Reading Time: 7 minutes Despite the Reserve Bank of Australia delivering 13 interest rate rises across 2022-23 in the pursuit of its 2-3% annual

Reading Time: 7 minutesDespite the Reserve Bank of Australia delivering 13 interest rate rises across 2022-23 in the pursuit of its 2-3% annual inflation rate goal, Australia�s inflation remains sticky.

For the September 2023 quarter, the Consumer Price Index (CPI) rose 1.2%, representing an annual increase of 5.4%.

December quarter�s (2023 Q4) results will be released by the Australian Bureau of Statistics (ABS) on the 31st of January 2024.

But what do leading economists say about the odds of inflation rising further in 2024?

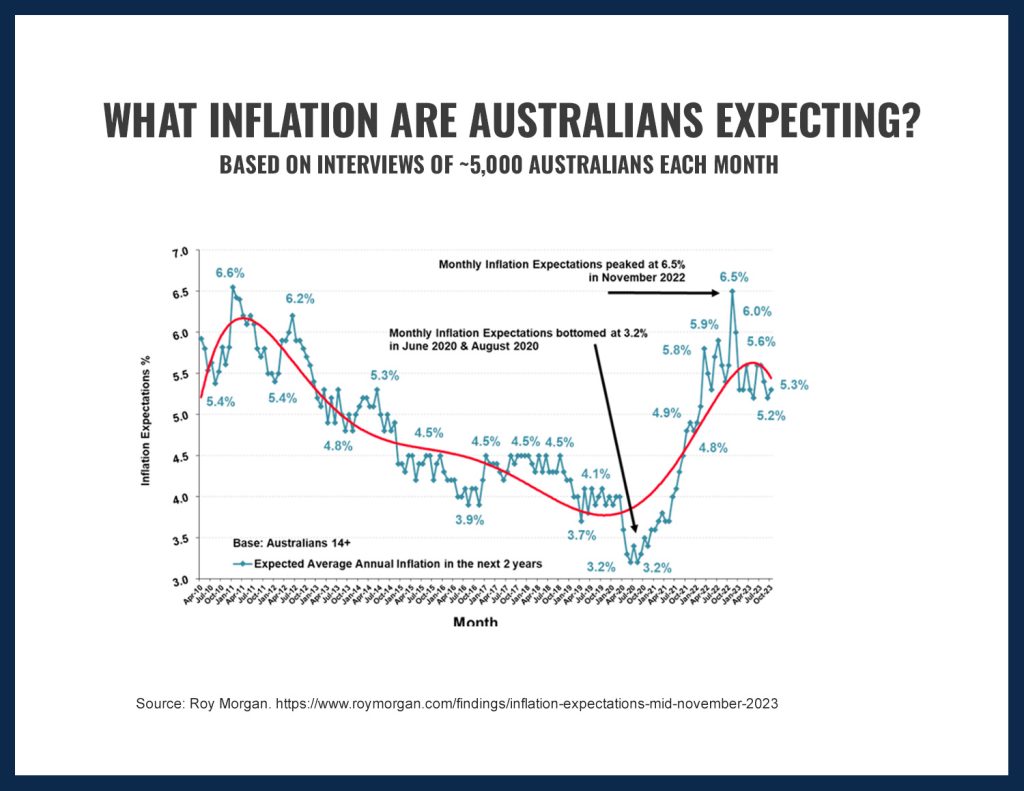

Above: Roy Morgan�s research found that Australians remain sceptical, mainly due to rising fuel prices and stubborn services inflation.

Australian Inflation Rate Remains Stubbornly High.

In its recent Mid-Year Economic and Fiscal Outlook (MYEFO) released in December 2023, the Australian Government revised its expectations for inflation levels in Q2 2024.

Treasury also forecast that inflation would return to the target range (2.75%) by mid-2025.

(Related: What Is The Cost Of Living In Australia?)

RBA is less optimistic, forecasting the CPI will decline to 4.5% for the December 2023 quarter � and won�t reach 3% until December 2025.

Above: The RBA remains ready to hoist interest rates if significant price rises continue.

