*The owners of this website may be paid to recommend some precious metals companies. The content on this website, including any positive reviews of these companies and other reviews, may not be neutral or independent. This is the perfect...

*The owners of this website may be paid to recommend some precious metals companies. The content on this website, including any positive reviews of these companies and other reviews, may not be neutral or independent.

This is the perfect opportunity to invest in precious metals if you haven't already. In unpredictable times, such as the one we are currently experiencing due to a looming global recession, it is critical to turn to safe-haven investing to safeguard and develop your finances.

While equities, bonds, and mutual funds are all tethered to the dollar; precious metals are self-contained. Traditional securities such as stocks, bonds, and mutual funds have typically moved in the reverse direction of precious metals. Whenever the stock market dips, gold and silver prices usually rise.

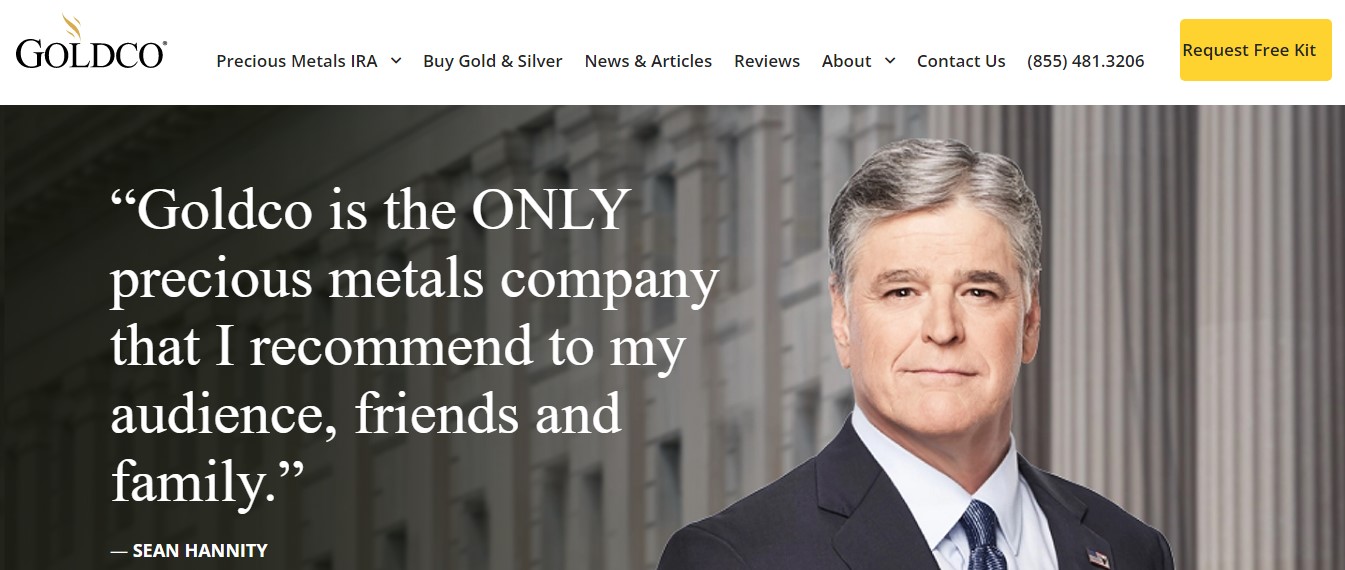

Pick a company like Goldco if you want a proven and true investment that can give security to your portfolio.

Who is Goldco?

Funded by Trevor Gerszt, Goldco is a reputable and professional precious metals company that has been in business for over a decade. The company is based out of Calabasas, California; Gerszt imagined a company that would assist each investor in making solid financial decisions. For the past two decades, they have helped thousands of consumers expand and build their wealth by investing in actual metals such as gold, silver, platinum, and palladium. Furthermore, precious metals are offered to customers directly.

Goldco's goal is to use precious metals to enable Americans to secure their retirement funds against stock market volatility and inflation.

Goldco has been trading IRA-approved gold and silver coins for a long time. They specialize in helping you choose precious metals suitable for you.

Collectors and investors can buy precious metals coins and bullion directly from Goldco. Goldco was rated the third fastest-growing financial services firm in the San Fernando Valley Business Journal.

It was also recognized as the fastest-growing company of the year 2021 in the greater Los Angeles Area by the Los Angeles Business Journal.

Pros and Cons

PROS

CONS

Can you trust Goldco?

Yes, Goldco is a legit business. The company has extensive expertise and is prepared to assist you in protecting your retirement savings. A Goldco gold IRA is, indeed, a secure investment. To begin with, just like any other IRA asset, your precious metals assets are held by a custodian.

Gold IRA custodians, in particular, specialize in storing precious metals and have secure vaults in which to store them.

They also carry insurance to protect your investments in the extreme event that certain metals are stolen or damaged due to an act of God.

Goldco’s Credibility and Accountability

We collated Goldco's complaints, reviews, and ratings from trusted third-party sources.

Goldco’s Education Tools Offered

Concerning investing, understanding what you're doing is crucial. As a result, Goldco ensures that its customers and investors are well-versed in the business.

Recessions, trade conflicts, and other topics are discussed in-depth on this site. Stock market crashes, currency fluctuations, and many other topics are addressed in educational videos. You can track the price of several precious metals in real-time.

Goldco's Reputation

Before investing in anything, whether it's stocks, bonds, gold, or silver, it's critical to do your homework. How can investors tell if they're dealing with a reputable gold IRA dealer? Luckily, the Internet makes it harder for businesses to remain anonymous. Customers can vent their grievances with gold IRA businesses by going online.

In their 15+ years of serving gold IRA consumers around the United States, Goldco has created an extremely favorable online reputation. Goldco continues to be a highly regarded corporation in its field, on par with its notable competitors and first among the sector's main rivals.

We've gone through the process of vetting many businesses. Only a few companies have made our list of credible gold IRA partners. Goldco as it turns out has an impeccable rep. Despite their many years in operation, it is impossible to discover any unfavorable reviews about Goldco.

Goldco's Fees

Goldco's pricing and fees are not listed on their website, although company officials stated:

"The required minimum purchase at Goldco to start a gold IRA is $25,000. Goldco’s preferred Custodian charges a flat annual account service fee which includes a one-time IRA account set-up fee of $50, as well as a $30 wire fee. Annual maintenance is $100, and storage is $150 for segregated storage or $100 for non-segregated storage.

Fees for gold storage and custodianship can vary depending on the company you select to handle these services (required by the IRS, as all IRA assets must be managed by a custodian). Depending on the Custodian, storage fees can range from $10 to $60 per month, or as a percentage of assets, from 0.35% to 1% annually. Goldco does not charge any storage fees for cash transactions over $25,000."

Services provided by Goldco

Goldco's IRAs are divided into gold IRAs and Silver IRAs. It's crucial to understand that Goldco only works as a broker for buying and selling precious metals. It does not act as a custodian of your IRA account. But they do say they'll help you fill out the paperwork with a custodian company.

Goldco works with customers to help them purchase IRS-approved coins and bullion for their Precious Metals IRAs. They also arrange these purchases with the customer's custodian and storage facility. They can also help you roll your current retirement savings over to a Precious Metals IRA. The following is a complete list of Goldco's products:

![Best Dating Sites for Over 50s [2023]](https://lifepart2.com/wp-content/uploads/2021/10/eHarmony.webp)