Quick Facts About the Car Buying and Selling Marketplace A year ago, car shopping was miserable, and dealerships held all…

Quick Facts About the Car Buying and Selling Marketplace

New car prices have now been lower than a year ago for three consecutive months. Used car prices fell last month, but the selection is still poor. Interest rates fell last month — perhaps the biggest news of all in the car market.A year ago, car shopping was miserable, and dealerships held all the leverage. A year later, shoppers now hold leverage at many dealerships. It’s a buyer’s market for new cars. Used car shoppers face a different fate, but conditions are still better than expected for them.

For new car shoppers, prices have now held under last year’s level for an entire quarter. Better yet, amid stabilizing economic news, lenders began offering lower interest rates on car loans. Loan payments are still historically high but are finally getting better. Many dealerships stock so many new cars we see significant discounts — though there’s still room for more.

We’ll walk you through what to expect while buying or selling a new or used car or trading one in. Many car shoppers are in both markets simultaneously, with a vehicle to swap. They’re likely to find balanced offers on their trade-in this month. Read on to find out more.

What New Car Shoppers Can Expect What Used Car Shoppers Can Expect Lower Supply of Cars LIkely Here for Good Automakers Are Building More Expensive Cars Older, Less Expensive Cars Harder To Find How To Buy a Car Right Now Selling a Car Right Now Trading in a Car Right Now Looking Ahead Tips for Buying a Vehicle Right NowWhat New Car Shoppers Can Expect

The new car market changed radically in 2023. At the end of November, the average new car sold for $48,247, which is 1.5% lower than a year ago. That marked the third straight month of 2023 prices, staying under 2022 prices. It also marks the only time in the last decade that the average new vehicle price has gone three months without rising year-over-year.

Discounts are staging a comeback for new car shoppers. Incentives lowered the price of the average sale by 5% last month. That’s not a historically good number; the same figure was routinely over 10% before the COVID-19 pandemic. But it means manufacturers and dealers are discounting cars to attract buyers again.

RELATED: When Will New Car Prices Drop?

