With European airlines making record profits, the big players are back on the acquisition trail. How close are we to the end of consolidation process in Europe? And which airlines are still in play?

Another airline consolidation deal in Europe

This week we saw the announcement that a consortium involving Castlelake, the Danish State and Air France - KLM had done a deal to acquire the bankrupt nordic carrier SAS. That deal will see SAS leave the Lufthansa-led Star Alliance and join AF-KLM’s SkyTeam. Whilst AF-KLM will initially have only 19.9% of the equity, the company did say they had paths to increase that over time.

With Lufthansa Group in the process of buying Italy’s ITA (the successor to Alitalia) and IAG trying to secure approval for its deal to acquire Spanish airline Air Europa, the list of independent European carriers continues to dwindle.

I thought it would be a good time to reflect on the state of play in Europe. How much consolidation has already taken place? And which airlines are still in play?

The competitive dynamics and the drivers of consolidation are a bit different in long-haul and short-haul, so I’m going to tackle these questions in two parts, starting with long-haul.

Wide-body capacity to/from Europe

Long-haul and wide-body operations are not quite synonymous, but the match is close enough for our purposes.

The chart below shows how the wide-body capacity operated to or from Europe breaks down. As usual, I need to clarify what I am defining as Europe here. I’ve included the EU, the EEA and the United Kingdom. That seems to me to define the territory where consolidation can readily occur from a regulatory perspective. Note that this definition excludes Turkey and Russia.

Based on July 2023 ASKs

The wide-body capacity splits fairly equally between carriers based in the region and carriers based outside it. Consolidation of the airlines based within the region is already well advanced, with two-thirds of the wide-body capacity already in the hands of the three big network groups. If the deals for SAS, ITA and Air Europa all complete, the percentage controlled by the big three will rise to 73%.

That would still leave the big three with only 33% of the total wide-body capacity, which doesn’t sound that concentrated. But in reality much of the capacity operated by carriers based outside of the region is flown by airlines with whom these three have joint venture deals. If you add in their joint venture partners, the big three are on track to have almost 60% of the market if these three deals go through.

Although much consolidation has already taken place, there are still some European long-haul operators that are not yet part of the big three. They are shown in the right most column of my chart above. Let’s talk about these airlines and which ones might still be “in play”.

Remaining long-haul targets

The biggest European wide-body operator not already owned by the big three is Virgin. That company is 49% owned by Delta and almost all of its flights are part of the transatlantic joint venture with Air France-KLM. That’s why I coloured Virgin as “blue” in the chart above. Could the ownership of Virgin change? Logically you might think it could become part of AF-KLM over time. Back in 2017, AF-KLM nearly acquired a 31% stake, but the deal never went through. I certainly can’t see Delta permitting it to be sold to either of the other two groups. But with its capacity already flown in co-operation with AF-KLM, even if a deal to acquire Virgin did eventually happen, it wouldn’t change much from a strategic perspective.

Next largest is TUI. As a diversified leisure and tourism business with annual revenues of €16.5 billion, the German leisure group is almost as large as the “big three”. With a high degree of integration of the airline with its other leisure businesses, it is hard to see TUI wanting to sell its airlines, or the big three having much interest even if it did.

After TUI comes TAP Air Portugal. In fact, using wide-body capacity as the measure of long-haul operations, as I have, understates TAP’s significance. About 20% of TAP’s long-haul capacity is flown by narrow-body equipment and the carrier is the market leader on the strategically important Europe-Brazil market. Its hub in Lisbon is perfectly located for serving Latin America. As the largest remaining long-haul operator that might be “in play”, it is no surprise that when last week the government of Portugal announced its intention to sell at least 51% of the airline, all three groups confirmed their interest. TAP is currently part of the Star Alliance, which is why I coloured it gold in the chart above. But it isn’t a member of any of Lufthansa’s joint venture arrangements, so wherever the company ends up, a deal would change the competitive position between the three groups.

Finnair also has strategic significance in that its Helsinki hub is well located for serving Europe to China and North Asian markets. Its wide-body capacity is mostly already operated under joint ventures with IAG and its partners. An eventual deal with IAG seems the logical “end state”, but the company’s business model has been heavily impacted by the closure of Russian airspace to European carriers. If a deal would require that issue to be resolved first, we might be waiting quite some time. SAS had been a member of Star for a long time before AF-KLM did their deal. ITA was in SkyTeam but that won’t survive its acquisition by Lufthansa. Consolidation trumps alliance affiliations, so IAG had better not be too complacent about its position with Finnair if the company decides it needs to be part of a bigger group.

Like TUI, many of the remaining independent operators are point-to-point, leisure focused airlines. French bee and Air Caraïbes are both owned by French family-owned Groupe Dubreuil. Corsair is another French leisure airline. Norse is the reincarnation of Norwegian’s low-cost long-haul business. Condor is a leisure airline based in Germany. Whilst the big three network groups do have interests in the low-cost and leisure markets, the leisure focus almost certainly makes these airlines of less strategic significance to the big three. Perhaps that would change if Norse manages to demonstrate real success in the development of long-haul low cost, but that’s probably the subject for a different post.

The last of the independent long-haul airlines of significance is LOT Polish Airlines. It is a member of Star Alliance and uses Lufthansa’s frequent flyer programme, Miles and More. One would think that would make the Lufthansa Group a natural acquirer, but I suspect that politics would probably preclude that given Poland and Germany’s history.

