Amazon accounting is known for being complex, time-consuming and stressful. Many people turn to bookkeepers and accountants to fulfil their tax obligations. Thereís no reason to avoid taking control of your financial situation. You just need to make sure...

Amazon accounting is known for being complex, time-consuming and stressful. Many people turn to bookkeepers and accountants to fulfil their tax obligations. Thereís no reason to avoid taking control of your financial situation. You just need to make sure that youíre accurately accounting for everything so that you can focus on a high profit margin.

This article will explain everything you need to know regarding Amazon accounting. It will also include the top three mistakes Amazon sellers make in tax preparation and how to correct them. So, letís get started.

Why is Amazon Business Accounting so challenging?

Bookkeeping is probably the most tedious task you have to do when you own an Amazon business. Many business owners prefer to hire an accountant to handle their bookkeeping.

Every industry has its challenges, but eCommerce is no exception. One, Amazon sellers must manage inventory across multiple markets. This can lead to inaccurate balance sheets and make it difficult to track your products. Amazon transactions are often quite large and have a variety of fees that you should consider. Accounting software can help, but it also opens the door for other problems. Weíre not even talking about tax liabilities.

Over 8,000 Amazon sellers have been my clients and their accountants over the course of my career. Over the years, I learned a few things that even experts can get wrong. Do you know the worst part? They didnít know they were making a mistake. They didnít know they were making a mistake, even though the books werenít balanced. It was too late.

How Amazon Bookkeeping Can Help You Find New Opportunities†

You might view bookkeeping as an essential evil if you are an Amazon seller. Thereís another way to view it that is more rewarding. Amazon accounting can be a great way to see how your business can increase profits. We all want to make peopleís life better and provide them with amazing products. Weíre here to help you grow your business.

Youíre at greater risk than paying more taxes if you get Amazon accounting wrong. You are also missing out on growth opportunities and profits. Letís look at common mistakes Amazon sellers make in managing their books and learn how to correct them.

These are the Top Three Most Common Amazon FBA Accounting Mistakes

While we all make mistakes, Amazon is one of my most popular. Here are the top three most common mistakes that people make when accounting for Amazon.

Confusion of their net deposits with sales

When you do your Amazon accounting, one of the most common mistakes is to enter your net sales. How can this happen? Simple. It is as simple as that. You can see how much money was deposited into your bank account and then you can enter the same amount in your sales number. This is a mistake!

Amazon deposits can be made up of a variety of transactions.

Amazon refunds Amazon Sales Amazon Seller Fees Amazon Storage Fees Amazon FBA Reimbursements Amazon FBA Fees Amazon Lending Amazon PPC (Pay Per Click or Advertising Costs). Amazon Reserved BalancesWhat happens if all these Amazon transactions are converted into a net deposit. This could lead to you over-declaring profits or under-declaring them. If you are VAT registered in the UK or tax for sellers based there, eventually this could lead to excessive VAT.

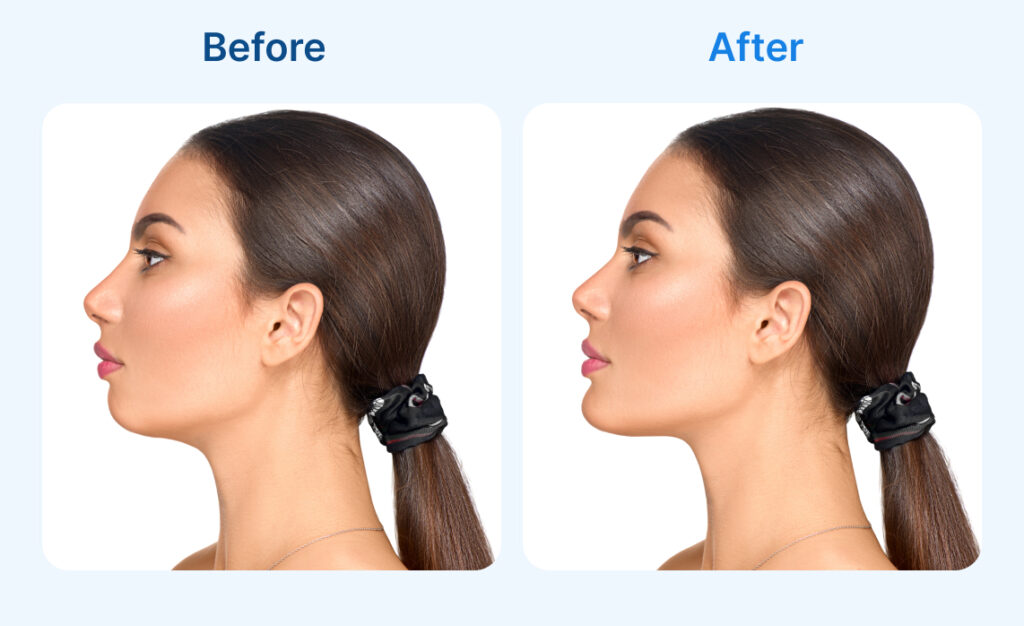

Image alt: A screenshot from a Xero Report where a deposit was incorrectly entered as sales.

