During a summer break, The Interpreter will feature selected articles each day from throughout the past year. Normal publishing will resume 15 January, 2024. This article first appeared on 6 February, 2023.

This year’s Lowy Institute Asia Power Index – an annual measure and analysis of each country’s resources and influence in the region – uncovered a number of unexpected findings.

Japan was the most searched country online among Index members

Which countries in the region are most interested in Japan online?

Which countries in the region are most interested in Japan online?

Japan maintained its position as the most frequently searched Asia Power Index country via online search engines in other Asia Power Index countries. The trend was most pronounced in Southeast and East Asia, where it was the most searched country among ten of the 14 countries, including Cambodia, China, South Korea, Malaysia, Mongolia, Myanmar, Philippines, Taiwan, Thailand and Vietnam. However, this was not the case in South Asia, where, generally, India or the United States was the most searched nation. Consistently high online search interest in Japan is one of 15 indicators used to calculate Cultural Influence in the Asia Power Index and is a proxy reflection of Japan’s soft power and attractiveness in Asia.

Thailand lost 85 per cent of its tourists during the pandemic

While traditionally one of Thailand’s strongest indicators, in 2020, the total number of foreign tourists from other Asia Power Index countries dropped from nearly 33 million in 2019 to five million in 2020 due to the impact of the Covid-19 pandemic. This included a loss of more than one million tourists from India, Japan, Laos, South Korea, Malaysia and Singapore, and nearly 11 million from China. When considering all tourists, it’s even more pronounced – dropping from nearly 40 million to under seven million. This trend continued in 2021, when the number of tourists dropped to less than half a million. All countries lost tourism revenue during the pandemic, but our data shows the uneven impact, with tourism accounting for around 10 per cent of Thailand’s GDP in 2019.

In 2022, the number of international flight routes from Beijing halved

One of the more noticeable changes in the 2023 Asia Power Index is the large loss of points for many nations in the connectivity sub-measure. Of these, it’s most noticeable in the travel hubs indicator. Measured in July 2022, the number of international flight routes declined for 16 Asia Power Index countries, including double-digit loses for cities Tokyo, Seoul, Kuala Lumpur, Moscow, Taipei, Bangkok and New York. While flight routes from many countries were cancelled in 2022, this was most extreme in China, with flight routes halving to 53 due to its protracted lockdowns and border closures. China also suffered large losses in other connectivity indicators, including those related to global trade and investment flows, which affected its overall Economic Capability and power scores.

China’s share of investment in Brunei reached 94 per cent

Following limited investment by Japan in Brunei in recent years, the share of capital investment from China among Asia Power Index countries over the ten-year period 2013–21 soared above 90 per cent. Almost all this investment, worth more than US$13.5 billion, came from one joint petrochemical project. While this is an extreme case, the overall trend in the region suggests that China is becoming a more important source of investment compared to Japan. Since the first edition of the Asia Power Index in 2018, the average share of Japanese investment across the region has dropped from roughly 12 per cent to ten per cent. By contrast, Chinese investment has increased from 16 per cent to 22 per cent.

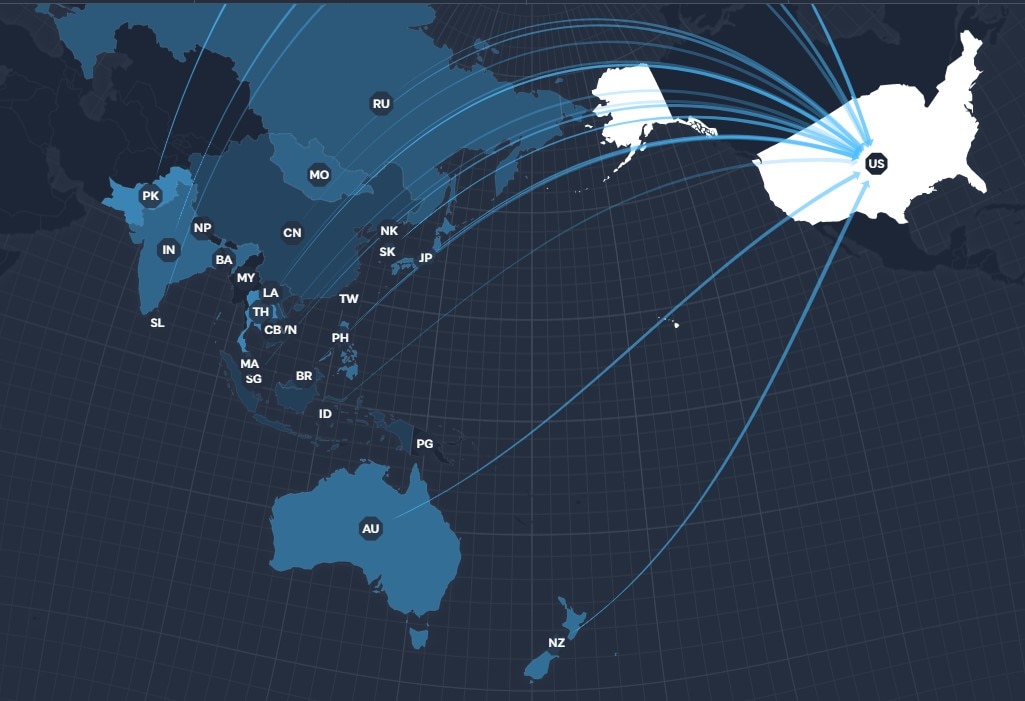

The United States was the top bilateral defence training partner for half of the Index nations

Which countries in the region do the greatest share of their defence dialogues with the United States?

Which countries in the region do the greatest share of their defence dialogues with the United States?

The United States is the most important bilateral military training partner for Australia, Bangladesh, Japan, South Korea, Malaysia, Mongolia, Nepal, New Zealand, Papua New Guinea, the Philippines, Singapore, Taiwan and Thailand, as measured by the number of combined trainings in 2021. Notably, the United States accounted for a quarter of Australian joint trainings, around 80 per cent of both Japan and South Korea’s, and more than half of the Philippines’. This highlights the preeminent role the United States plays as a defence partner in the region, a key source of relative US advantage.

More than a third of Japan’s bilateral diplomatic dialogues were with the United States

This edition of the Asia Power Index includes new data, tracking the extent of high-level diplomatic engagement among Index countries in 2021. Japan and the United States met more frequently than any other pair of Asia Power Index countries. Japan held ten meetings with the United States out of a total of 27 meetings tracked. These included two 2+2 meetings, four foreign ministerial-level meetings, and four at the leader level. The next most common pairings were between South Korea and both China and the United States – six each – and five between Australia and the United States. In addition, China met with more than three-quarters of the Index countries, while the United States met with less than a third. This data highlights that deep partnerships with select allied countries are a hallmark of US–Asia strategy, in contrast to China, which prioritises shallower relationships with a larger number of partners.

These data points are drawn from the 133 indicators that the Lowy Institute uses to measure power in the Asia Power Index. For more on the Index and its findings, visit power.lowyinstitute.org.