Despite below-trend GDP growth predicted in the coming year, both Commbank and Westpac believe the RBA won�t need to tighten rates further to quell inflation.

Westpac stated in December 2023:

CommBank�s economic insights noted weaker consumer demand and a smaller-than-expected budget deficit revealed in the government�s MYEFO:

Predictions for the CPI headline rate in 2024 from the banks include:

| Westpac | 0.8 4.3% annual change | 0.7 3.5% annual change | 0.8 3.5% annual change |

| NAB | 0.7 4.6% annual change | 0.7 4% annual change | 0.7 3.9% annual change |

| CommBank | None | 3.6% annual change | |

| ING | 4.4% annual change | 4.1% annual change | 3.9% annual change |

What Will Happen To Inflation In 2024?

Don�t forget that you can look at the Australian economy in one of two ways:

Both are important. But in times of stress, humans overestimate the impact of the former and overlook the indirect (yet powerful) impacts of the latter.

Factors that can sustain increasing inflation include:

Above: Some of the most significant price rises occurred in the rental market.

What Is The History Of Inflation Rates In Australia?

Australia saw a number of spikes in the inflation rate in the 70s, 80s and 90s.

The RBA adopted the 2-3% inflation target in the early 1990s, with cash rate changes as the primary tool to stimulate or dampen economic activity and keep inflation stable.

Pent-up demand from that period was cited as a major cause of skyrocketing inflation as pandemic restrictions eased. Australia�s inflation rate hit a 22-year peak in December 2022, reaching 7.8%.

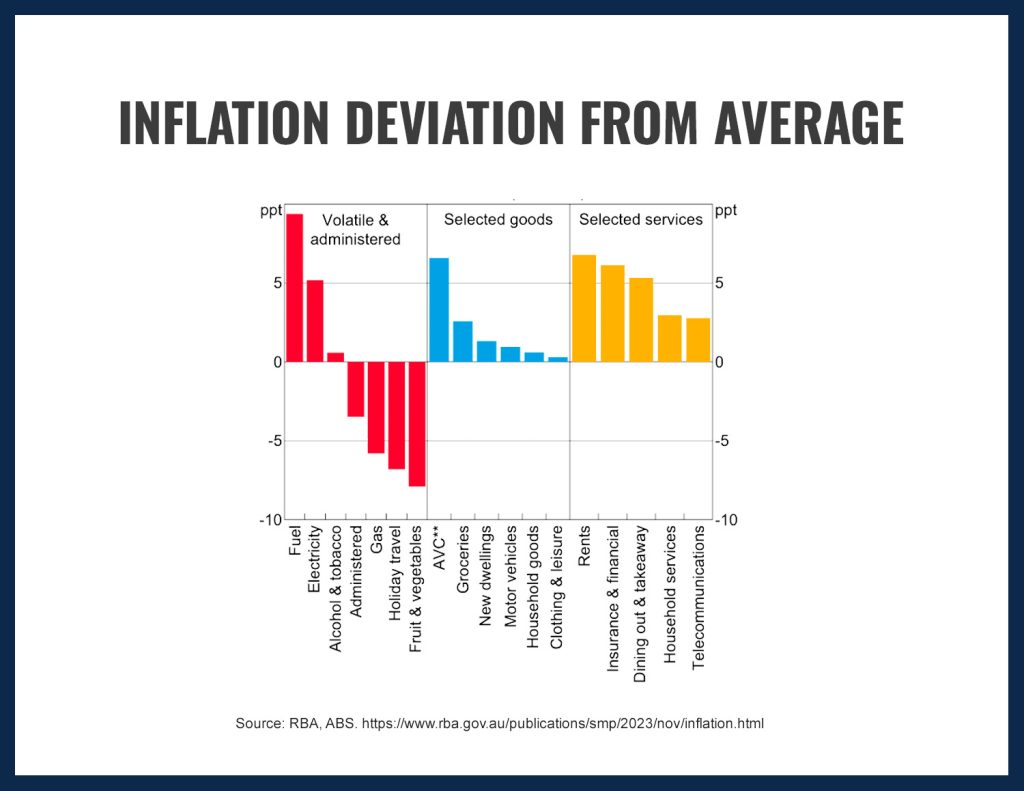

Above: Consumer price index averages can obscure price movements in different parts of the economy. Services inflation is still high, while food inflation is falling. Fruit and vegetable prices have recorded the biggest falls.