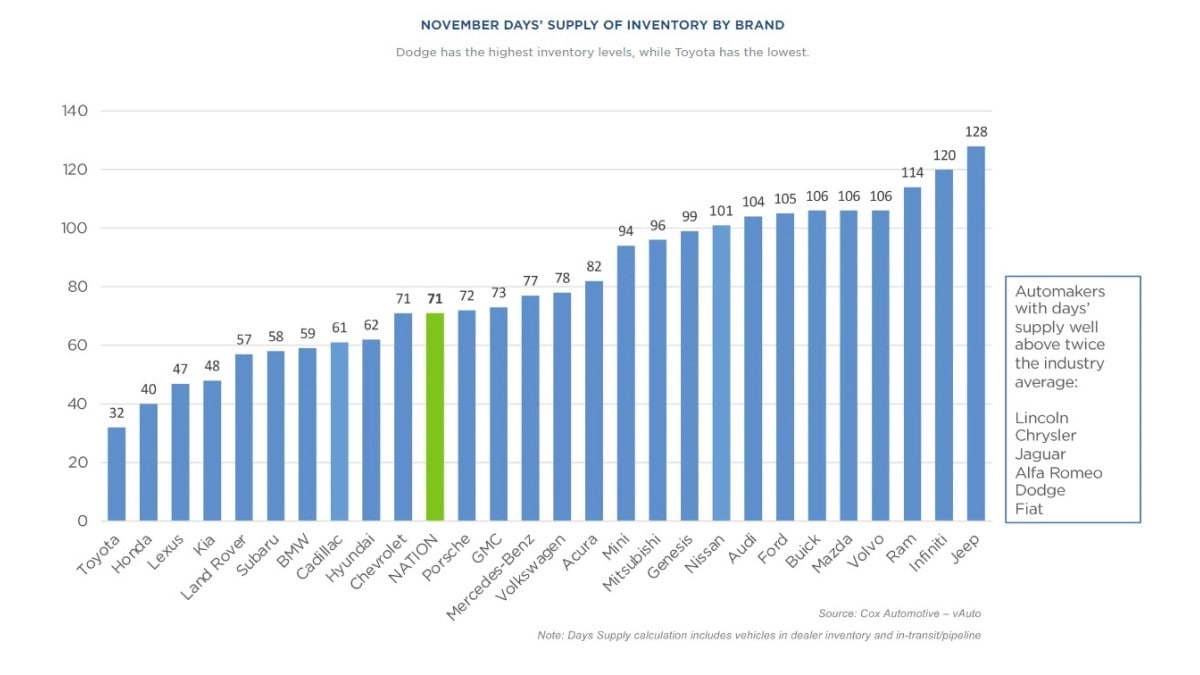

They have to. Many are oversupplied. An old rule of thumb in the auto industry tells dealers to keep about 60 days’ worth of new cars in stock. That’s the level, veteran salespeople say, at which your local dealership likely has the combination of colors and features you’re seeking in stock.

But take a look at the chart of days’ supply above. Jeep — 128 days. Ram — 114 days. Mazda — 106 days. Audi –104 days. Numbers like that look problematic for dealerships.

Still, some dealerships face undersupply issues. Toyota, Honda, Lexus, and others are undersupplied by normal standards. But so many dealers have too much stock that the industry average is above the usual target. The problem is particularly severe for a few Detroit-based companies that stocked up in anticipation of a long strike, then saw the United Auto Workers union settle its 2023 strike without ever shuttering most factories.

Shoppers pick up negotiating leverage when a dealership stocks an oversupply of cars.

Interest Rates Finally Falling

But the biggest news affecting your next car purchase doesn’t involve the dealership. It involves the bank.

The Federal Reserve has held interest rates steady since midsummer, and lenders are finally starting to believe the worst of inflation is behind us. In November, they lowered rates. The average new car loan rate almost reached 10% in October and is now down to 9.6%. The average used car loan rate peaked at 14.4% in mid-November and is now down to 14%. Those rates remain historically high. But they are coming down for the first time all year.

High interest rates have made car shoppers miserable. If they turn around, we’re moving into a buyer’s market. You might benefit from waiting to see if they fall even further. But buying now no longer means paying more in interest every week you wait.

Our favorite measure of car prices doesn’t consider cash. It looks at time. The average earner would now need to work 38.5 weeks to pay off the average new car. That’s the most affordable new cars have been in more than two years.

