Imagine a future in which trading cryptocurrencies is not restricted by the conventional rules of the game. Perpetual decentralized exchanges (PDEXs), a relatively new player in the DeFi ecosystem, come into play in this situation. Because of the dynamic...

Imagine a future in which trading cryptocurrencies is not restricted by the conventional rules of the game. Perpetual decentralized exchanges (PDEXs), a relatively new player in the DeFi ecosystem, come into play in this situation. Because of the dynamic nature of the sphere, perpetual DEXs have revolutionized the industry and increased their market value to over $2 billion. However, it hasn’t been an easy ride.

These platforms have been vying for space in a market that is largely controlled by CEXs despite their creative strategy. Perpetual DEXs hold about 3% of the total trading volume, so they have their work cut out for them. It’s like David vs. Goliath.

The difficulty lies not only in scale but also in technology. Perpetual DEXs have seen challenges similar to building a sandcastle with a teaspoon. Their on-chain order books have been pitted against those of the more streamlined and elegant CEXs. Each David, though, has his slingshot. Perpetual DEXs see it as the unrealized potential in a market that yearns for decentralization and innovation.

That’s where Swych PDEX enters the scene with style. Swych PDEX isn’t simply trying to follow the trend in a world where GMX and dYdX have been making waves; it wants to create a new one. Consider it a fusion of technology and ambition, ready to ride the next big thing in leveraged trading. It’s important to redefine the race, not just enter it.

Ultimately, it’s about altering the rules, and Swych is prepared to do just that.

Introducing Swych PDEX

Swych’s perpetual DEX focuses on risk management and innovative mechanics tailored for both beginners and expert traders.

Key Insights:

Clean interface and is user-friendly. Fully integrated TradingView chart. Tradable assets include BTC, ETH, and BNB. Ability to set take profit and/or stop loss when entering a trade. Ability to set take profit and/or stop loss after entering a trade. Ability to add/remove collateral while in a trade. Full position, order, and trade history details. Mobile access. Paper Trading mode with live pricing data. Market and Limit orders. PnL is the Net PnL, so what you see is what you get.Clean Interface and User-Friendly

Swych PDEX is designed with simplicity at its core, ensuring a smooth and intuitive trading experience. This user-friendly approach lowers the barrier to entry for new traders and streamlines the process for experienced users, making the platform accessible to a broad audience.

Fully Integrated TradingView Chart

The platform features a fully integrated TradingView chart, offering comprehensive tools for market analysis. This customization enables traders to tailor their analytical approach, adapting the chart to fit their trading styles and preferences.

Tradable Assets

Swych PDEX will initially support BTC, ETH, and BNB, offering a diverse range of trading options. This variety caters to different investment strategies and preferences, with plans to expand the asset list further in the future.

Setting Take Profit and Stop Loss

Traders are allowed to set take profit (TP) and stop loss (SL) orders both at the time of entering a trade and after the trade is already open. This flexibility in managing trades is important for effective risk management and strategy implementation.

Dynamic Collateral Management

Traders can add or remove collateral while trade is active, providing enhanced control over their trading positions and risk exposure.

Comprehensive Trading Information

Swych PDEX provides detailed information on positions, orders, and trade history. This transparent environment is to make informed decisions, review trading strategies, and track market performance accordingly.

Mobile Compatibility

Recognizing the need for trading on the go, Swych PDEX offers a mobile-friendly interface. This feature ensures that users can manage their trades and stay connected to the market anytime.

Paper Trading Platform

The paper trading feature with live pricing data is ideal for practice and strategy development, especially for new traders or simply those who wish to test the waters. It allows traders to simulate real-market trading without financial risk, making it an invaluable tool for learning and experimentation.

Order Types

Supporting both market and limit orders, the platform accommodates a variety of trading strategies. This flexibility allows traders to execute trades based on their market expectations and risk appetite.

Transparent PnL Reporting

The platform shows PnL as Net PnL, providing a clear and honest view of a trade’s outcome, after accounting for any fees. Traders can see the actual fees before opening a trade and see the fees while the trade is open. Gross PnL is shown as well.

