Nord2, allowing the gas pipeline from Russia to Germany to be completed. Now many millions in Europe are suffering in ways that Trump foresaw, but in ways the Europeans never, ever imagined. Even though Trump had told them previously at a NATO conference that Russia was a danger to Europe’s sovereignty.

Biden also curtailed crude oil production in America and stopped imports from Canada into America, resulting in America being forced to import oil, some ironically, from Russia.

The high crude oil prices and subsequently the high fuel prices are only partly due to Russia, they are mainly due to Biden’s commitment to the so called ‘progressives’ in his Democratic Party, who in reality are anything but progressive. They are from the far left and committed to taking America down the zero carbon, no fossil fuel pathway no matter what it costs America and the rest of the world.

The world has massive reserves of LNG. The UK stopped developing its LNG reserves years ago as it strode towards zero carbon and world acclamation for going ‘green’.

Now governments in Europe are are starting to realise the error of their ways as unaffordable gas prices are causing millions to be cold in their own homes — people are having to choose between food and heating —Foodbanks and food kitchens are facing unprecedented demands and claims that children are going hungry grow by the day.

In a matter of weeks Europe’s interdependent security blanket has been shown to be nothing more than gossamer dream, they are now questioning the fragility, the goals and the cost to their economies of interdependence and globalisation which are other words for trusting people.

Australia, now the biggest producer of LNG in the world also has massive reserves, there are 114 trillion cubic feet in the ground waiting to be developed. Australian reserves are the 10th largest in the world and far smaller that those in Russia, Iran, Oman and Qatar.

The world wide demand for LNG will last for decades, it remains to be seen if Australia, before the ink has dried on COP26, has the will and the moral fibre develop its reserves, sell gas to the world and so benefit all of Australia by helping to pay off the humongous debt caused by the Covid pandemic. What is certain is that the world will not run out of LNG and LNG will drive post pandemic, post war, world wide recovery.

The Take Home Message for Europe-Is this the end of globalisation and the EU?

The take home message Europe is a sobering one for the rest of the world particularly Australia.

Over the last fifty years or so, certainly since Reagan and Gorbachev pulled down the Berlin Wall and took the world out of a cold war, the world leaders, many of them who have never known war, let alone fought one, have gradually moved their nations into a position of interdependence, they have conditioned their people to believe that globalisation, interdependence, is the only way forward.

Suffering as they now are, will the people of the EU challenge the prevailing political philosophy that independence, national autonomy, and economic self-reliance have no place in the world in the twenty first century and will they want to move back to being more self-reliant?

The world saw how many EU leaders reacted when Boris Johnson moved to have a referendum to take the UK out of the embedded interdependence of the European Union. They saw how angry the EU became when the British people voted ‘yes’ in that referendum and then elected Boris Johnson to be their prime minister and leader to take them out of Europe.

The dominant attitude of the majority of EU leaders was, ‘How dare they leave the family of Europe. How dare they seek national sovereignty rather than be subservient to the EU Parliament and its legions of faceless bureaucrats?’

When Covid19 became a pandemic there were tens of millions of people moving around the world for work. Economic interdependence was rife particularly in tourism and in essential services like medicine. When the pandemic was confirmed those millions moved back ‘home’ and interdependence was replaced nationalism. The result was that many countries, particularly Australia, suffered serious disruptions as their essential services were forced to reorganise themselves.

The European Union, the EU is reeling as it realises that just one man, Vladimir Putin, who appears to be at least deranged and perhaps stark raving mad, within a matter of months has wrecked the interdependence, the globalisation mantra that European leaders and their governments have carefully fostered for decades.

Russia could have become the major, secure supplier of energy to over 400 million people in Europe. Putin could have controlled gas supplies and prices through the pipelines he had built to supply the whole of Europe. He could have influenced national economies and given a whole new meaning to (economic) interdependence. Now Europe has to re-build, it has to replace Russia, how and with whom remains to be seen.

