2023 marked another dynamic year for aerospace. New challenges appeared, others stuck around and some thankfully faded. What changes could 2024 bring? We spoke with five GE Aerospace experts on the trends they are watching next year...

2023 marked another dynamic year for aerospace. New challenges appeared, others stuck around and some thankfully faded.

What changes could 2024 bring? We spoke with five GE Aerospace experts on the trends they are watching next year and the impact those trends will have on the global aerospace system.

1) STEP UP IN SUSTAINABILITY: Milestones push industry to accelerate Sustainable Aviation Fuel, technology.

2030 sustainability milestones are rapidly approaching, and while countries around the world are pursuing multiple approaches to reduce aviation emissions, one of the most promising contenders is Sustainable Aviation Fuel, or SAF. The United States plans to produce 3 billion gallons of Sustainable Aviation Fuel by then compared to the 15.8 million gallons used in 2022. In Europe, the continent will require 6 percent of all aviation fuel be SAF, up from its 2 percent today. And more than 100 countries just agreed that aviation fuel in 2030 should be 5 percent less carbon intensive – so expect to hear a lot about SAF in 2024.

While GE Aerospace and partner engines can run on SAF blends today, the U.S. will need to extend an expiring tax credit that incentivizes SAF production to help maintain price parity with standard Jet-A fuel. Meanwhile, the FAA is expected to award next year more than $245 million for projects that transport, store, or produce SAF.

“There is no one-fuel or one-technology that will get us to the net-zero goal. It will take new fuels, it will take new engines, and it will take new technologies to get us there,” said Mohamed Ali, GE Aerospace’s vice president and general manager for the company’s engineering division. “We don’t have a day to spare.”

While SAF will lead the way next year, count on manufacturers to keep investing heavily in engine efficiency technologies necessary for the 15-20 percent carbon emissions reductions most net-zero plans count on. The open-fan engine architecture GE Aerospace and Safran are jointly developing as part of the CFM RISE program is targeting a more than 20-percent fuel efficiency boost compared to engines today*. GE Aerospace is also partnering with NASA and Boeing to develop a hybrid-electric powertrain for flight?and CFM is developing hydrogen combustion technologies in collaboration with Airbus. Expect all of these to gain more attention in 2024.

*CFM International is a 50/50 joint company between GE Aerospace and Safran Aircraft Engines

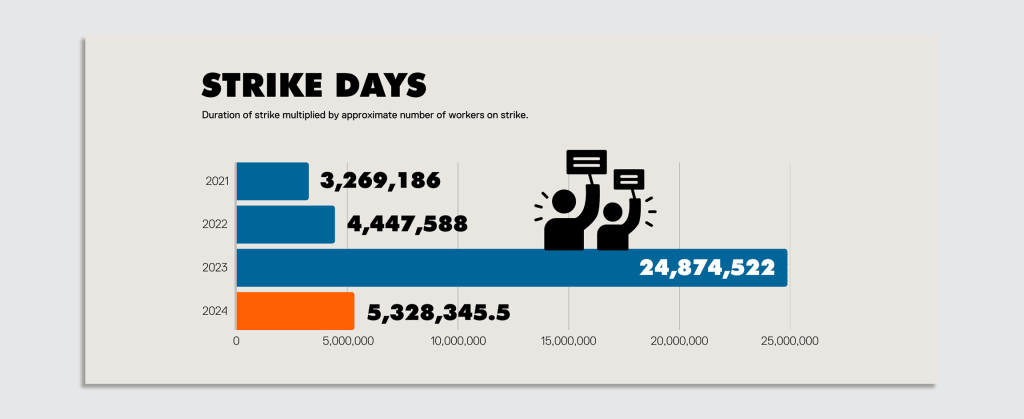

2) WORKERS WANTED: Increased attention to train workers building, repairing, and maintaining aircraft and engines.

Airlines have hired thousands of pilots since the pandemic, improving their operations and helping meet post-pandemic travel demand. But the need for workers who build, maintain and repair those aircraft and their engines shows no sign of easing.

