As an Amazon seller operating in Japan, it�s crucial to stay informed about updates and policy changes that can impact your business. Amazon recently sent out an important announcement regarding tax rate compliance and new invoice policy requirements that...

As an Amazon seller operating in Japan, it�s crucial to stay informed about updates and policy changes that can impact your business. Amazon recently sent out an important announcement regarding tax rate compliance and new invoice policy requirements that came into effect on October 1, 2023. In this blog post, we�ll provide you with the details of this announcement and guide you on how to ensure your compliance with these changes.

Understanding Tax Rate Compliance

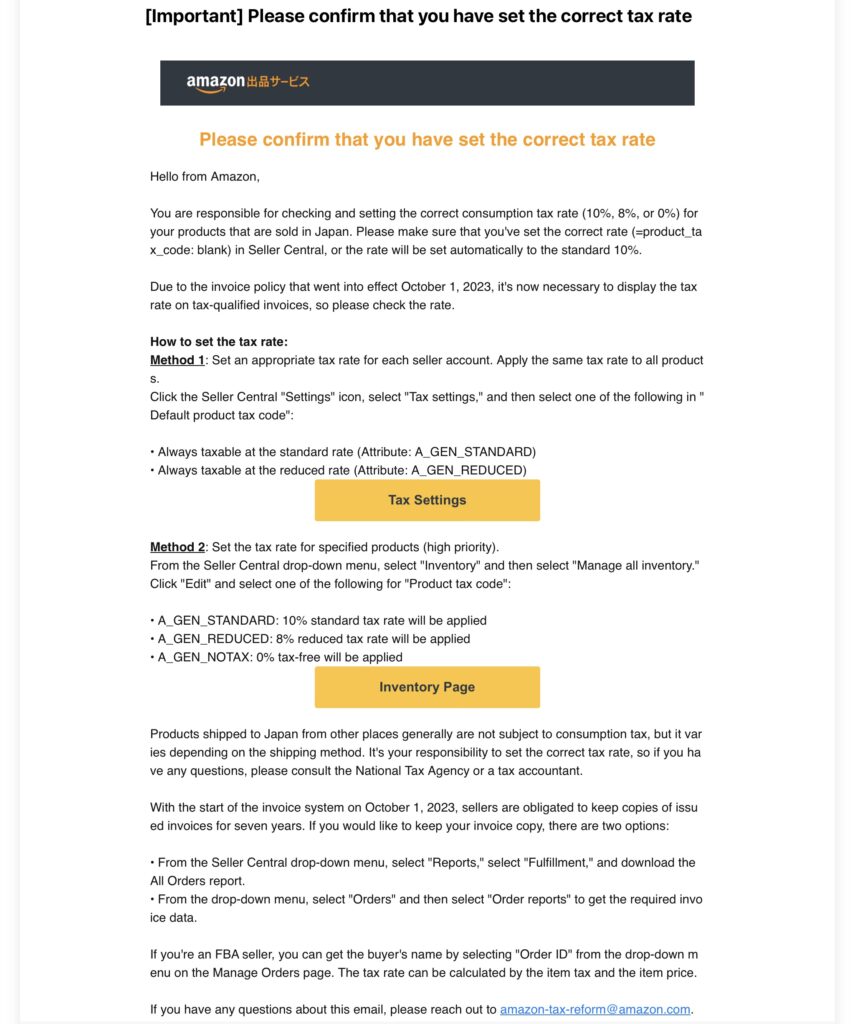

In the announcement, Amazon highlights the need for sellers to accurately set the consumption tax rate (10%, 8%, or 0%) for their products sold in Japan. Setting the correct tax rate is essential to adhere to tax regulations and maintain transparency in your business operations.