Is China to Australia what Russia is to Europe?

Is Australia is under the thumb of President Xi Jinping’s China as Europe is to President Putin’s Russia? There is compelling evidence that it is.

Over the last twenty years the barons and baronesses of commerce and industry in Australia, perhaps without successive governments realising, have committed Australia to be dependent on China for many of the ingredients that are necessary to carry out and to enjoy a normal quiet and peaceful life. If this dependence isn’t changed and soon, China will determine Australia’s destiny, its future.

Parallel Realities.

In these tense and somewhat confusing times there are contradictory parallel realities or universes at play concerning Australia’s relationship with China. It is these realities Australia should concentrate on.

The first reality.

The first reality for Australia are the strained diplomatic relations with China, which appear to be deteriorating by the day, at least according to the press in both China and Australia.

The first reality for Australia are the strained diplomatic relations with China, which appear to be deteriorating by the day, at least according to the press in both China and Australia.

It’s a game of tit-for-tat, in which politicians of both countries seem to revel. China provokes and the Australian government reacts; then they change places. The language is often strong and the protagonists in a show of strength puff up their chests like pigeons on the town square and strut around. The media love it, they exaggerate it to make something from nothing — anything for a headline. This results in the Australian voter, more often than not, getting an overstated and inaccurate picture of Australia’s real relationship with China.

The second reality-Trade.

The second reality is Australia’s real relationship with China, it’s called ‘trade’.

The second reality is Australia’s real relationship with China, it’s called ‘trade’.

Trade between Australia and China goes on seven days a week, fifty two weeks in the year and it is the lifeblood of Australia and (at present of) China.

“Trade involves the transfer of goods and services from one person or entity to another, often in exchange for money.”

The diplomatic wires may be down, the politicians may not be talking to each other, but the irrefutable reality is that the traders, the business people in Australia and China ensure, because their very livelihoods depend on it, that trade between Australia and China continues with as few interruptions as possible.

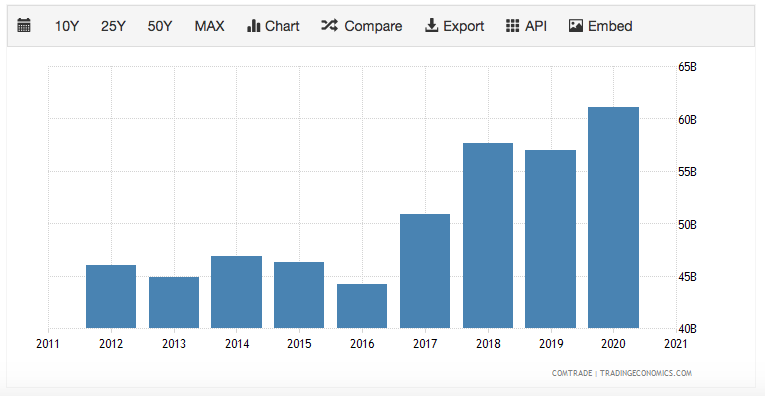

Trade over the last two or three years between Australia and China, contrary to what the media and some politicians would have the people of Australia believe, has not been damaged by the antics of those same politicians; the reality is that trade between the China and Australia; exports to China and imports from China have been and continue growing year on year, in spite of the highly publicised cancellation of rural exports.

Some foods have slowly and by various routes found their way back into China. Those that haven’t, have found alternative markets.

Some foods have slowly and by various routes found their way back into China. Those that haven’t, have found alternative markets.

Australia and the World now Depend on China.

Over the last decade or so, Australia’s reliance on China has been growing and growing; growing to the point where the question must be asked whether Australia and its people would be able to function as they do today, without the remarkable range of goods that Australia imports from China?

The Iconic German Mercedes – Made in China with Chinese pollution.

The Iconic German Mercedes – Made in China with Chinese pollution.

