As December starts, America’s car dealers have more new cars in stock than at any point since the spring of…

As December starts, America’s car dealers have more new cars in stock than at any point since the spring of 2021.

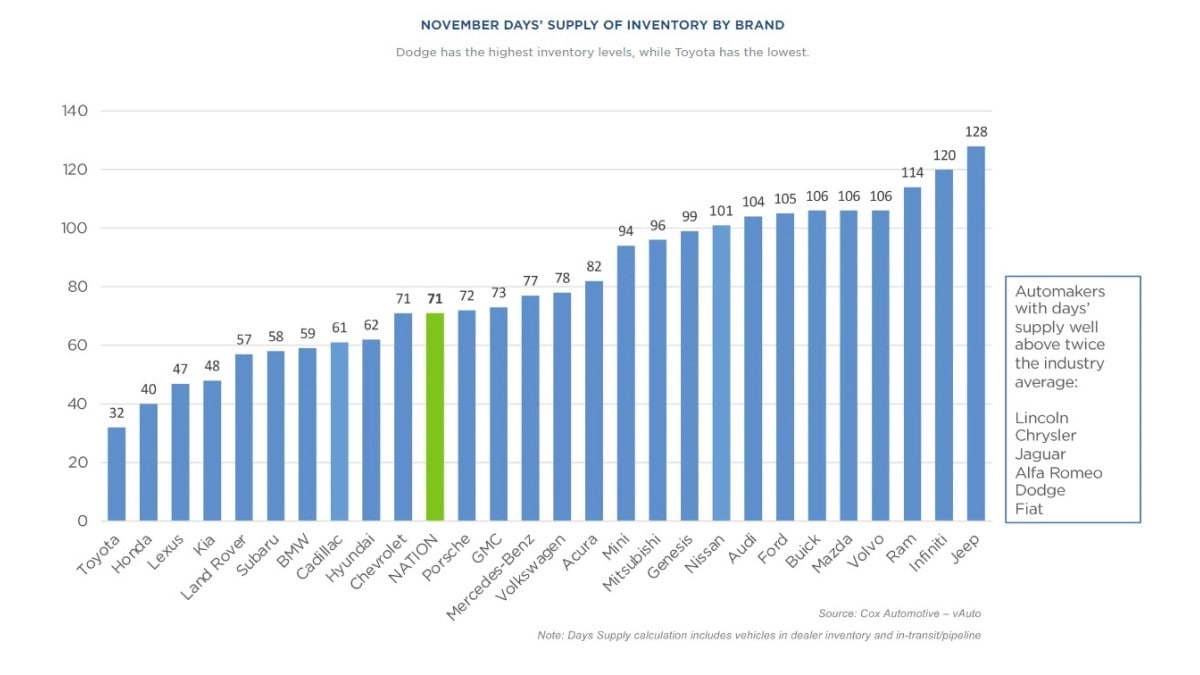

Car dealers measure their supply of cars in a metric they call “days of inventory.” It measures how long it would take to sell out of new cars at today’s sales rate if they couldn’t acquire more.

An old industry guideline tells dealers to aim for 60 days’ worth on the lot. That, the logic says, is the level that means they probably have the combination of color and features you want in stock.

Related: The 10 Best Car Deals in December

The average dealer currently has a 71-day supply, according to Kelley Blue Book parent company Cox Automotive.

Incentives Rising To Sell Off the Stockpile

An oversupply brings prices down. The average new car sold for less in November 2023 than in November 2022 – the third straight month of year-over-year price drops.

Incentives — those discounts that automakers or dealers advertise to attract buyers — are still below historical norms, but climbing back toward them.

Related: The 10 Best SUV Deals in December

Discounts made up 5% of the average sale price, up from 4.9% last month. Non-luxury incentives are low by historical standards but at their highest point since September 2021.

For comparison, non-luxury incentive packages averaged 10.5% of the average sale in November 2019.

How We Got Here

Automakers stocked up on new cars over the summer, anticipating a long autoworkers’ strike. The United Auto Workers then declared a strike but adopted a new tactic that saw them close very few factories, shuttering more as negotiations drew longer. That meant many factories never slowed.

Related: The 10 Best Truck Deals in December

Automakers now find themselves slowing factories to allow the stockpile to sell off. Last week, Stellantis announced it was cutting one of three shifts at a Jeep plant in Detroit and cutting jobs and output at a Jeep plant in Toledo, Ohio.

General Motors is scheduling downtime at several North American assembly plants for maintenance and product changeovers in the coming weeks.

Some Brands In Better Shape Than Others

The oversupply problem isn’t universal. Toyota dealers ended November with an average of just 32 days’ worth of cars on the lot. Honda, Lexus, and Kia dealers were all similarly below 50.

At the other end of the scale, Jeep dealers had a surprising 128-day supply on hand. Nine brands had over 100 days’ worth, including truck giants Ford and Ram.