How to Fix the Issue: To get a clear picture of your profitability, and to maintain accurate books, you need to separately account for each transaction type. You should keep an eye on the changes in fees (e.g., rising fees) and separate Amazon fees according to type. Letís say you have a very high monthly storage fee. You could look at inventory that has been kept for longer than 90 days or 180 days, and then sell it quickly to get lower storage fees.

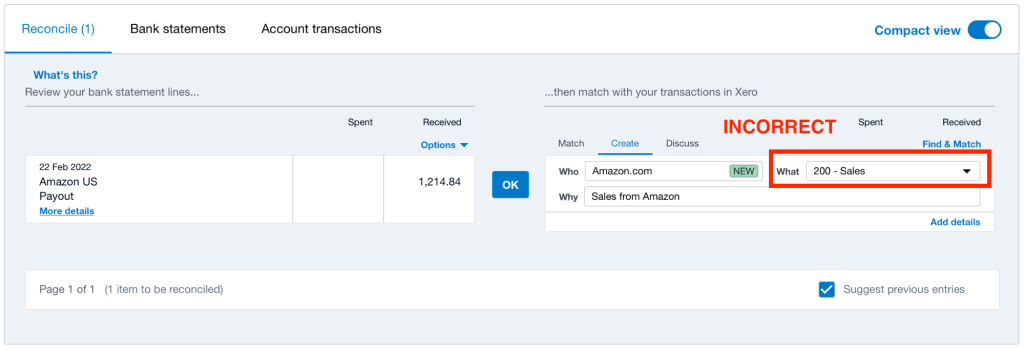

Summary File: Misusing your Amazon Date Range

Another mistake that I have seen business owners make with Amazon is downloading the Date Range Summary report every month and then entering the Income or Expense totals into your accounting software. Your Amazon income will not match your Amazon deposits. Why? Amazon pays 14 days in advance, so it is impossible to be certain the figures are correct.

Image alt: A screenshot from an Amazon date range summary.

This is how to fix it: Avoid using Amazonís date range summary report to calculate what should be entered into your accounting software programís Income and Expenses. To ensure you capture all data accurately, you should use the settlement reports together with the VAT reports (if your company is based in the UK).

†

Application of the same GST or VAT to all sales

The third common mistake in Amazon accounting is not separating your export sales from common sales, where Amazon has already remitted tax to a country. This is especially true if you use Amazon Fulfilment (or FBA) which automatically handles all shipping returns and product returns.

Amazon FBA automatically activates the Global Shipping Program. This means that unless you opt out, Amazon will manage your entire product lifecycle. Amazon will treat any sales to customers in foreign countries as exports, and will classify them as either Free Income GST (for Australian sellers), or Zero Rated VAT for UK sellers.

How to fix this issue: You need to correctly identify and separate any overseas sales that you make through Amazon FBA. Many FBA sellers fail to do this and end up paying more VAT or GST than they should.

Here are some general tips to avoid Amazon accounting mistakes

We have covered three common Amazon accounting errors (which you may or might not have been making). You might now be curious about the best way for you to ensure your books are clean. These are my three tips to ensure you pay the correct amount of taxes.

Use the right reports Donít be too detailed. Automate your accounting.Letís take a look at each one in more detail.

Use the Best Reports on Each Case

To keep your bookkeeping organised, you need to know which reports should be used for what tasks. This will allow you to determine at every point your sales, refunds, fees, transactions, and other information. A good way to keep your bookkeeping clear if you are a new Amazon seller is to spend at most half an hour each month looking at these numbers, and then ordering them in spreadsheets.