Understanding Fees and Real Yield

Swych PDEX operates on a real yield fee system, designed to sustain the platform while rewarding its users. This system not only ensures the smooth operation of the exchange but also contributes to the generation of real yield for the investors. Here’s a breakdown of the fee structure and how it ties into the concept of real yield.

Exchange Fees Explained

The fee structure of Swych PDEX is carefully adjusted to balance the need for operational sustainability to reward its users. It’s a model that reflects the platform’s commitment to creating a mutually beneficial ecosystem for all its stakeholders.

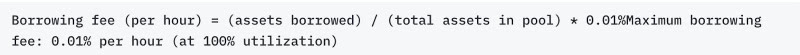

Position Fee: Swych PDEX charges a 0.1% fee for perpetual trading. This fee is applied to each trade. Liquidation Fee: A nominal charge of $5 is levied as a liquidation fee. This fee is incurred when a position is liquidated, which usually happens when the market moves against a leveraged position beyond a certain threshold. Dynamic Borrowing Fee: This fee is calculated as (assets borrowed) / (total assets in the pool) * 0.01%, with a cap of 0.01% per hour at full pool utilization. This fee structure is for managing the liquidity and risk associated with leveraged trading. Execution Fees: Swych PDEX maintains minimal execution fees, set between 0.0025 as the minimum and maximum. These fees are essential for executing trades on the platform and are kept minimal to encourage trading activity.

Execution Fees: Swych PDEX maintains minimal execution fees, set between 0.0025 as the minimum and maximum. These fees are essential for executing trades on the platform and are kept minimal to encourage trading activity.

The Concept of Real Yield

The real yield on Swych PDEX refers to the actual earnings users receive from the exchange, derived from the various trading fees collected. Unlike hypothetical or projected returns, real yield represents tangible income generated from platform activities. This yield is a crucial aspect of Swych PDEX’s business value proposition, as users not only engage in trading activities but also become beneficiaries of the platform’s success through real yield distribution.

Revenue Distribution

Swych PDEX implements a strategic fee revenue distribution system, ensuring operational sustainability while rewarding its community and investors. This approach reflects a commitment to balance operational needs with the benefits provided to platform users. Here’s an overview of how the fee revenue is allocated:

Allocation of Collected Fees

Treasury: 5% of the fees are allocated to the protocol’s treasury. This is for the ongoing maintenance and development of the platform, ensuring its smooth operation and continuous improvement. Lottery: 10% of the collected fees are directed towards the lottery mechanism. This feature adds an element of excitement and additional earning potential for the platform’s users. Investors: Swych PDEX allocates 35% of the fees to its stakeholders. This distribution underlines the platform’s commitment to providing real yield and returns to those who invest in it. Liquidity: 50% of the fees are allocated back into the exchange itself. By reinvesting this portion into the platform’s liquidity, Swych PDEX ensures robust market health and ongoing liquidity provision. This is important for maintaining efficient market operations and enhancing the platform’s overall performance between trading pairs.Focused on Balanced Growth

This distribution model is a cornerstone of Swych PDEX’s strategy to create a sustainable and thriving ecosystem. It balances the need to cover operational costs and invest in future development to provide tangible benefits to its community and stakeholders. Note that the percentage weights above may change and move more rewards towards stakeholders. As the platform continues to grow, this approach positions Swych PDEX as a forward-thinking player in DeFi, prioritizing both platform stability and user rewards.

