Not all borrowing is bad. Someone with a low-rate mortgage of modest size on an appreciating house has a very valuable asset. And some retirees pay off their credit cards every month without breaking a sweat. But about four...

Not all borrowing is bad. Someone with a low-rate mortgage of modest size on an appreciating house has a very valuable asset. And some retirees pay off their credit cards every month without breaking a sweat.

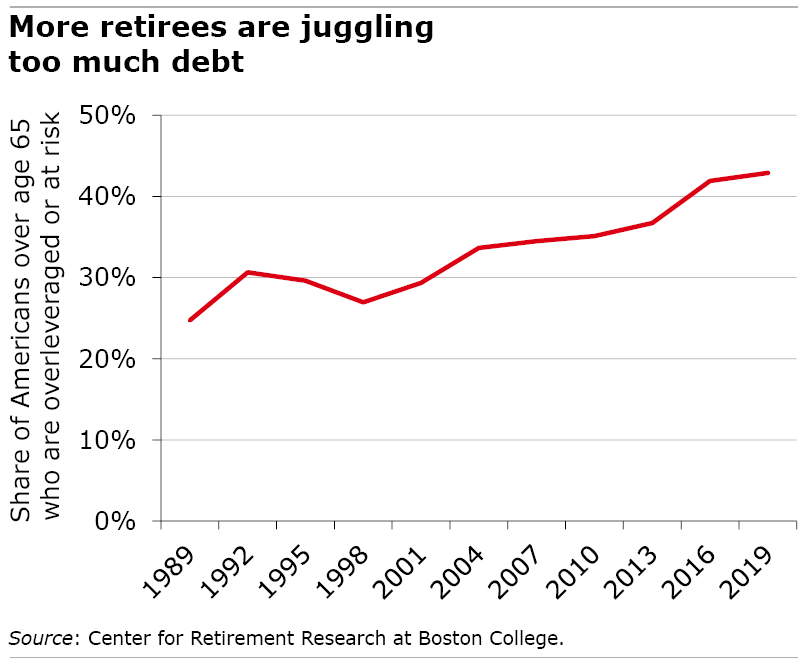

But about four out of every 10 older U.S. households are falling into the trap of having too much debt, a new study finds.

These high-risk households, mostly retirees, tend to be burdened by low incomes or large balances on unsecured debt like credit cards, which accumulate interest at a rapid pace. Some are overleveraged and may be unable to afford their homes.

The low-risk borrowers are their mirror image: no unsecured debt and relatively low debt payments and debt-to-asset ratios.

The share of U.S. households over age 65 that carry some debt has risen sharply since the late 1980s, from 38 percent to 63 percent currently. And most of that growth has been driven by the high-risk borrowers, who already have too much debt or are in danger of becoming overleveraged, the researchers at the Center for Retirement Research find.

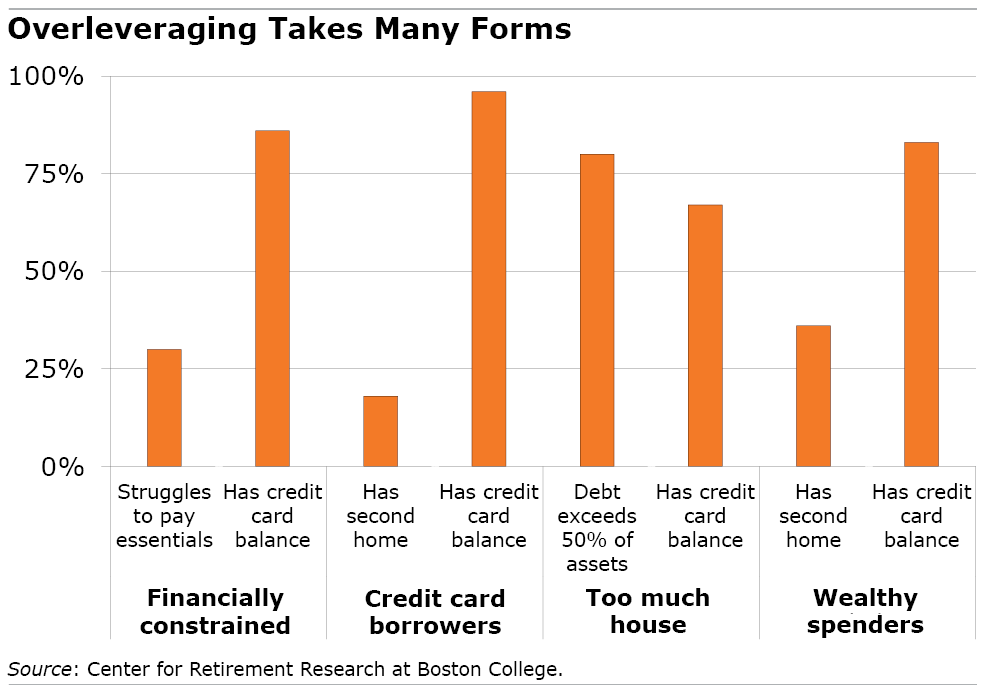

They grouped these high-risk borrowers into four basic types in the chart below:

Financially constrained. Their problems start with low incomes, and they may be forced to use their credit cards “just to get by,” the researchers said. They are the single largest group, amounting to a third of all high-risk older borrowers, and the vast majority have credit card debt. One in 10 also has medical debt. A third of them are people of color.

Credit card borrowers. These retirees are likely to be middle class “with no obvious need to borrow,” the researchers said. They don’t struggle with paying for essentials to the extent low-income households do. But virtually all of them are carrying credit card debt and two out of 10 have second homes.

Too much house. They could be either low- or middle-income. Two things set them apart from the other high-risk borrowers. First, nearly half have so much debt that the payments are absorbing at least 40 percent of their monthly household income. They also owe large amounts on their mortgages, which equal 60 percent of the home’s value, on average. Nearly a third are people of color.

Wealthy spenders. The label speaks for itself. Even though they have high incomes, a large majority have debt in the form of revolving balances on their credit cards. They often have a second home. One in four of these households spends at least 40 percent of their ample income paying their mortgages and other debts.

All these retirees, who are at high risk of getting into financial trouble, are a cause for concern. But the researchers said the best way to help them would be through targeted approaches that recognize the diversity of financial issues that individual households face.

While low-income borrowers may need more federal assistance to cover their essential expenses, financial counseling may work better for higher-income people who overuse their credit cards.

“A one-size-fits-all solution does not exist,” the researchers said.

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.