Australia is not Robinson Crusoe when it comes to relying on China. Over the last thirty to forty years manufacturing industries, mainly from America and Europe as well as Australia, have eagerly exported their technology and their jobs together with their industrial pollution to China, all because China assured them they would make bigger profits by manufacturing in China.

Everything from nails to prestige motor vehicles and luxury goods and everything in between, are now being made for the world, in China. It was the price western governments were prepared to pay and delighted to sanction because it enabled them to appease the Thunberg Warriors, Extinction Rebellion and the climate evangelist Antonio Guterres and his United Nations Climate Council mob and claim praise for being on the zero carbon stairway to heaven.

The world famous Caterpillar machinery Made in China

The world famous Caterpillar machinery Made in China

Like their idol Pontius Pilate, western nations deliberately ignored the reality that China, largely on their behalf, now produces upwards of 30% of the world’s emissions. China now emits more greenhouse gas than the entire developed world combined.

Does China care? It seems not, why would they, when so many in the world are increasingly dependent on them for manufactured goods? Perhaps goods which many nations can’t manage without? Is that not worth thinking about?

There are now two big questions facing the world: Can the world manage without manufactured goods from China, and the big and far more fascinating question; ‘Can China maintain its standard of living and growth without many of the world markets it now dominates?’ The numbers make fascinating reading:

The Importance of China’s Trade with Australia.

The star is in WA

The star is in WA

What Australia imports from China is dwarfed many times over by what China imports from Australia. The big difference is that Australia exports raw materials to China while China exports to Australia finished goods, consumables which China has manufactured from the raw materials it imports from around the world.

China at present is vitally important to Australia, particularly to Western Australia. A couple of years ago royalties, wholly from WA miners, accounted for thirty per cent of the general revenue of the West Australian Government.

In the financial year 2021/2022 that figure looks like being topped with ratings agency S&P forecasting a WA state revenue surplus of $8 billion, all due to the escalation in iron ore and LNG prices.

In the same year that royalties accounted for 30% of WA state government revenue, taxes from the miners around Australia, put close to another $40 billion into the federal coffers. Coincidentally Medicare costs Australia ~$40 billion a year and the National Disability Insurance Scheme (NDIS) ~$20 billion; the latter is funded jointly by the federal government and the states and any increases in costs will be borne by the Federal Government.

Christmas Creek Mine

Christmas Creek Mine

Add to that $40 billion, the income tax paid by some of the highest paid workers in the land, together with all the other taxes paid by the companies who support and supply the mining industry in WA and around Australia to get some idea of the importance of mining to Australia.

Between 2019 and 2020 mining contributed 10.4% to national GDP and agriculture about 3%.

Could Australia afford one of the best health services in the world, Medicare, and the internationally applauded NDIS, without the taxes and royalties paid by the mining industry?

WA Growth needed people.

Over the last fifty years, to meet the labour needs of the China-reliant mining industry, the population of WA has grown by 200%, from just over 600,000 to over 2 million. The irony is that the permanent rural population in the agricultural regions in WA has more than halved in that time.

Over seventy five per cent of the population of WA (1.5 million) live within the the greater Perth Metropolitan Region, which stretches for 156 kilometers along the best coastline in the world, from Two Rocks in the north to Herron in the south.

About half of City Beach is made up of open space, topped by the stunning beach itself. Photo: Illustrations Photography

About half of City Beach is made up of open space, topped by the stunning beach itself. Photo: Illustrations Photography

If China stopped buying from the miners in WA, thousands upon thousands of highly paid workers living in high priced houses and driving the best motor vehicles one can buy, would be out of work. There would be no point in going to Centrelink looking for jobs because they wouldn’t be any.

The WA Government would be unable to meet its current debt of over $30 billion.

Without China the Western Australia economy would go ‘back to the future’, back to where it was in the seventies — a state dominated by agriculture and these days by an agriculture dominated by grain farming, which only needs a few trained seasonal workers.

