The group’s CEO and bonafide aviation geek was in classic form last week at investor day.

?Dear readers,

Today’s edition is free for all readers, and it is full of information from Air France-KLM’s three-hour investor event last week — its first since 2019. While some executives read from scripts and share little new information at these investor days, Air-France-KLM CEO Ben Smith — an Airline Observer favorite — is not that kind of executive.

I’ve compiled for you some of the most interesting things Air France-KLM shared, including news about the loyalty program profitability, Air France’s scheduling practices, and the future of the Paris hubs at de Gaulle and Orly. Executives also delved into their strategy on M&A and shared why a management decision at one U.S. carrier is leading to improved profits at Air France and KLM. I encourage you to read it and share it with a colleague.

One note first: Smith, the group CEO, spends much of his time discussing issues in France. Some have criticized this focus on Air France and Transavia France, rather than on the full group, and earlier this year I asked Smith about it. Essentially, he said, when he arrived in 2018, KLM was among the world’s most efficient airlines, and Air France was not. Today, Air France is much improved, and Smith increasingly is making subtle changes at KLM, including standardizing business class, adding premium economy, and optimizing operations at Amsterdam Schiphol.

But yes, even now, Smith does talk about Air France and Transavia France a lot. So be warned.

Now, here’s the good stuff.

It's time to make real money from loyalty

Air France-KLM, which in October raised €1.5 billion ($1.64 billion U.S.) from Apollo Group by issuing perpetual bonds backed by loyalty program revenues, is serious about monetizing Flying Blue. Last week, for what management said was the first time, Air France-KLM shared details about the program's profitability.

In 2022, Flying Blue accounted for 15 percent of Air France-KLM's operating result, said Henri de Peyrelongue, the group’s executive vice president of marketing. Air France-KLM generated an operating result of €1.2 billion last year, suggesting loyalty was about a €180 million business. This year, Air France-KLM should make a heftier operating profit — it made €1.7 billion in the first nine months of 2023 — but executives didn’t say whether investors should expect another 15 percent contribution from Flying Blue, or whether this year's loyalty profit instead will mirror 2022's €180 million haul.

Either way, that profit is a pittance compared to Delta, which is on pace for $7 billion in compensation from American Express this year. No European airline makes as much as U.S. airlines do from loyalty programs because of differences in government regulations and consumer preferences. Still, as Air France-KLM executives made clear, they plan to increase revenue. They’re even talking to counterparts at Delta — a joint venture partner and minority owner of Air France-KLM — about best practices.

"It's a different market here in Europe, but I think this is a big plus for us, and an advantage that we're trying to leverage as best we can," Smith said.