What Used Car Shoppers Can Expect

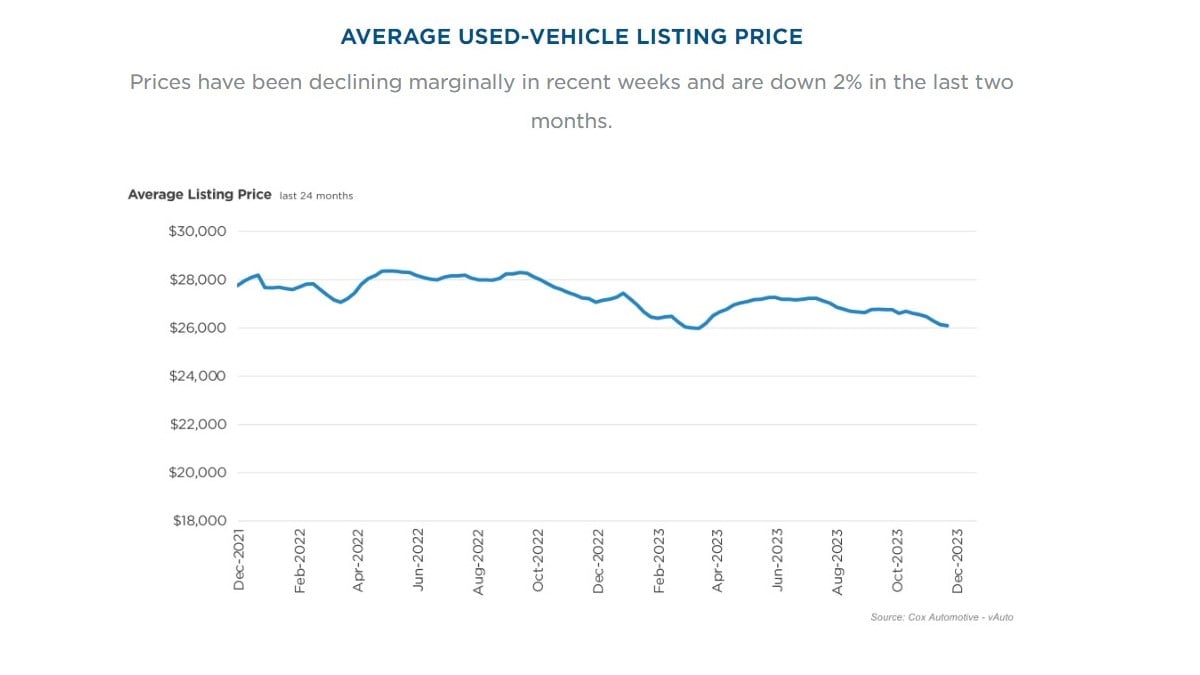

The average used vehicle listing price at the end of November was $26,091. That’s $1,065 lower than the average a year ago.

The used car market has settled on a new equilibrium. Supplies remain lower than dealerships would like. But supplies are no longer pushing prices up.

“Used-vehicle inventory volume at the start of December was roughly unchanged from last month and last year, indicating the used-vehicle market is relatively balanced,” said Chris Frey, Cox Automotive senior manager of Economic and Industry Insights. “It has been stuck in the 2.2 million to 2.3 million range for some time now, which is generally considered tight.”

Cox Automotive is the parent company of Kelley Blue Book.

Yet, even with supplies tight, prices are falling. Kelley Blue Book analysts expect used car prices to remain generally high for several years. Automakers built about 8 million fewer cars during the pandemic. Used car inventories could remain low for years as those cars never find their way to the used market, keeping prices higher than Americans had grown accustomed to.

The market has somewhat adjusted to a new normal, with wholesale prices falling despite supply limitations.

The most affordable used cars remain the hardest to find, with dealers stocking just a 37-day supply, on average, of used cars priced under $10,000. Days’ supply increases with every higher price segment, with used cars priced over $35,000 the easiest to come by.

Honda dealers have the thinnest supply in the industry, with just 43 days’ worth of used cars in stock on average. Toyota and Subaru follow at 44 and 46.

Lower Supply of Cars Likely Here for Good

A worldwide shortage of microchips helped drive car prices higher for much of the last two years. With the chip shortage essentially over, some automakers and dealer groups plan to keep the supply of cars low, allowing them to charge more for vehicles. The days of dealer stockpiles and hefty discounts may never fully return. Pre-pandemic, Americans routinely bought 16 million to 17 million new cars yearly. In 2021, we bought just over 15 million. Last year, shoppers purchased close to 13.7 million new vehicles. In 2023, Cox Automotive predicts Americans will buy 15 million new cars.

RELATED: Ordering a Car from the Factory — Everything You Need to Know

Automakers Are Building More Expensive Cars

Though short-term trends are pushing new car prices down, automakers are focusing efforts on building more premium cars. The era of the inexpensive car is disappearing.

A recent analysis finds that sales of cars priced at $25,000 or less have fallen by 78% in just five years. Five years ago, automakers offered 36 new models in that price range. This year, that number is just 10. Meanwhile, those priced at $60,000 or higher have grown by 163% during the same period.

Cox Chief Economist Jonathan Smoke explains the recent Federal Reserve interest rate hikes keep some shoppers from buying cars. “This trend induces automakers to focus on profitable products for consumers who can afford to buy, which keeps less affluent consumers out of the new-vehicle market altogether and limits what is available and possible in the used market for years to come,” Smoke cautions.

Older, Less Expensive Cars Harder To Find

If you hope to find an older vehicle and your budget is less than $15,000, these cars remain in short supply. More would-be new car shoppers started buying up the available used vehicles, drawing down the inventory.

Plus, Americans are holding onto their cars longer than ever. The average vehicle on American roads is now 12.5 years old. Automakers also produced fewer cars for several years after the 2008 recession. That leaves fewer higher-mileage, older used vehicles available to sell.

The most accessible used cars are priced between $15,000 and $30,000. Cars priced under $15,000 remain challenging to find.

How To Buy a Car Right Now

If you want a new or used vehicle, be prepared for sticker shock. For new cars, prices remain about 23% higher than during the early days of the pandemic. But take stock that your next car will likely last longer and help you drive safer than ever with all the technological advances and offerings.

