Long Temr Update Bitcoin using entropic methods. 2019.

I will be busy in the coming days, so the yearly update for 2023 is being released early.

Every year i post an outlook using entropic methods explained in the technical section of this blog. Here you can find the 2015, 2016, 2017, 2018, 2019, 2020, 2021, and 2022 forecast update, where you can find more information about this approach.

Updated values for bitcoin (in brackets values of 2022) using daily data since August 2010 (from now on I will use only BITSTAMP data, as today there are not many differences between major Bitcoin exchanges.).

| BTC/USD | |

| Growth Factor G | 1.00090 (1.00130) |

| Shannon Probability P (see this as entropy) | 0.5214 (0.5254) |

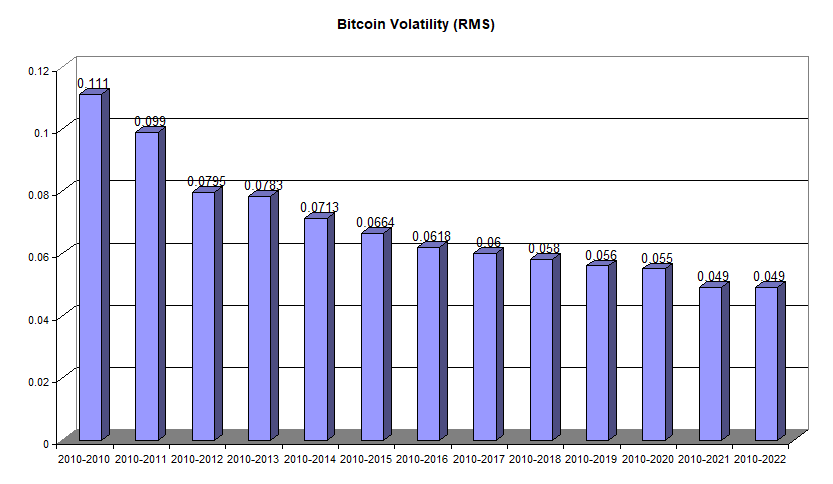

| Root mean square RMS (see this as volatility) | 0.049 (0.049) |

The entropy values of Bitcoin versus the USD have remained relatively consistent in 2022. The Growth Factor (G) has decreased slightly to 1.00090% compounded daily or 139% per year, which is less than the 168% seen one year ago. The optimal fraction of your total wealth to invest in Bitcoin has slightly decreased to 4.3% (~0.5214*2=1.0428 – 1 = 0.0428 or 4.3%, which is still roundable to 5% like last year).

The volatility of Bitcoin, unlike in previous years, has not decreased this year if we consider the average value from the beginning of the historical series, around August 2010 and it appears that for now, it remains stable at a fairly high value when compared to other assets such as gold, stocks, bonds, and forex currencies.

Despite a challenging year in 2022, the BTCUSD growth factor is still much better than traditional markets, except for the Shannon Probability, which still matches that of the US stock market (around 0.52). This means that on average, out of 100 days, an asset goes up 52 days and down for 48 days.

| 2023 Price forecast | Full Historical Volatility | Half Historical Volatility |

| Forecast using only G* | ~23,000$ | ~23,000$ |

| Upper bound adding volatility | ~58,000$ | ~36,500$ |

| Lower bound subtracting volatility | ~9,100$ | ~14,500$ |

*23000 is obtained with 1st January as a starting price (around 16500$) times (1.0090^365)=~1.39 | 16500*1.39=22900, just change 365 with the number of days you prefer for a different forecast.

What happened in 2022?

A year ago, I predicted an upper boundary of $199,000 using full volatility and about $123,000 using half of historical volatility, these two targets were calculated based on the opening price on January 1, 2022, which was around $48,000. The calculated support levels were $48,000 and $29,800.

It has been a negative year as we have never gone beyond the first calculated support level of $48,000, indicating a general weakness, while some support at $29,800 was seen during the year until May, after which even that level was abandoned and broken to the downside.

It should be noted that the first support at $48,000 acted as resistance during the spring when Bitcoin was unable to break through this support from below. When yearly supports act as resistance, it is evident that the market is weak.

Conclusions

I do not have any clear long-term trading recommendations for you this year as the Federal Reserve’s change in monetary policy to combat inflation has reduced the liquidity necessary to support strong Bitcoin prices. It may be wise to wait for a potential change in policy, but I expect Bitcoin prices to gradually decline towards calculated support levels for next year ($9,100 and $14,500). Based on my analysis using monthly bands based on Kaufman’s average, the most probable support area is around $12,000 (as shown in the chart section below), inside the 9,000$-14,000$ support price range for 2023.

If market volatility increases significantly above historical average, it may be a good opportunity to engage in a short-term trade by buying Bitcoin within the price range of $6,500 to $9,000. The value of $6,500 has been calculated using twice the historical volatility of Bitcoin as a reference and I consider it a rock solid support level in the event of a catastrophic market downturn.

If there is an improvement without making new lows, it is evident to me that resistances should be sought around $36,000, where we have the first resistance level computed with entropic methods and where there is also the monthly Kama average.

It is very unlikely to break $58,000 during 2023.

Unfortunately, this year I do not have a clear idea, I remain pessimistic however looking for a target at $12,000 where eventually buy something should I notice an improvement in market liquidity.

I’m at your disposal for any questions; see you at the next update and Happy New Year!

Charts

Bitcoin’s cumulative volatility as expected is dropping every year and is stabilizing towards a value that is still a bit high compared to other traditional assets (stocks, gold, bonds range from 0.01 to 0.03) but the very high average returns of btc compensate the high volatility. The values represent the root mean square of logarithmic returns of bitcoin daily data.

Bitcoin’s cumulative volatility as expected is dropping every year and is stabilizing towards a value that is still a bit high compared to other traditional assets (stocks, gold, bonds range from 0.01 to 0.03) but the very high average returns of btc compensate the high volatility. The values represent the root mean square of logarithmic returns of bitcoin daily data.

The second lower monthly kama average price band will probably slowly reach the $12,000 level during the 2023.

The second lower monthly kama average price band will probably slowly reach the $12,000 level during the 2023.I expect to find similarities between the levels calculated in the Kama indicator i use and those used with this approach, the formulas for calculating the bands in my indicator are the same as those used in this update.