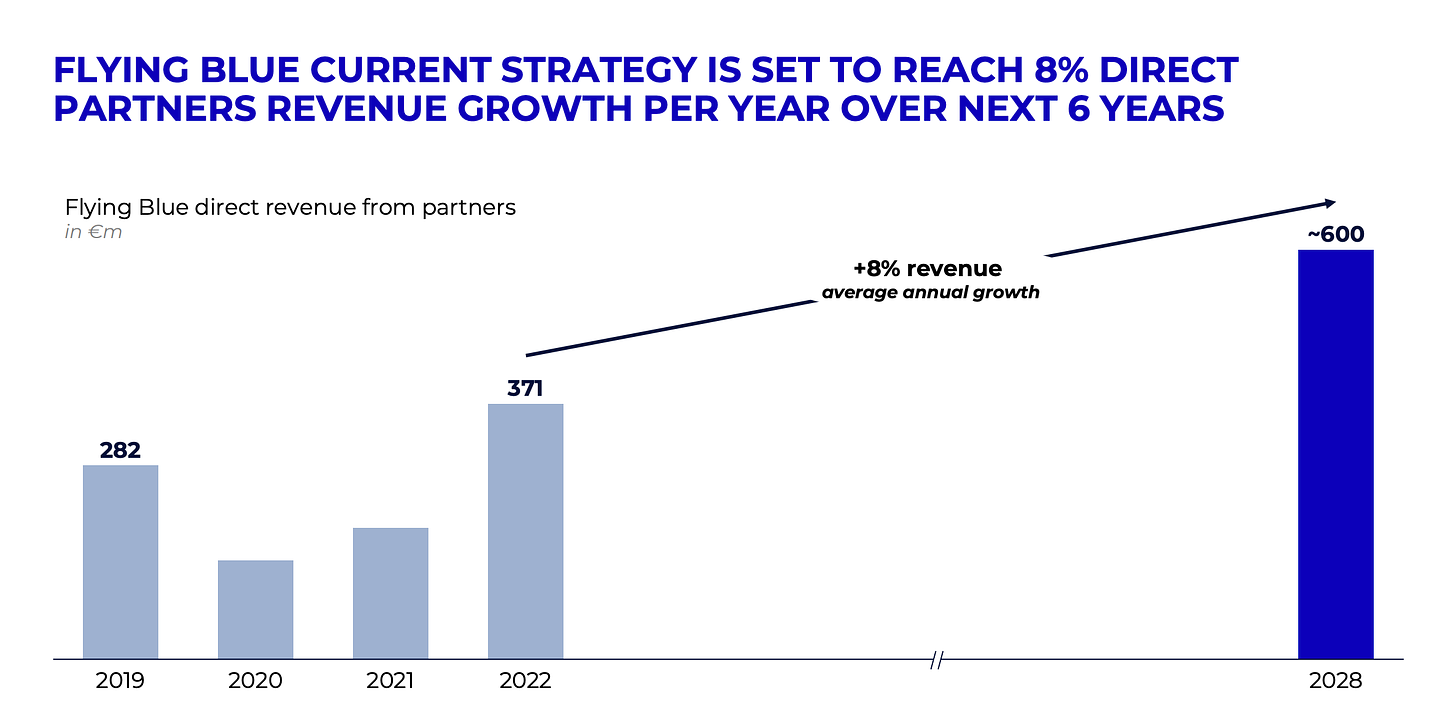

The group intends to boost profits by selling more points to third parties. Today, about half of miles generated by Flying Blue go to airlines, the company noted in a slide, and the rest are bought by outside companies, including banks, which typically pay more. By 2027, Air France-KLM wants to sell 60 percent of points to non-airline partners. As it grows that business, it expects to increase partnership revenue by 8 percent per year through 2028, according to a slide.

How will it accomplish this? One target is the U.S. credit points-to-miles conversion market, as U.S. consumers trade their bank points for Flying Blue's currency. Another target is Canada, where Air France-KLM launched a new credit card with a fintech company called Brim Financial. In addition, Air France-KLM will refocus on the German and UK credit card markets, while possibly increasing revenue from ongoing partnerships with companies like Bilt, Amazon and Hertz, executives said.

Here are some other facts Air France-KLM shared about Flying Blue:

It has about 22 million members, and 13 million active members, defined as “having earned or redeemed miles over past 36 months.”

33 percent of total members are based in France.

12 percent of total members are based in Belgium, the Netherlands, and Luxembourg.

72 percent of total members come from Europe.

Another 12 percent come from North America.

This year, Flying Blue members have accounted for 41 percent of all flight coupons sold by Air France and KLM, but 47 percent of revenues. According to the company, this 6 points of difference is worth €1 billion in revenue.

Need a last-minute gift for a professional colleague? Send them a subscription to The Airline Observer.

Smith is still making Air France more efficient in the air…

You know the truism: airplanes don’t make money on the ground. Yet when he arrived at Air France-KLM, Smith said he noticed Air France using lazy scheduling practices, even while KLM flew airplanes to the max. "We had a lot of flights where we were leaving airplanes on the ground for eight to 12 hours at the destination, doing double-overnights," Smith told analysts. Sometimes, airlines fly double redeyes for competitive reasons — maybe the market prefers to fly overnight — but Smith said that wasn’t true at Air France. On many of these routes, Smith said, Air France had a monopoly position and it could fly whatever schedule it wanted. "It wasn't necessary from a competitive position," he said. Smith told analysts he’s mostly fixed the problem and Air France utilization is up.

…. And on the ground

Unlike Amsterdam Schiphol, Paris Charles de Gaulle was not built to facilitate international connecting traffic. But Smith — who made Toronto Pearson an adequate (and dare I say efficient) hub for sixth-freedom connecting traffic bound for the United States — has turned his attention to micro-improvements at de Gaulle. He's looking at little things "like signage,1 having the right connecting times, [and] trying to cluster the flights that do have a lot of connections in the right zone of the airport."