How Does Australia�s CPI Compare Globally?

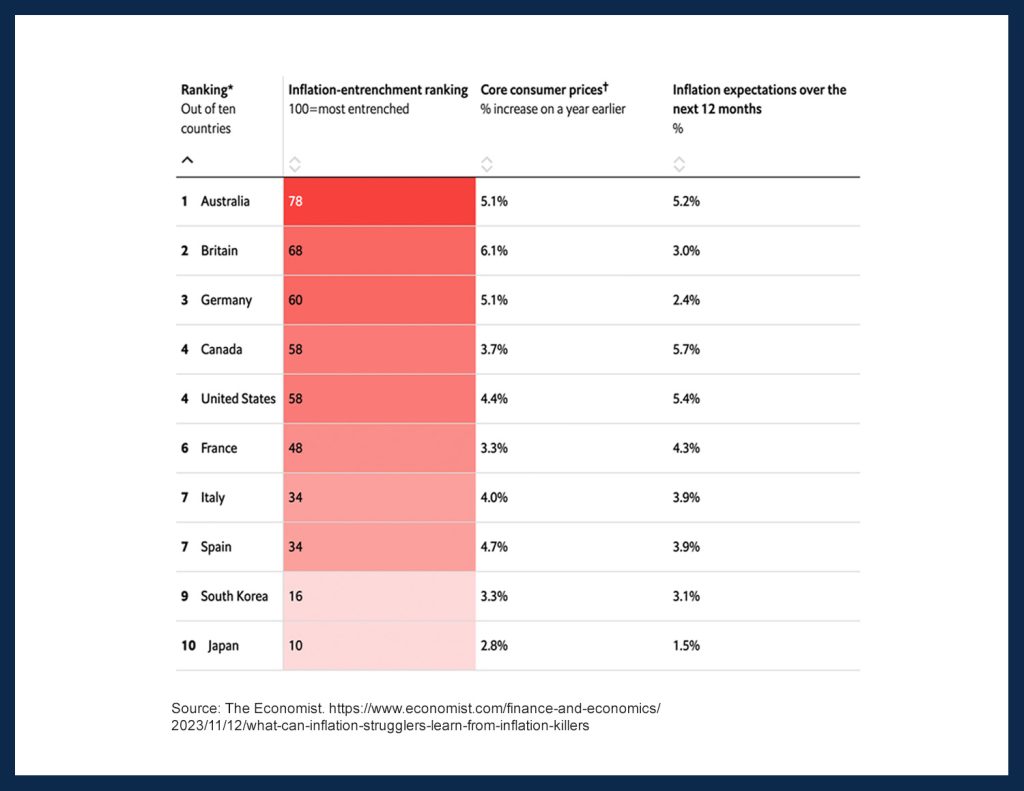

Australia�s inflation rate is one of the worst among advanced economies.

While many countries � the US and UK included � have experienced rising inflation of late, there�s evidence that inflation is easing more quickly elsewhere.

Above: The Economist coined a measure of �inflation entrenchment�, a statistic used to demonstrate the stickiness of inflation. Australia is leading the pack, likely due to some of the most generous pandemic stimulus measures.

In its Interim Report released September 2023 titled Confronting Inflation and Low Growth, the OECD said that while inflation was well above central bank targets in almost all G20 economies, core inflation was beginning to decline at a moderate pace.

However, services inflation was persistent and was set to remain so. It�s driven by labour costs, energy prices and the �sizeable weight of housing rental prices� in some countries (particularly the US).

Did You Know?

The OECD predicted global growth to dip in 2024, with most advanced economies being held back by a tightening bias needed to rein in inflation � but said risks remain tilted to the downside.

In particular, a key risk is whether hawkish monetary policy delivered so far will be sufficient to slow inflation down to target levels.