RELATED: Buying Older, Used Cars in 2024

Vehicle quality studies repeatedly show that today’s new cars suffer fewer problems than those from just a few years earlier. That means buyers of higher-priced used cars will likely see the vehicle driving on the road even longer. The same goes for those buying new ones.

With most automakers now building such durable cars, they compete by adding more high-tech features. Features like adaptive cruise control and Apple CarPlay are now more common than ever on entry-level vehicles. Read on to see our tips on buying a car below.

How to Leverage Incentives to Buy a New Car

Car incentives made up 5.2% of the average deal in November. They are up 136% from this time last year, signaling it’s a car buyer’s market. To take advantage of incentives, read about our monthly best car deals to find dealer or manufacturer incentives, including cash back and lower interest rates for financing your next vehicle.

RELATED: How to Buy a New Car in 10 Steps

Selling a Car Right Now

Few of us can sell a car without needing to buy a replacement. But, if that’s you, what are you waiting for? You will get more for your car today, and that’s excellent news. The best way to get the most money for your used car is to sell it privately. But if you don’t want the hassle, there is still an opportunity to sell to a dealership.

PRO TIP: If selling a car, consider selling it peer-to-peer using Kelley Blue Book’s Private Seller Exchange marketplace. It’s a low-cost method that helps consumers earn more for their car than selling to a dealership.

Trading In a Car Now

Falling used car prices mean a little less for your trade-in. But the ongoing shortage of used cars will be with us for years. You’ll still likely see respectable offers for your used car this month.

Searching for a decent price for your trade-in is still a good idea by shopping it around. Each dealership tries to keep a balance of vehicles on its lot. Sometimes, the one you want to buy from doesn’t need your trade-in desperately, but a competitor does.

Research your vehicle’s Kelley Blue Book value, then call several local dealerships to see what they’ll offer you for it. Or try our Instant Cash Offer tool, which brings the deal to you from various dealerships without obligation. You can choose your preferred offer or use it to negotiate with others.

Looking Ahead

According to the Cox Automotive/Moody’s Analytics Vehicle Affordability Index, new vehicle affordability improved slightly month over month and year over year. “Trends in new-vehicle affordability factors mainly moved in favor of consumers in November to the best level of affordability in more than two years,” said Smoke, the economist. “Income growth again more than offset the impact of higher prices while incentives grew and auto loan rates edged down.”

However, easing inflation could relieve car buyers if the Federal Reserve decides to lower rates in 2024, which could further impact car loan interest rates.

RELATED: 10 Best Used Car Deals

Tips for Buying a Vehicle Right Now

If you shop right now, we recommend a few strategies to help you find the right new or used car that fits your budget.

Expand your search. Widen your search to a broader geographic area. Stay patient. Call dealerships early and often to see what’s coming off the trucks for those harder-to-find vehicles. Leave a refundable deposit if you want first dibs. Buy a less expensive model. With higher car loan interest rates, consider buying a cheaper vehicle model instead of a more expensive one in the lineup you’re considering. Understand the timing. Be prepared to shop for several weeks, and know it involves calling or visiting several dealerships as you look for the right fit. Don’t jump. Shop around your trade-in as aggressively as you seek out the right car. Don’t accept the first offer. You could sell yourself short. Weigh your options. Don’t just look for a car; search for the best interest rates from banks or credit unions. Then, weigh all your options, including financing incentives and deals at the dealership, if that’s where you buy your next vehicle. Also, you may find the price differences of some newer model used vehicles are almost the same as new cars. Just keep all your options open during your search. Don’t pay dealer markups. If you see a markup, sometimes called a market adjustment, on your final invoice, ask that it be removed or shop at another dealership. Question all add-ons. If your sales summary includes entries like “window tint” or “fabric protection” and other add-ons you didn’t request, ask for those line items to be removed from your invoice. Many dealers tack on these extras to make quick profits.It may make sense to keep your existing car for another year if you can. If you must buy, be prepared to take excellent care of your next car to keep it running for a long time.

Related Articles About Car Buying and Selling:

Buying a New Car During the Chip Shortage: What You Need to Know 7 Ways to Help Protect Yourself When Selling a Car How to Sell a Car Online Recalls 101: What You Need To Know To Stay SafeThis article has been updated since it was initially published.