It seems to be working, he said, as customer ratings have improved. Two other changes also helped. First, with the retirement of the Airbus A380s, Air France no longer worries about five superjumbos spilling passengers into a terminal that cannot support them, all early in the morning. Second, Air France is reducing its reliance on connecting passengers. It had about a 50-50 mix of connecting versus local in 2019; today, it's about 53-47 in favor of local. Smith said he'd like to increase that to 55 percent local because the revenue is better. But it can only go so high, because "we have a lot of routes that would not be able to fly daily if we didn't have the feed," Smith said.

Do you remember Hop? It’s mostly gone now.

To Smith, a brand must stand for something or it should not exist. As you’ll recall, one of the first moves he made when he became CEO of the group was to retire France's long-haul, low-cost entry called Joon.

Smith hasn’t been as blunt with Hop, which flies Embraer E170s and E190s on regional routes from Paris, but he has turned away from a mixed-brand strategy. Air France was operating Hop as a separate brand with different leadership, but Smith has renamed it Air France Hop and gutted the independent Hop management so revenue management, sales and marketing now is run by Air France. He wants customers to feel as though they’re flying on the parent airline, more closely mimicking United Express, American Eagle, or Air Canada Express.

You’ll see the difference in the liveries. Airplanes had been painted in Hop’s garish orange, blue and white colors. Now, they’re in Air France classic livery, with Hop painted in small letters.

Look for growth in North Africa from Paris

As you may know, Air France essentially is pulling out of Paris Orly and leaving its slots to its sister company, the lower cost Transavia.

Smith has discussed woes at Orly before, but it’s always shocking to hear the losses Air France has incurred on its domestic routes: Just the flights from Orly to Nice, Marseille and Toulouse lose "at least" €80 million per year, he said. As Air France turns those routes over to Transavia, "the objective is to eliminate those losses and get them to at least break even, if not profitability.”

But with limited domestic demand, the company needs to be creative about where else it can fly from Orly. Smith said he has ideas.

“We're going try to move a good 60 to 70 percent of the domestic capacity out of Orly and redirect that to European and North African destinations," Smith said. "We see that North Africa is extremely strong. New capacity gets absorbed quite quickly. We're able to make money quickly. It's the European services which take time."

Smith acknowledged competition from Vueling and EasyJet but said Air France-KLM will tweak its loyalty program to win share. ”We are just now starting to dial up our Flying Blue, which is the key unique tool that we have that the others do not have,” he said.

Why didn't Air France-KLM want ITA?

Smith doesn't like messy. And ITA was messy. "As Air France-KLM, we've invested in the former Alitalia twice," Smith said. "To put the third opportunity in front of our board, we'd have to be quite solid and quite comfortable that we could make it."

Smith could not make that assurance, saying he had two qualms. First, it would be complex to operate from two airports in Milan. Second, he did not have a solution to the seasonality of Rome, where there's not much traffic in January, February and March. "We stepped back, and we are quite comfortable that with our position at Linate, at Rome, and at Malpensa, we will get the feed that we want," Smith said. "It's not causing us any grief that we did not move forward."

Lufthansa instead was the winner.

Smith probably wants SAS. But he makes no promises.

As SAS emerges from bankruptcy protection, Air France-KLM is buying 19.9 percent of the airline, with the right to take a majority position after a minimum of two years. Conventional wisdom suggests Air France-KLM will exercise this right, but Smith told analysts it’s no sure thing. “Any investments that we're looking at has to be within our risk profile,” Smith said.

With its current investment, Air France-KLM already is a major winner, Smith said. SAS has said it will join Skyteam from Star Alliance, pushing the airline “out of the Lufthansa Group sphere,” a net positive for his company, Smith said. In addition, SAS may join the transatlantic joint venture with Air France-KLM, Delta, and Virgin Atlantic, another big victory.

I expect Air France-KLM probably will try to control SAS, if only to keep pace with expansion by IAG and Lufthansa Group. Still, Smith warned analysts that taking over another airline is more complex than buying 20 percent. “We have a lot to do with Transavia, which is a major project,” Smith said. “To have to look at transforming another airline, with the team that we have, it is not something we take lightly.”

As for TAP, who knows?

We've heard Smith salivate at the prospect of buying Tap Air Portugal so it can improve its position in Brazil. We learned last week that Brazil has been a top performer for Air France-KLM with all of the group’s flights profitable.

"This was not the case in 2019," said Angus Clarke, the group's chief commercial officer.

