Look for Tesla to announce a third quarter sales shortfall, analysts say. TheDetroitBureau.com explains why.

A refreshed Tesla Model 3 could lift its sales in the fourth quarter, analysts say.

A refreshed Tesla Model 3 could lift its sales in the fourth quarter, analysts say.Several Wall Street analysts caution that Tesla may miss projections for third-quarter deliveries, due to planned manufacturing shutdowns and lackluster demand that caused the automaker to hike discounts.

The news may come as soon as Sunday, according to a Reuters report.

In the third quarter, analysts predict Tesla to deliver anywhere from 439,200 to 455,000 vehicles. According to an average of 11 analysts’ forecasts gathered by British financial information company the London Stock Exchange Group (LSEG), that is less than the general Wall Street projection of 458,713 units.

If LSEG’s predictions prove true, it would represent a 1.6% decline in sales from the second quarter, and Tesla’s first back-to-back slide in sales since the second quarter of 2022.

Softening sales may compel further price cuts to boost sales in the face of increased competition and a general downturn in demand for electric vehicles. But the company is already dealing with four-year low profit margins, due to a price war the company initiated in January.

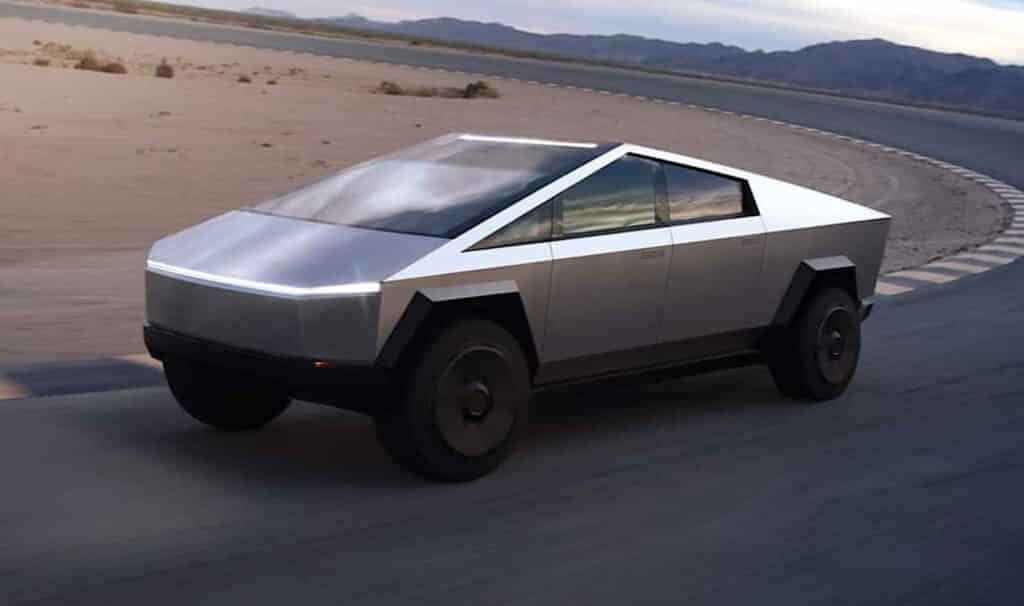

The Cybertruck’s arrival could also boost sales.

The Cybertruck’s arrival could also boost sales.Why the weakness?

Barclays, Baird, Guggenheim and other brokerages attribute the predicted weakness to downtime at the automaker’s European and Chinese factories for equipment upgrades, as well as preparation for the Cybertruck and the upgraded Model 3 sedan.

A negative report, according to some analysts, may necessitate further price reductions to boost sales in the face of increased competition and a general downturn in demand for electric vehicles. This could negatively impact Tesla’s market-leading profits.

Not everyone is negative

On the flip side, the UAW’s strike against General Motors, Ford and Stellantis, now entering its third week, should help Tesla’s stock price, both short- and long-term. Any UAW labor cost increase will further degrade GM, Ford and Stellantis EV margins, which already lag Tesla’s. And further production shutdowns could lead to thinning inventories of EVs, a problem not faced by non-union Tesla plants, as well as foreign automakers increasingly manufacturing EVs in America.

Certainly the UAW strike could help Tesla.

Certainly the UAW strike could help Tesla.And not everyone agrees with LSEG’s forecast. According to American financial data and software company FactSet, predictions range anywhere from about 440,000 units to 510,000 units, a difference of 70,000 units.

Other analysts are saying this quarter’s delivery numbers don’t matter in the long-term given the fresh product in the pipeline. Any weakness now could be made up by a far stronger fourth quarter, with Tesla’s refreshed Model 3 and new Cybertruck possbily proving more competitive in China against entries from Ford Motor Company and BYD.

But such analysts are still in the minority, given that 41% covering Tesla stock rate its shares a Buy, versus 64% a year ago. The current average Buy-rating ratio for S&P 500 stocks is around 55%.

Certainly, Wall Street’s signals are decidedly mixed. But one metric tells the tale, and that’s Tesla stock price. It has more than doubled this year.