Short-haul operators

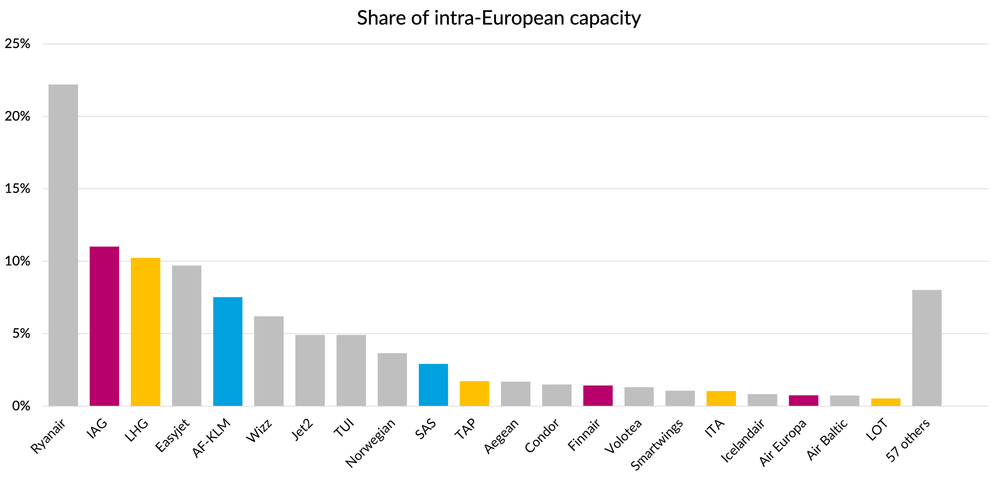

The minimum scale requirements of short-haul are much less demanding than for long-haul. The simplest example of why that is true is that the aircraft are smaller and less expensive. So it is no surprise that there is still a much longer tail of small airlines than we saw on the long-haul side, as you can see from the following chart. As before, I’ve colour coded the airlines which are either affiliated with, or in the process of being acquired by, the big three network groups.

Based on July 2023 ASKs

In terms of airlines that we haven’t already discussed in the long-haul section, the biggest are of course the large low-cost short-haul specialists.

The most striking thing that jumps out at you in the chart above is the size of Ryanair, more than twice the size of the next biggest player. That must be placing some pressure on the other low-cost carriers to consolidate to create a comparably sized rival. The obvious play would be to put the second and third biggest low-cost airlines together. EasyJet and Wizz have had merger discussions in the past, but they fell through. Whilst they are both point to point focused low-cost carriers, in truth there is quite a big gap between the models, as EasyJet has drifted up-market in recent years and WIzz continues to pursue an “ultra low-cost” model.

An alternative option for EasyJet could be UK based Jet2. The airline has grown to a significant size in the last few years, especially in the summer season. EasyJet has been increasingly focusing on its package holiday business and that’s where Jet2 has always been strong.

Its a bit harder to see where Norwegian may end up. It has just done a deal to acquire regional operator Widerøe (I combined their capacity in the numbers above). Norwegian was probably already an unlikely target for the big low-cost airlines, with its Nordic focus giving it quite high unit costs. It seems to me that the Widerøe deal makes it even less likely to be an attractive target for them.

The remaining carriers which make it onto my chart are Agean (Greece), Volotea (Spain), Smartwings (Eastern Europe), Icelandair and Air Baltic (Latvia). Whilst I’m sure there will be deals done over time, none of these would really “move the dials” for the big players.

Could any of the low-cost specialists get together with the network groups? There has often been speculation that EasyJet might become a target for IAG, but getting that past the competition regulators would be, shall we say, “challenging”.

In truth, it is hard to see how any of the network groups could make the numbers work for buying any sizeable low-cost player, given the mismatch in valuation multiples. It would be difficult to justify paying a premium to buy an airline trading on a double digit earnings multiple when your own shares trade at a multiple of 4 or 5. You might hope that the merged company would trade on a blend of the multiples, or better, but the most likely outcome would be an averaging down, with much value being destroyed in the process. Unless and until the network groups achieve a rerating of their shares, I can’t see how such deals could work.

So where does that leave us?

When I started out in the airline business thirty years ago, I assumed that once regional consolidation had finished playing out, deregulation of the airline industry would have progressed to the point that the next step would be global consolidation. To an extent, that has happened through the mechanism of the joint ventures, with the big three European groups’ partnership deals with their US counterparts as the centre-piece. But that is an imperfect form of consolidation, and the prospect of governments relaxing airline ownership and control restrictions on a global basis seems more distant today than it did three decades ago.

For the moment though, there are still a few regional consolidation deals to be done that will keep the bankers’ fees rolling in. The big three network carriers already have their plates quite full, with each having a deal in progress. The TAP privatisation will keep everyone busy in 2024. After that, it looks like quite slim pickings for the network airline groups. The TAP privatisation could be the last big move in the European consolidation end game for these three.

In the short-haul low-cost space, there is still a chance of some major moves. Ryanair, as usual, looks to be sitting pretty. Whilst a deal between other low-cost airlines might create a stronger competitor, there is equally a risk of management distraction and cost inflation due to integration issues. Given its size advantage, Ryanair doesn’t have any strategic need to buy anybody and can afford to focus on organic growth.

Nevertheless, Ryanair probably has the most financial “firepower” of any of the European airline groups. I’m sure there will be a few bankers out there trying to persuade Michael O’Leary that he should put some of that to use.