Important!

These could trigger an abrupt reassessment of liquidity, duration and credit risks.

Above: Projected inflation rates for 2024 (Australia, Eurozone, UK, US, Canada & Japan).

Frequently Asked Questions About Australian Inflation Rate.

If you find macro- and microeconomic concepts difficult to wrap your head around, you�re not alone. Get up to speed with my definitions below.

Headline Consumer Price Index vs Underlying CPI: What�s The Difference?

Headline and underlying CPI are two different ways to interpret the price change data collected by the ABS.

Another way CPI is analysed is the �Seasonally adjusted� figure that accounts for regular seasonal price movements, such as an increase in the price of education in March each year.

The measure spreads out the impact of �seasonal� pricing over the year.

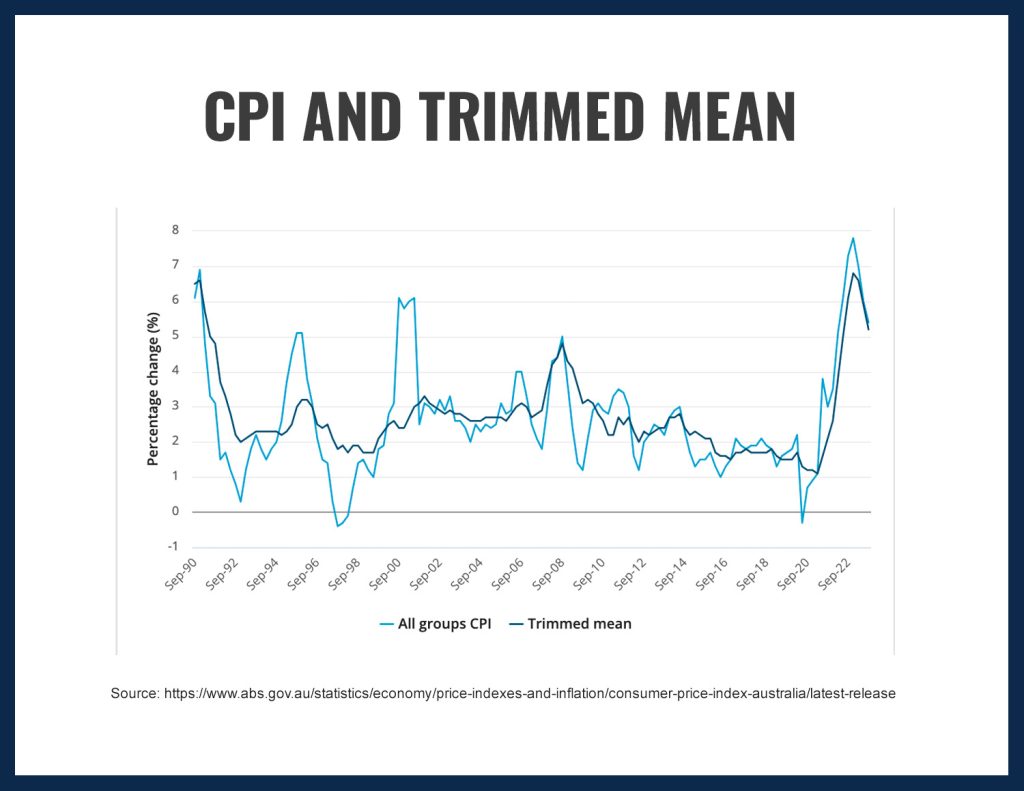

Inflation is currently slightly lower based on the Trimmed mean, at 5.2%.

Above: Consumer Price Index vs Trimmed Mean.

How Is The Consumer Price Index (CPI) Calculated?

Staff from the ABS investigate current prices on a fixed �basket� of things that an Australian household would typically spend their money on, like groceries, housing, transport, healthcare, entertainment, and utilities (around 1 million prices are collected every quarter).

They calculate the price change from the previous quarter in aggregate to determine an overall inflation rate.

What Is Inflation?

Inflation is a consistent, economically significant price rise across the economy.

Practical Example.

