In recent Core Scientific news, the Bitcoin miner firm confirmed it will successfully emerge from bankruptcy proceedings in January 2024. The post Bitcoin Miner Core Scientific to Exit Bankruptcy in Jan 2024 appeared first on Bitcoin News.

In recent Core Scientific news, the prominent Bitcoin miner firm has officially confirmed that it will successfully emerge from bankruptcy proceedings in January 2024.

The firm filed for bankruptcy in December 2022 during harsh digital asset industry turbulence.

According to the announcement shared on Thursday, Core Scientific stated that it reached an in-principle agreement with shareholders that revolves around the distribution of convertible notes and stock by mid-January 2024. Further, the firm has plans to re-list on Nasdaq in the near future.

“The global settlement removes key hurdles to our anticipated emergence from Chapter 11 in January,” said Adam Sullivan, Core Scientific’s Chief Executive Officer.

Core Scientific News On Bankruptcy Filing

Core Scientific has formally settled its agreement with the “Ad Hoc Noteholders Group, the Unsecured Creditors Committee, the Equity Committee, and B. Riley, the company’s debtor in possession lender.” As per Sullivan, the firm now aims to increase its operations and focus on strengthening its business and balance sheet in 2024.

Sullivan added:

“With our team highly focused on operational excellence, a post-emergence pathway to de-lever our balance sheet, and a plan for continued growth in 2024 and beyond, we are excited to pursue the opportunities ahead of us in the new year.”

The shareholders of the Bitcoin mining firm will receive new shares that will be exchanged at a ratio of 25:1 to provide them with $1.08 per pre-exchange share. Additionally, noteholders are entitled to $1.628 for each $1 of face value for convertible notes maturing in April and $1.201 for each $1 face value for notes with a due date in August.

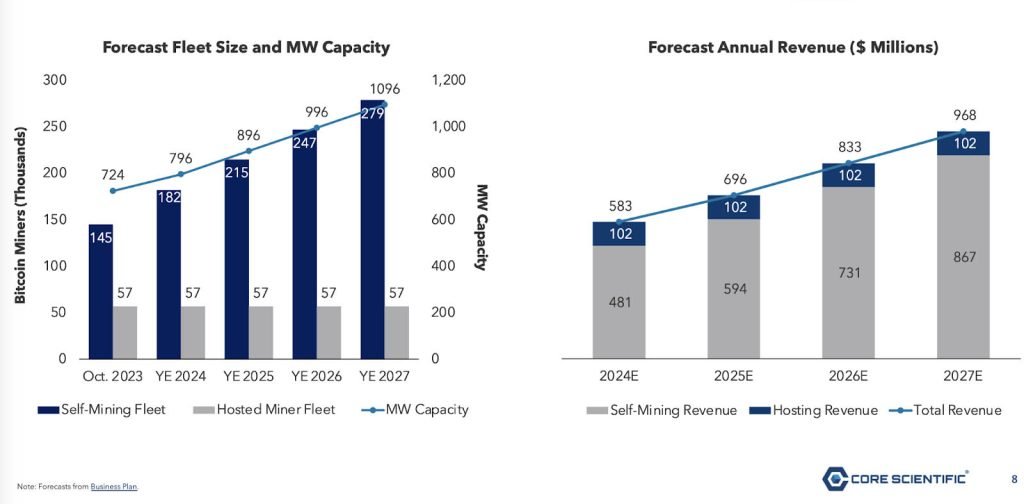

Core Scientific Forecast through 2027 — Source

Core Scientific Forecast through 2027 — Source

“Core Scientific also intends to file a motion requesting that the Court modify certain dates and deadlines with respect to the Plan, including an extension of the deadlines to vote on the Plan or file an objection to the Plan. The Company expects to emerge from Chapter 11 in mid-to-late January 2024,” noted the firm.

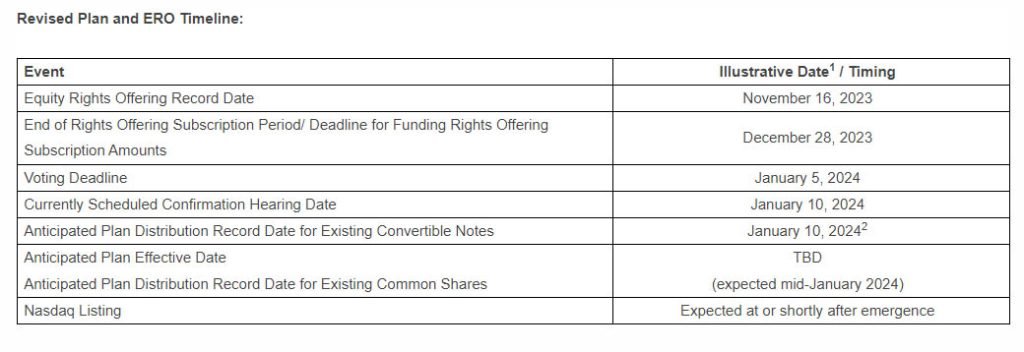

Timeline published by Core Scientific — Source

Timeline published by Core Scientific — Source

The Collapse of Compute North

The collapse of Compute North, another major player in the Bitcoin mining sector, was a notable event that preceded Core Scientific’s bankruptcy filing. Compute North filed for bankruptcy protection in September 2022, citing its inability to meet debt obligations. The company’s reorganization plan was approved in February 2023, involving the sale of 13 assets, including four major ones, to satisfy a secured debt of $250 million.

While some players struggle, the mining industry continues to attract interest. Notably, Tether, the issuer of the world’s largest stablecoin, USDT, has expressed intentions to enter the Bitcoin mining industry. Tether plans to construct mining facilities and acquire stakes in other Bitcoin mining companies. In November, Paolo Ardoino, the upcoming CEO of Tether, confirmed plans to invest nearly $500 million in the Bitcoin mining sector.

As Core Scientific navigates its way out of bankruptcy, the broader bitcoin mining landscape is evolving, with companies adapting to market dynamics and seeking new avenues for growth. The emergence of Core Scientific from bankruptcy signals resilience and adaptability in an industry that remains both challenging and promising.

The post Bitcoin Miner Core Scientific to Exit Bankruptcy in Jan 2024 appeared first on Bitcoin News.