Trading Incentive Program

Swych PDEX will soon introduce another initiative designed to reward traders based on their trading volume. This volume-based promotion is a feature that incentivizes active trading on the platform, providing tangible rewards for traders who engage frequently in market activities. Here’s a closer look at how this program works:

Mechanics of the Volume-Based Promotion

Incentive Structure: For every $25,000 in trading volume, the trader is rewarded with $10 in USDT. This reward system is designed to encourage higher trading activity, offering a direct monetary benefit to active users. Calculation of Trading Volume: The trading volume is determined by the formula: volume = collateral x leverage. This means the volume is calculated based on the amount of collateral a trader uses, multiplied by the leverage applied to their trades.Example

Let’s consider an example to understand how this works in a practical scenario:

Scenario: Ia trader decides to open a position in ETH. They use $1,000 of collateral and apply a leverage of 10x. Volume Calculation: In this case, the trading volume would be $1,000 (collateral) x 10 (leverage) = $10,000. Incentive Accrual: Since the trader has generated $10,000 in volume, they are partway to reaching the $25,000 threshold for the reward. Once their cumulative trading volume reaches $25,000, they would receive $10 in USDT. There is no cap as to how many times a user can qualify for the $10 reward.This program is especially appealing to high-frequency traders or those who trade with significant volumes, as it offers an additional financial perk on top of potential trading profits. It’s an innovative approach that not only fosters increased trading activity on the platform but also adds an extra layer of reward for Swych PDEX users.

Extra Features

Swych PDEX is not just resting on its current offerings but is actively expanding its features to enhance user engagement and provide additional value. The introduction of NFTs and a focus on educational resources are steps in this direction.

Swych Academy and Educational Material

How-to Guides: Additionally, Swych PDEX provides accessible how-to guides, available here. These guides offer step-by-step instructions on various platform features and trading methodologies, making it easier for users to navigate and utilize the platform effectively. Swych Academy: Aimed at beginners and experts alike, this is risk management 101 and it’s accessible here. The academy is specifically appealing for users to learn and study about trading at their own pace. It covers essential topics such as understanding candlestick charts, risk management, chart patterns, general trading information, and advanced trading techniques. This broad spectrum of content ensures that all users, regardless of their experience level, can find relevant and helpful information. It’s designed to empower traders with knowledge, enhancing their decision-making skills and trading acumen.NFT Integration: A New Way of Earning

Shortly, Swych PDEX plans to integrate NFTs into its ecosystem. These NFTs will not just be digital collectables but designed to offer practical utility within the platform.

The unique aspect of these NFTs is their ability to provide additional avenues for earning real yields. This feature will potentially open new earning opportunities for users, leveraging the popularity and innovative aspects of NFTs to enhance the overall trading experience on the platform.

This upcoming feature and all educational resources underscore Swych PDEX’s commitment to continuous improvement and user empowerment. The integration of NFTs and the focus on comprehensive education testify to the platform’s dedication to providing a holistic and enriched trading experience.

SWYCH Token: The Keystone of the Ecosystem

Swych has and will have a wide range of products like liquidity pools, the perpetual exchange we mentioned above, staking, and yield farming solutions, and all of these will be powered by the Swych token, $SWYCH. The token acts as the cornerstone, intertwining various elements, and unique functionalities in the ecosystem to provide a comprehensive experience for the user.

Utilities

Liquidity Pools: Users will benefit from liquidity pools on Swych, where they can deposit funds and earn from the trading fees generated, receiving LP tokens as a stake in the pool. Phase Two: The next phase of the Swych Token will focus on enabling users to generate real yield without additional fees, through staking pools. Real Yield Staking: This feature will offer users the opportunity to earn real yield based on their staking positions. NFTs: An opportunity that will offer unique and utility-focused NFTs, for additional rewards and engagement opportunities within the ecosystem. Lottery, Launchpad, and More: An enhanced lottery system, an accessible, permissionless launchpad, and a focus on listing diverse tokens, ensuring the safety and interest of investors. Incubator Project and Gamification: Looking further ahead, Swych will introduce an incubator program to support new projects and integrate gamification elements into its ecosystem.The above elements are the roadmap, which users can find in more detail in the gitbook. The SWYCH token ties together these diverse elements, providing a unified and streamlined DeFi experience for every user within Swych’s ecosystem. Its integration across different functions and features ensures that the ecosystem remains interconnected, offering users multiple ways to engage, invest, and earn rewards within the platform.