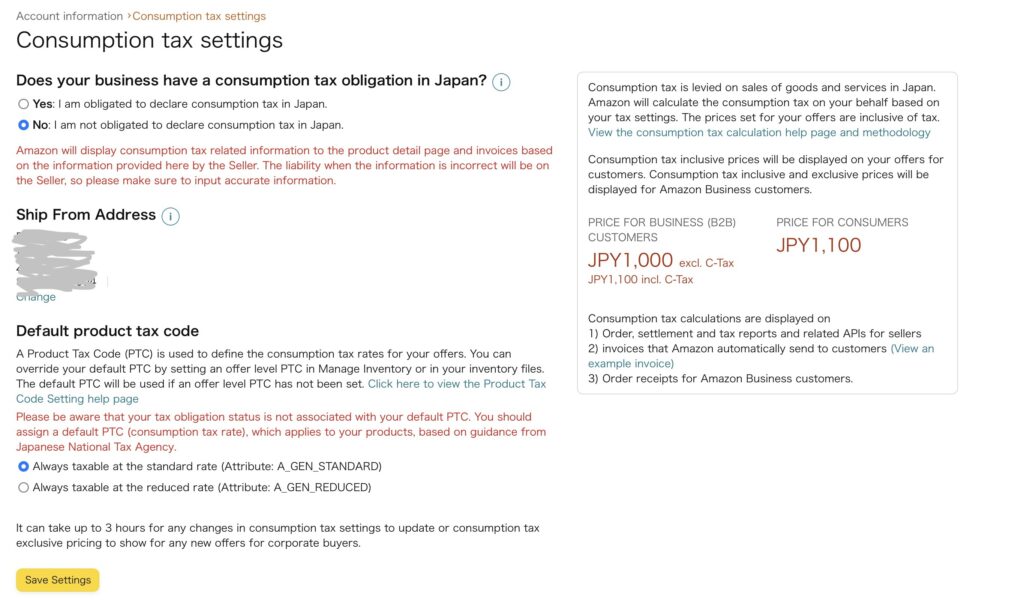

If you do not set the tax rate correctly in Seller Central, Amazon will automatically set it to the standard rate of 10%. To avoid this, it�s crucial to take the following steps:

Method 1: Set a Default Tax Rate for Your Seller Account

Log in to your Seller Central account. Click on the �Settings� icon. Select �Tax settings.� In �Default product tax code,� choose one of the following options: Always taxable at the standard rate (Attribute: A_GEN_STANDARD) Always taxable at the reduced rate (Attribute: A_GEN_REDUCED)Method 2: Set Tax Rates for Specific Products (High Priority)

From the Seller Central drop-down menu, select �Inventory.� Choose �Manage all inventory.� Click �Edit� for the product you want to update. In the �Product tax code� section, select the appropriate tax rate: A_GEN_STANDARD: 10% standard tax rate A_GEN_REDUCED: 8% reduced tax rate A_GEN_NOTAX: 0% tax-freeIt�s important to note that products shipped to Japan from other locations are generally not subject to consumption tax. However, this may vary depending on the shipping method, so sellers should take the responsibility to set the correct tax rate.

New Invoice Policy Requirements

Starting from October 1, 2023, a new invoice policy is in place, requiring sellers to display the tax rate on tax-qualified invoices. To ensure compliance with this policy, make sure you have set the correct tax rate for your products. This change is designed to enhance transparency and assist customers in understanding the tax implications of their purchases.

Invoice Record-Keeping

Another significant change is the requirement for sellers to keep copies of issued invoices for a period of seven years. This is an important compliance measure to ensure that your business adheres to tax regulations. Here�s how you can obtain and store invoice data:

From the Seller Central drop-down menu, select �Reports,� then choose �Fulfillment� to download the All Orders report. Alternatively, you can select �Orders� from the drop-down menu and then choose �Order reports� to access the necessary invoice data.For FBA sellers, you can obtain the buyer�s name by selecting �Order ID� from the drop-down menu on the Manage Orders page. You can then calculate the tax rate based on the item tax and item price.

Seeking Assistance

If you have any questions or require further clarification regarding these changes, Amazon provides an email contact for inquiries: [email protected]. Don�t hesitate to reach out if you need guidance or support.

Staying compliant with tax regulations and adhering to Amazon�s policies is essential for your success as a seller on the platform. The recent updates regarding tax rate compliance and the new invoice policy in Japan are important steps to ensure transparency and meet customer expectations. By taking the necessary actions to set the correct tax rates and keep proper invoice records, you can continue to thrive as an Amazon seller in the Japanese marketplace and provide an excellent shopping experience for your customers.

Follow this link to update your Consumption tax settings on Amazon Japan:

Here you can view a screenshot of e-mail from Amazon regarding the matter:

hope you found this article helpful. If you are experiencing issues with your Amazon Seller Account and your Seller Account already received a warning or is under a review, I can help you resolve the matter.

If you would like to hire me to privately assist you, feel free to subscribe and reach out through my dedicated assistance page at�www.onlyfans.com/kikaangelic, where I provide support with Amazon related matters in exchange for a small $24.99 fee.�Alternatively, you can post into my�free public discussion forum for Amazon Sellers, where I will answer your question.

To stay in touch, feel free to join and post into my large�Amazon Seller Performance � Friendly Advice � Worldwide�Facebook group, where you will be very welcome.

Many Amazon sellers recently started trading stocks and crypto currencies, hoping to diversify their income, which is a very good idea with all the uncertainty which comes with the platform. For this reason, we launched a new Facebook group,�Crypto Arbitrage Income (Bitcoin, Crypto, Altcoins, Blockchain, Trading)�� feel free to join us and forget about the troubles of selling on Amazon for a moment!

Additionally, here you can watch my YouTube video, where I am addressing everything you need to know about Seller Identity Verification and how to pass it:

The post Amazon Japan Asks Sellers to Confirm Their Consumption Tax Rate first appeared on Seller Union.