So the Big Question is:

Is the Pilbarra Iron Ore Industry and so 30% of WA Revenue at Risk?

China Imports from Australia in 2020 were about $140 billion.

Iron Ore ~S$93 billion

LNG ~$15.6 billion (2020) $50 billion 2021.

China makes about fifty percent of the world’s steel and it buys the majority of the iron ore it needs to make that steel from Western Australia.

There are alternative suppliers of iron ore, like Brazil. They have been on the horizon for years and many stories have been written about them, but they haven’t, yet, managed to get it all together and be a major supplier of iron ore to China.

Valemax 400,000 tonnes

Valemax 400,000 tonnes

That is not to say that China does not want to deal with Brazil, far from it. It has to be in the best interests of China to encourage Brazil as an alternative supplier, but so far distance, the cost of getting ore from Brazil to China has been a major impediment for Brazil’s miners. In an attempt to beat the tyranny of distance, the Brazilians built huge Valemax ships that can carry 400,000 tonnes of ore, twice the amount of many ore carriers from Australia. In spite of ore prices doubling, which should have favoured the Valemax ships, Brazil didn’t make any significant inroads into the Chinese market selling them iron ore worth just $37 billion in 2020.

Africa.

There is another deposit of high grade iron ore, which Australia is watching, it’s in Guinea in West Africa and called ‘Simando’. This major high grade deposit is part owned by the Chinese (40%) and part by Rio Tinto (45%) and part by a consortium including the Guinea government (15%). As often happens in developing Africa, it appears that the politics in Guinea have inhibited the development of this deposit.

A rail line is being built to transport the ore 620km to port, but there have been complications regarding the route; whether it should take the shortest path through neighbouring Sierra Leone or the longest through Guinea.

Part of Rio Tinto’s Simandou iron ore project in Guinea. Photo: The Australian.

Part of Rio Tinto’s Simandou iron ore project in Guinea. Photo: The Australian.

The consensus of the iron ore industry twelve months ago was that this Guinea deposit at ‘Simando’ , was proving difficult to commission, maybe it could one day put a dent in the Pilbarra dominance of the China market, but it will not be the ‘Pilbarra Killer’ that some were forecasting a few years back.

That all changed on March 29 2022, when it was revealed that the partners had reached a US$20 billion deal with the government to develop Simando. This includes the completion of the rail line and a new port at Conakry both to be completed by late 2024. The ‘Pilbarra Killer’ may be closer than was previously thought and to make matters worse for Australia, the Valemax ships are ready to work between Africa and China.

China looking for (a) Scrap

China is the biggest market for scrap iron from America. Photo: hinrich foundation.

China is the biggest market for scrap iron from America. Photo: hinrich foundation.

In an attempt to lower costs of making steel, another challenge for the Pilbarra could be China’s growing interest in re-manufacturing scrap steel. Scrap is not predicted to be a major competitor in the near future but it is there and growing none the less. Put scrap iron together with the Simando deposit, which the Chinese part own, together with some ore from Brazil and that could keep the Pilbarra miners on their toes and the West Australian Government nervous, but not just yet — maybe.

China and the rest of Australia.

China stopped buying coal from Australia but they are still its biggest customer for natural gas, a business now worth some $50 billion a year for 80.9 million tonnes.

China’s refusal to buy Australian coal was proving to be a boon for the Australian miners, even before the war in Ukraine. Russia, previously one of the biggest coal exporters in the world, particularly to Europe, is now facing world wide bans after it invaded its neighbour and started killing the population.

Since China banned Australian coal India, Korea and Japan have increased their purchases and they have now been joined by some nations in Europe. China’s efforts to hurt the Australian coal miners have failed.

Urea is a nitrogenous fertilizer and made from LNG. It is vital to crop production in Australia and around the world. Australia as the biggest supplier of LNG to the world became an importer of urea from its biggest customer for LNG, China. Russia is the other big maker of urea and supplies from that source have nearly stopped.