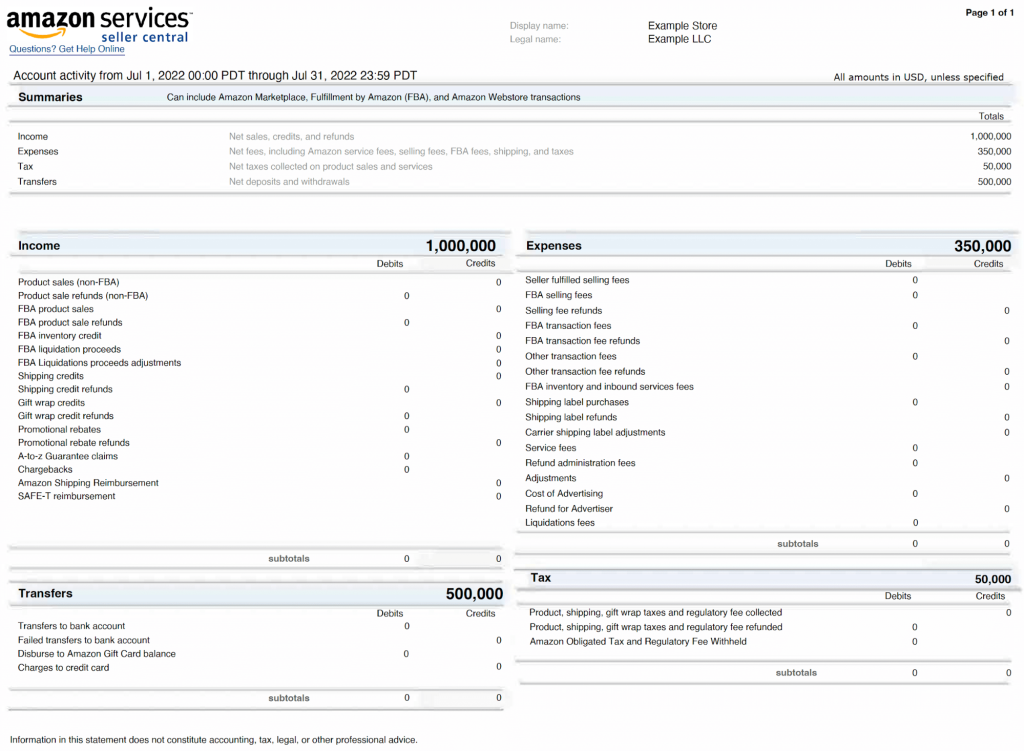

This is possible by downloading Amazon settlement reports. This report lists all transactions over a specified time period (your Amazon payouts period). This report can be downloaded easily by visiting Amazon Seller Central Account, clicking on Reports > Payouts > All Statements.

Image alt: A screenshot of an Amazon Settlements report.†

Microsoft Excel can be used to organise the various transaction types, and then to migrate the information into your accounting software.

Important Note: UK Businesses should also use the Amazon VAT Transactions Report. This will allow you to see which sales have been exported and where Amazon has already collected VAT. You can also use the All Orders Report to identify which items were shipped out of Australia so that you can adjust the GST rates.

Detailing without being too detailed

Accounting can be difficult so you need to ensure that you have sufficient detail about all fees and transactions. This will help you to identify the right amount of tax, pay it on time, and look for opportunities for growth. There is no such thing as too many details when it comes to Amazon accounting. Analysis paralysis is what I call it!

Although it can be tempting to separate each transaction type and fee, this will only make your life more difficult and waste time. Thereís a healthy balance between too much and too little data. It is important to have enough information in order to make informed decisions.

Accounting Automation

The last piece of advice I have is simple: Automation can be a time-saver and can provide valuable information that can help you grow your business. Automation can often do a better job than yours, and thatís not offensive.

Image alt: Your accounting shouldnít take too much time!†

Doing your own Amazon accounting comes with risks. It can be tedious and time-consuming. Itís not worth spending hours downloading, analysing and then moving reports to cloud software. Amazon says that you should not spend more than 10 minutes per month on your books.

There are many tools that you can use to automate your Amazon accounting. This will allow you to calculate more accurately and ensure that you donít pay more tax than what you should.

Amazon Accounting Software Automation: The Best Option

To manage your Amazon bookkeeping, you donít have to pay a lot of money for an accountant. You can automate all the essential tasks with Link My Books in just a few clicks.

If you are a business owner looking to ensure your books are in order, you can start by making a commitment to not waste time reconciling Amazon payments. Automate your business today to allow you to focus on the important things: Growing your company.

Author Bio

Link My Books is a software that plugs into your Amazon account and Xero or QuickBooks to accurately automate your Amazon accounting. Not only does it save you time each month versus manual bookkeeping, it can also help you to reduce the likelihood of overpaying tax due to inaccurate accounting.

The post Amazon Accounting Mistakes that will Cost you Big Time appeared first on ManageByStats.