If the average price of insurance and financial services rose by $1,000 across the country, that would be considered inflation. If the price of these services rose in a single city, it would not be considered inflation.

Most often, inflation is caused by an imbalance in the supply and demand of money.

Why Is Inflation Dangerous?

Inflation can become a self-sustaining cycle. History is full of examples where out-of-control inflation brought relatively strong economies to their knees.

Higher prices make goods and services less affordable to everyday people, who demand higher wages again.

What Caused The Latest Spike In Australia�s Inflation?

During lockdowns, the Australian government rolled out one of the most generous stimulus packages in the world.

Can Inflation Lead To A Recession?

Yes. Rises in inflation, combined with interest rate rises, can force people to spend less while encouraging businesses to lay off employees. Unemployed people are less likely to buy goods and services, accelerating the downturn.

Did You Know?

The definition of �recession is two consecutive quarters of negative GDP growth.

Final Words On Rising Inflation Rate In Australia.

While there�s always a risk that prices will continue to surge, most experts agree Australia�s inflation rate will trend downward in 2024.

It�s expected that fewer supply constraints and reduced consumer spending � due to Aussies feeling the impact of cost of living � will both reduce underlying price pressures.

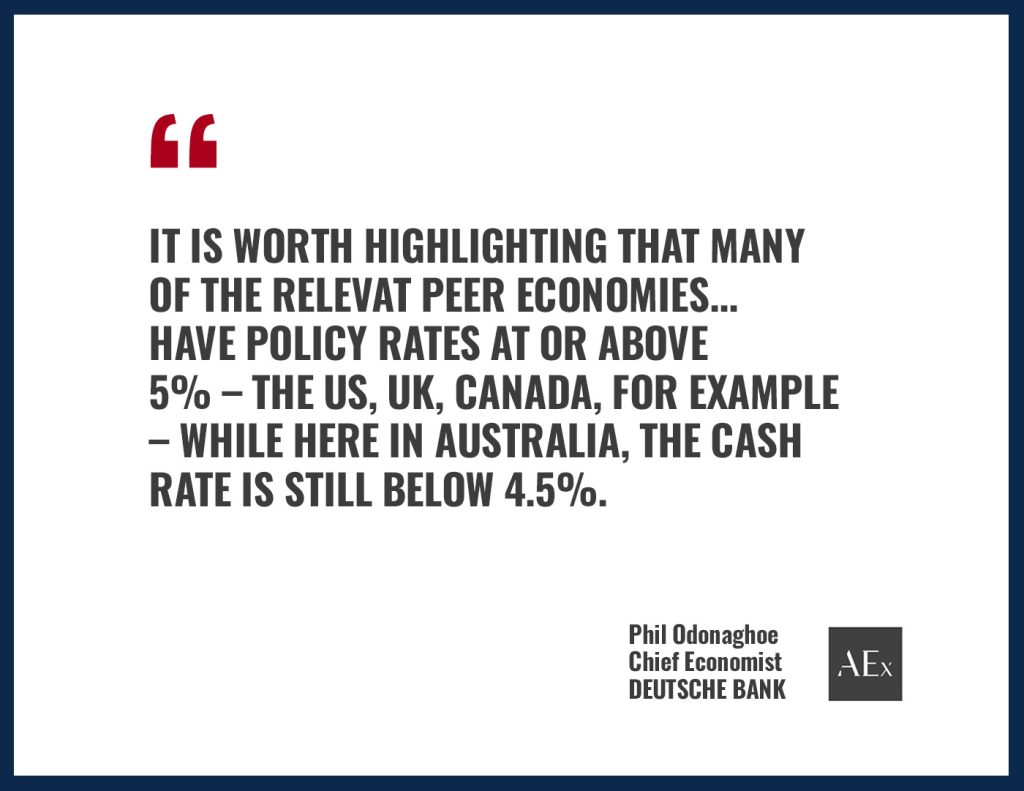

But nobody knows for sure whether the monetary policy tightening we�ve already seen � with the cash rate now at 4.35% � will slow down spending enough and how the chips will fall in relation to other macroeconomic factors like global supply, GDP growth and unemployment.

Jody