Exporting Australia’s natural gas to the world.

Exporting Australia’s natural gas to the world.

Natural resources are the backbone of the Australian economy and China is the backbone of Australia’s market for those resources. As the politics of the world change due to the war in Ukraine, Australia’s market for LNG may decrease in China and be welcomed in Europe. World demand for coal is increasing by the day and to meet that demand Australia is going to open new coal deposits.

Australia sells more than Iron Ore and Gas to China-$20 billion more every year.

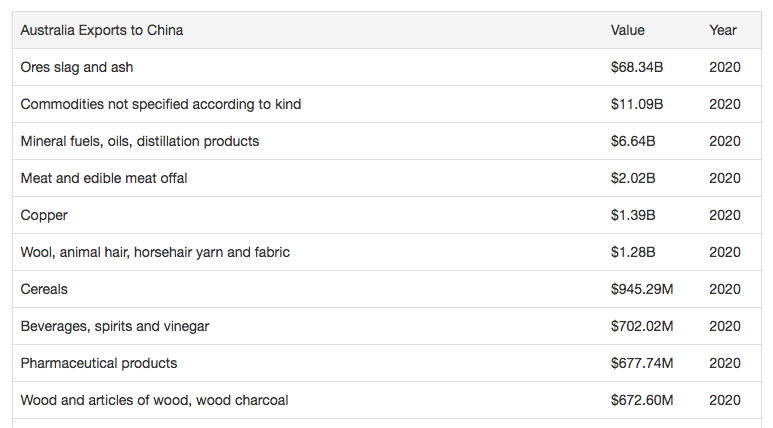

It is an eye-opener when contemplating the range of goods that Australia exports to China. The trade is dominated by the iron ore and gas, but there are other exporters who sell at least another $20 billion of Australian products to China every year.

To what extent these exporters depend on their business with China cannot be determined from the figures, but with China being the biggest consumer market in the world we can be sure it is important to them and to Australia’s balance of trade.

It must be presumed that the Australian Government and the Prime Minister and Minister Dutton know exactly what they are doing when they use strong language concerning the Federal Government’s view of the potential for China to damage Australia and others in the Pacific Region, because every comment is measured in China for its effect. The last thing our small and often tenuous export markets in China need is some politician intent on making the morning papers with an inflammatory remark.

Australia’s top ten exports to China in 2021.

Never mind the big exports everyone talks about like iron ore and gas, look below at meat, that would be beef and lamb, ~A$2.8 billion. China is Australia’s biggest buyer of wool and who would have thought that Australia traders sold them nearly as much in beverages, spirits and vinegar as they did in cereals?

What Australia Imports from China.

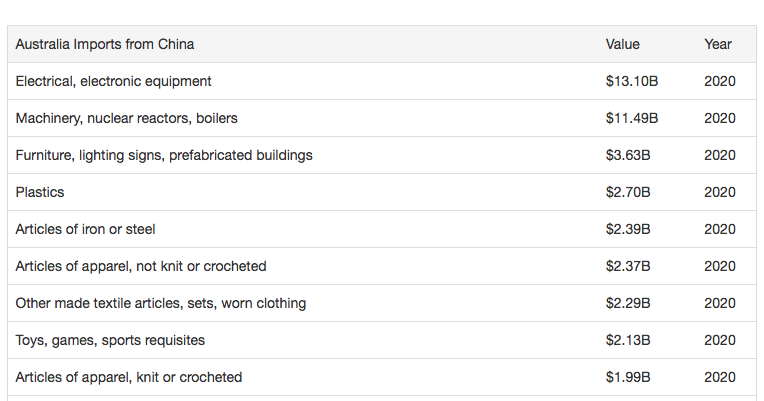

In 2020 Australia Imported from China goods worth a staggering A$86.0 billion.