Air France’s partnership with Gol, which it recently renewed, helps considerably, Clarke said. "It delivers solid eight-figure profitability to our Brazilian P&L,” he said.

Now that Gol is part of the Abra Group with Avianca, Clarke said Air France-KLM is exploring a commercial partnership with Avianca, "irrespective of them being in the Star Alliance."

Smith believes in the power of brands

Five years ago, you could not have a conversation with an Air Canada executive without the person calling their employer “North America’s best airline.” Smith, who was Air Canada’s president, believed in the airline’s brand. If you're the best, he believes you should say it. "I think we take the brands for granted," Smith said.

Now, he’s acting similarly at Air France, arguing prior management failed to invest in the brand. At Air Canada, Smith told analysts, "we pushed that as far as we could. But the brand at Air Canada is not Air France, and never was going to have the same potential."

He told analysts he plans to further refine brand strategies at Air France and KLM, as the airlines add new airplanes and retrofit older ones with a standardized business class. When customers know what to expect from a premium brand, and they can rely on it, they may become more loyal, he said.

“We have not been able to work on that because we did not have the hard products in place to be able to put out a customer promise that is — or should be — best-in-class,” Smith said.

What I have always liked about Smith is that he’s a realist. At Delta, Ed Bastian often talks about the airline’s revenue premium, as if every customer chooses Delta because it’s a best-in-class experience. Yes, some customers do choose Delta because of the experience. But many more Delta flyers view air travel as a commodity. Smith told analysts he knows many customers don’t care about brand. But for those who do, he said he can drive a premium.

“We know we are in a heavily commoditized business — that doesn’t go over our head,” Smith said. “But even if we get five or six or seven percent of our customers truly buying us for the value of the brand, they will pay a little bit more. I am not looking for 100 percent of the aircraft.”

American Airlines is firing its best customers and Air France-KLM is winning

Clarke, the group’s chief commercial officer, made a not-so-thinly veiled swipe at American, criticizing the U.S. carrier's ire toward travel agents. "Obviously, American Airlines is sort of leading — they think they are leading — the way in new distribution strategies," Clarke said.

Like American, Air France-KLM participates in NDC but so far, the technology is leading to lower-yield traffic, Clarke said, so unlike American, the company is no rush to effectively fire travel agents who are using older and more expensive technology.

"The yield you get from the high-end corporate travel managers, the high-end agents, that are still coming via GDS is so far superior to any cost associated with it," Clarke said. "We just can't turn our back on that and walk away."

The good news is that American’s decision is leading to better profits at Air France-KLM, according to Clarke, as the group takes a bigger slice of the U.S. market through joint contracts with Delta.

"We are winning share, certainly from American," he said. "American is losing corporate share to United and Delta, and ... we're a net beneficiary of that."

Smith still loves first class

I sometimes joke that in addition to being group CEO, Smith must also be the product manager for Air France’s international first class. He loves to brag about everything from its bread and butter, to its lounges, to the inflight crews.

"La Premiere is now profitable," after years of heavy losses, Smith told analysts. "I don't think there are any other carriers — I don't know their numbers — that could claim that."

At the end of next year, Air France will introduce a new first class product, and I suspect fares again might rise. Industry watchers know Air France often charges far more than Lufthansa Group or British Airways for first class on the same routes. But Smith said it can go higher.

"We can put in a 50 percent increase,” Smith said. “Someone who is buying that ticket is not moving back to business class. Once they've sat there, they are not going to do it." He compared it to a shopper spurning Hermčs for Zara. "It's not happening.”

IAG can have its Level. Smith doesn’t seem interested.

Don't look for Air France-KLM to fly low-cost, long-haul anytime soon. Somehow it works for IAG, which is expanding Level, but Air France-KLM has no plans to join the market with Transavia. "We don't have any plans to fly Transavia beyond the medium haul," Smith said.

Correction

In my piece earlier this week about U.S. airline guidance, I used the wrong number for Southwest’s 2024 growth targets. Southwest intends to grow capacity by 6 to 8 percent next year. I regret the error.

That’s all for today. As we head into the Christmas holiday, I expect this newsletter will be quiet. I’ll be back the first week of January.

Do you think Lufthansa Group CEO Carsten Spohr’s takes note of airport signage? If you know more, you can let me know. But I’m guessing Smith is among the only major airline company CEOs who pays attention to such minor things.