In the chart above, there is a new buy signal from a modified RSI oscillator after an apparent four-year interval, with a smoother output compared to the original. My yearly prediction, which I typically release in January, appears to...

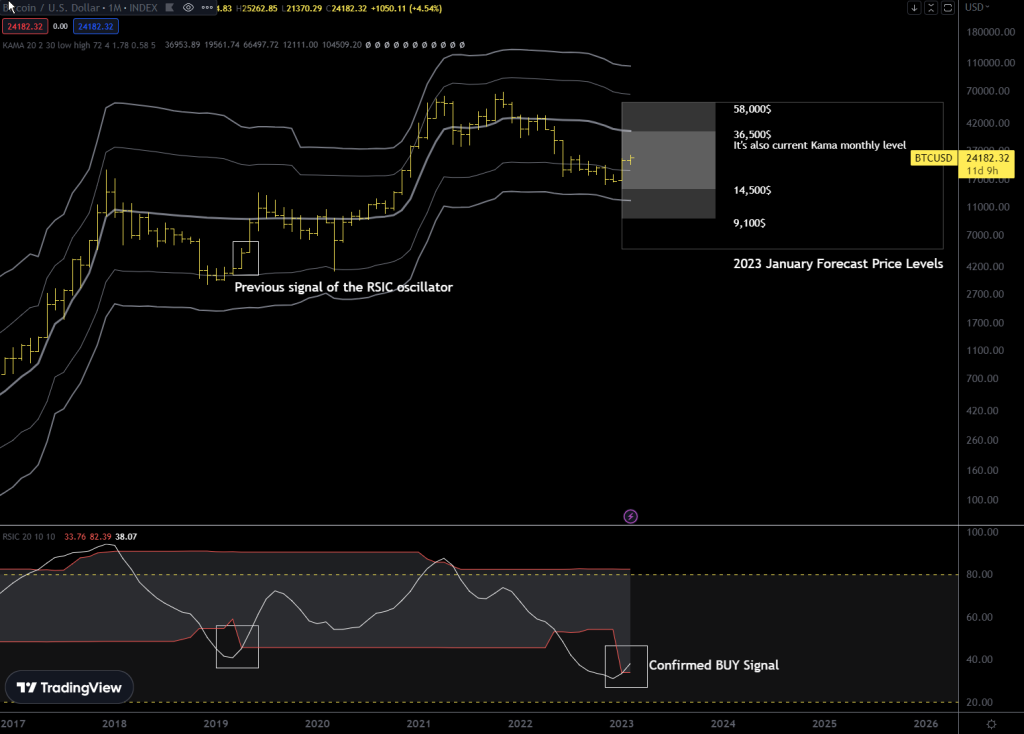

BTCUSD Monthly Chart with KAMA+Deviation Bands, RSIC oscillator confirming new buy signal

BTCUSD Monthly Chart with KAMA+Deviation Bands, RSIC oscillator confirming new buy signal

In the chart above, there is a new buy signal from a modified RSI oscillator after an apparent four-year interval, with a smoother output compared to the original. My yearly prediction, which I typically release in January, appears to be consistent with the Kama average levels. The estimated target range for this upward movement is at least around $36,000, with a maximum potential upside of $58,000. As a result, I believe that we will not see a new all time high during this year.

It can be noted that the examined oscillator also gave two bearish signals in 2017 and 2021, at the respective peaks of the four-year bitcoin cycle.

Does the 4-year halving cycle exist or not?

While many people believe in the 4-year cycle of Bitcoin, which is linked to the halving phenomenon, I personally think that this effect is not significant. The price of a commodity, including Bitcoin, is mainly determined by the supply-demand balance and the liquidity of the market, rather than by scarcity or safe-haven properties. Indeed, there are many scarce things in the world that have no value simply because there is no demand for them.

In my view, Bitcoin�s price is affected by liquidity cycles and the interest of investors in the asset for various reasons. When the liquidity provided by central banks decreases, Bitcoin�s price is likely to bottom out as well. However, it may take many years for Bitcoin to overcome the influence of central banks, given their significant impact on the global financial system.

In practice, if we measure it, the long term cycle we can find in Bitcoin is three years and a three months (on average), which surprisingly resembles the liquidity cycle in China observed in its 10-year bond yield, CN10Y.

10 Year Chinese bond and major Bitcoin tops

10 Year Chinese bond and major Bitcoin tops

It is important to acknowledge that the Chinese 10-year bond yield can be influenced by central banks, including the People�s Bank of China. This is because bond yields reflect the expected return for investors who hold them until maturity, and interest rate changes can impact the bond�s value. Central banks have the power to adjust interest rates through various monetary policy tools, such as altering the money supply, setting interest rate targets, and buying or selling assets like bonds.

Therefore, movements in the Chinese 10-year bond yield can serve as an indicator of shifts in monetary policy, which may have a ripple effect on other asset classes, including Bitcoin. It�s worth noting that Bitcoin is known for its high volatility, and any changes in monetary policy could potentially affect its value as well in a dramatic way.

It�s important to keep in mind that the total market capitalization of Bitcoin is currently around half a trillion dollars, while the liquidity being moved by central banks is much larger, estimated at around 100 trillions dollars. The impact of monetary policy decisions by central banks on Bitcoin�s price may be significant at this point, given the relatively small size of the Bitcoin market compared to the global financial system. However, as the market value of all existing Bitcoins grows over time, it may become more resilient to external factors, including monetary policy decisions. Nonetheless, it�s likely that the influence of central banks on Bitcoin will continue for many years to come.

We can observe that in the current cycle, approximately 20 months have passed from the peak in 2021 to the recent bottom. Based on this, we can hypothesize that the current cycle may be 40 months long, which is in line with the previously calculated value of 39 months (3 years and 3 months).

I hope you enjoyed the article, and I would like to invite you to comment and share your opinion. You can comment here or on Twitter. If you are Italian, an italian version of this article is available at bit-reminder.com