Making or receiving payments in foreign currency often entails fees that can erode your profits. Luckily, there are various strategies to mitigate charges associated with cross-border foreign currency payments, one of which is by signing up for Amazon Seller...

Making or receiving payments in foreign currency often entails fees that can erode your profits. Luckily, there are various strategies to mitigate charges associated with cross-border foreign currency payments, one of which is by signing up for Amazon Seller Wallet (ASW). Receive reduced fees for the first year when you sign up by November 30th.

What is Amazon Seller Wallet?

Introduced in July 2022, Amazon Seller Wallet allows you to store and manage your US store earnings within a single online payment system, giving you control over how much and when to transfer your money to your bank accounts.

You can also conveniently use the funds in your wallet to pay vendors, suppliers, and contractors. Simply add them as recipients to be able to start sending USD payments from your wallet.

Note: Donít confuse Amazon Seller Wallet with Amazonís disbursement solution called Currency Converter for Sellers (ACCS).†

ACCS automatically converts and deposits your international earnings into your domestic currency, often making it a go-to choice for sellers.†

Seller Wallet, on the other hand, enables you to keep your Amazon payouts in a virtual account and freely convert or transfer the money whenever necessary. Simply put, you get to decide when to initiate money transfers.

ASW Primary Features

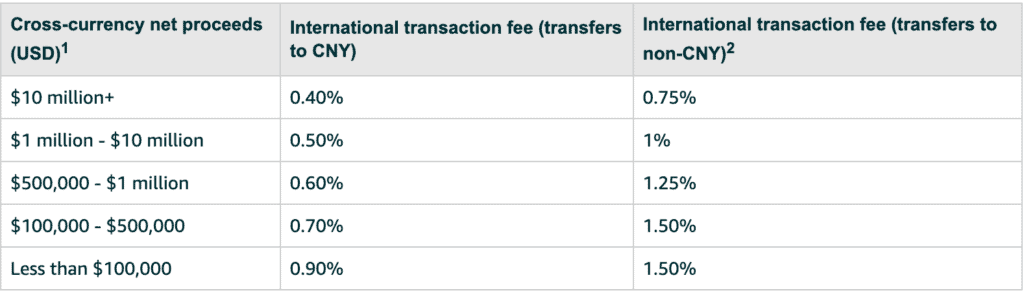

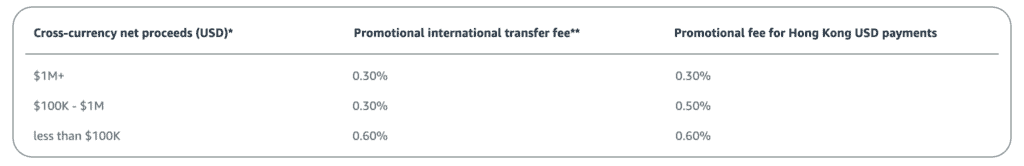

Enrolling in Amazon Seller Wallet is free with no mandatory minimum amount. No account maintenance fee required. Free US domestic transfers and payments to vendors with a US bank account. Amazon Seller Wallet uses the backend technology that sellers trust to ensuring the safety of their transactions and the security of their information. For a fee, you can make international transfers to your own bank accounts in more than 20 currencies or send payments to USD-denominated bank accounts in Hong Kong. However, Amazon says this fee decreases as your sales grow. See transaction fees below:

ASW Cost Benefits

Quickly make international transfers from your wallet. You can now skip transferring your payouts from Amazon to your bank account before settling payments with your business partners. For global sellers, this translates to savings on currency conversion fees and prevents losses when utilizing USD proceeds for USD-based transactions. Heightened control over your money. Without extra cost, conveniently monitor all your store proceeds, bank transfers, and vendor payments in a centralized location. Special sign-up offer. Despite Seller Walletís ease of use, itís important to note that Amazon imposes a fee on the converted amount. In addition to this cost, using ASW exposes you to the uncertainties of fluctuating exchange rates, potentially diminishing your profits.†As mentioned, you can optimize your financial savings by enrolling in Seller Wallet before November 30, 2023, and unlock exclusive benefits with Amazonís special sign-up offer. By doing so, youíll gain access to reduced fees for cross-currency transfers and Hong Kong USD payments for up to a year.

Enjoy lowered fees (e.g., paying only 0.60% vs. 1.5%) for transfers and payments determined by your cross-currency net proceeds Ė the earnings derived from all of your Amazon stores operating with a currency distinct from your reporting country within the last 12 months.

How to Get Started

Check if youíre eligible to sign up for the program. If yes, fill out the registration form and submit the necessary documents. Add your bank accounts and recipients.Click here to learn more about Seller Wallet.