One report from AAR Corp. forecasts that the global aviation market will need 34,500 new mechanics annually, that is in addition to thousands of aerospace engineers needed each year during the next decade, and even more workers who need trade skills to do many good-paying jobs in aerospace.

“A job in aerospace can become a great career. There are plenty of workers, but we must expand our outreach to recruit and provide people with those skills,” said Russell Stokes, president and CEO of GE Aerospace Commercial Engines and Services.

Look for aerospace manufacturers to expand their apprenticeship programs, build partnerships, and try new models to recruit and retain workers. In Massachusetts, a partnership between GE Aerospace and the state has helped more than 300* individual so far each receive 415 hours of no-cost technical training from experienced aerospace instructors. And late this year, GE Aerospace opened a new training academy for its apprenticeship program in Wales in the United Kingdom.

*Latest numbers from end of CY2022.

3) FUTURE FIGHTERS: Geopolitical tensions will continue, highlighting need for new capabilities.?

The wars in Ukraine and Israel serve as reminders of the geopolitical tensions that exist and the importance of investing today to ensure we can meet the needs of the U.S. military both today and in the future. For aviation, this means providing the warfighter with more range, greater thrust, and better thermal management to allow more mission systems capabilities.

“Every generation has to earn their place in the sky; it is not promised to us,” said Amy Gowder, president and CEO of GE Aerospace Defense & Systems.

Expect the conversation in Washington and other capitals to focus on the need for not just increase defense spending but investment in industrial bases to bring new capabilities online, including advanced engine development. Both the House and Senate have set aside $150 million and $280 million, respectively, in the FY2024 appropriations bills to continue work on one of those advanced engines, GE Aerospace’s XA100 adaptive engine, which recently completed a third round of testing

“An adaptive engine is the first, 21st century engine that will allow the United States to maintain its air dominance,” Gowder said.

4) MADE IN: U.S. will continue push for more manufacturing.

Regardless of the outcome of the 2024 elections, increasing manufacturing in the United States will remain a priority for the country, compelling companies to both invest and make sure leaders know about it. This pressure, combined with decades-worth of orders from airlines, will keep aerospace workers busy building engines and airframes.

We will see companies invest to meet those demands and stay competitive. Already, GE Aerospace invested $335 million in its U.S. manufacturing operations in 2023 alone. Upgraded test cells in Lynn, Mass., facility improvements in Auburn, Ala., where additive manufacturing occurs, and new tooling in Lafayette, Ind., in anticipation of increased LEAP engine production were just some of the investments.

“These are investments not only in the future of flight, but in strong futures for the communities where we operate, ensuring our ability to continue making innovative, high-quality engines in the US and around the world,” said Tara DiJulio, GE Aerospace’s chief corporate affairs officer.

5) TRAVEL DEMAND: Companies will look for new strategies to meet strong travel demand.

2023 marked the return to pre-pandemic air travel levels as airlines across the globe placed a record number of plane and engine orders. They’ll need that capacity to meet air travel demand that shows no sign of slowing down: The United States, Europe, Latin America, and the Middle East all reached pre-pandemic traffic levels in 2023. Asia-Pacific and Africa will in 2024. Manufacturers will look for ways to maintain quality as production increases.

“More and more people are flying to see family, do business and make connections around the world, and we are using every tool we have — especially Lean — to help airlines maximize the availability of their fleet and to deliver the engines they need to meet demand,” said Mike Kauffman, GE Aerospace’s vice president of supply chain.

Take GE Aerospace’s site in Greenville, South Carolina. The team used Lean to make the CFM engine lines 25 percent more efficient while reducing the resource used by 34 percent.

Or head to one of the company’s On Wing Support facilities near the Cincinnati/Northern Kentucky International Airport. The team looked at how to reduce the time it took to teardown an engine, order parts and reassemble the engine. Through Lean, they were able to reduce the time by more than 33 percent, getting planes back in the sky sooner for airlines.

Media Contact:

Matthew Lehner

matthew.lehner@ge.com

202-841-8485