That is equivalent to $7 billion a month or ~$2 billion every week of manufactured goods arriving in Australia from China. That was presumably the FIS value (Free Into Store) The retail value, or the value to the economy would be about double, so ~$172 billion.

It is glaringly apparent that Australia and particularly Western Australia, would not be the place it is today without China as the main buyer of its iron ore, LNG and $20 billion of other goods. Australia at present is reliant on China for 47% of its export trade.

The question that Australia must ask is how important to every day life in Australia are the manufactured goods it imports, in ever increasing amounts, from China?

In 2018 Australia imported goods from China worth $77 billion. (The chart above is in US$) In 2020 Australia imported US$61 billion or A$86 billion, that is a growth of 12% in two years. From ~US$46 billion to US$61 billion in 8 years. That is a staggering growth. For every dollar that was spent with China it meant a loss for other manufacturers around the world including in Australia.

What does Australia import from China that makes it or could make it, dependent on them for its everyday needs?

Made in China

Made in China

It is a sobering experience to go round a house, looking for the place of manufacture of all the things that are used every day. It’s easy to see why in 2020 Australia imported ~$18 billion of ‘electrical and electrical equipment, that is nearly $700 for every man woman and child in Australia in 2020, or $13 a week. The three lines on the chart that refer to clothing and fabrics comes to a total of~$9 billion which is equivalent $346 for every person in Australia in 2020. If that figure seems high the challenge is to go through everyone’s wardrobe and check the labels.

The top ten imports from China into Australia.

If Australia didn’t import these goods from China, where would it get them from at the same price that they pay China? The answer is there isn’t anywhere, not in the short term anyway. That is not an idle claim. Companies like Bunnings, Target and Office Works rely heavily on China for what they sell — check the labels on the next visit. What would the balance sheets of these companies or the balance sheet of Wesfarmers their owner look like if China stopped supplying?

Conclusion.

In a democracy the people elect their politicians and those politicians form parliaments to govern the people. It is the expectation of the people that those who govern will protect the country and the people from adversity in all its forms; we can now see that successive governments have failed the people of Australia in this regard. Australia and certainly WA is dependent for its future on China.

In six weeks the future of much of Europe has been thrown into question following Russia’s brutal invasion of Ukraine.

The lessons for Australia when looking at what is happening in Europe are sombre and serious. Australia is an island and far, far from anywhere, it is not Europe, it does not have close neighbours there are no land bridges, just thousands of kilometres of ocean.

Europe’s dependence on Russia for coal, oil and particularly gas (LPG) is a more that troubling reminder to Australia that it is totally reliant on other nations for all of its oil supplies.

China could do to Australia what Russia has done to Europe and without a shot being fired. China could close the South China Sea. That one move would prevent Australia’s supplies of crude oil going to Japan, Korea and unbelievably to China. It would also prevent refined products, petrol and diesel as well as AV Gas getting to Australia from those countries.

There are between 20 to 40 days supply of fuel oils in the country and on the high seas at any one time. That supply is not just to keep vital services running, it is to keep the ADF in the air and mobile on the ground. How’s that for national defence?

Not only would the vehicles in Australia start running out of fuel after a few weeks, the people of Australia would start running out of food. What is grown on the farm would remain on the farm and what is on the high seas would remain on the high seas. It is fake news for the government to claim that Australia grows enough food to feed 75 million people. It might grow enough calories, but ‘man shall not live by bread alone’.

Australia must become more self-reliant in every way, not just in making and processing more of the essential food and goods in Australia, it must also quickly develop innovative ways for Australia to remain and maintain its status as a proud and independent sovereign nation.

Australia must question the global interdependence, globalisation and the market economy, which have been the political fashion for decades, which are now comprehensively failing.

It must keep it’s relationship with China under close control and review.

I will look at this in the next episode of The Global Farmer. I will discuss just what can Australia do to turn the tide on what is becoming a worrying political climate in our region? Russia has shown us all that what the world thought a few months ago to be impossible, is in fact, a brutal reality.