Coinbase recently responded to Senator Warren’s claim that the exchange adopted “revolving door politics” to stop effective digital asset regulations. The post ‘Revolving Door Politics’: Coinbase Responds to Sen. Warren appeared first on Bitcoin News.

Leading American digital asset trading platform Coinbase recently responded to United States Senator Elizabeth Warren’s claim that the exchange adopted “revolving door politics” to prevent the implementation of effective digital asset regulation in the country. This refers to Senator Warren’s raised concerns over the digital asset industry’s recruitment of former government officials to influence policymaking through lobbying efforts.

Faryar Shirzad, Chief Policy Officer of Coinbase, took to social media platform X to condemn Warren’s allegations, stating that the only publicly listed digital asset trading platform in the U.S. has been committed to the implementation of a clear regulatory framework for businesses to operate in the U.S.

“We are very proud of our record of rooting out illicit activity on our platform and of our deep partnership with law enforcement in going after bad guys,” said Shirzad.

Revolving Door Politics: Warren’s Allegations

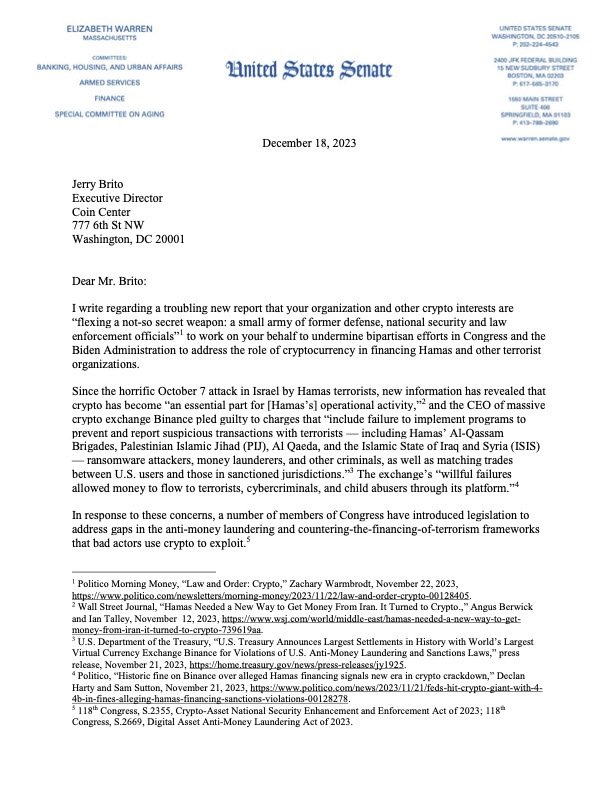

On December 19, in a letter addressed to Coinbase and digital asset advocacy groups Coin Center and Blockchain Association, Warren accused these entities of hiring ex-government officials to postpone regulations and affect policy making in Washington.

The U.S. Senator from Massachusetts accused these blockchain-focused firms of employing individuals with military and law enforcement backgrounds to obstruct lawmakers’ efforts in formulating clear regulations, specifically addressing the potential use of digital assets in terrorism financing.

Sen. Warren’s letter — Source

Sen. Warren’s letter — Source

Senator Warren stated:

“This abuse of the revolving door is appalling, revealing that the crypto industry is spending millions to give itself a veneer of legitimacy while fighting tooth and nail to stonewall common-sense rules designed to restrict the use of crypto for terror financing—rules that could cut into crypto company profits.”

The senator was possibly referring to the Coinbase Global Advisory Council, which consists of numerous former national security advisers, political appointees, and even elected lawmakers. Warren claimed that all these members of the Council are now acting as lobbyists for Coinbase while strongly criticizing this move.

Shirzad’s Response

Shirzad responded to Warren’s letter, noting that the exchange’s “success stems from hiring national security and law enforcement veterans who help us do everything we can to protect the American people,” while adding:

“Any suggestion that we are hiring these people to stop legislation is ridiculous. In fact, Coinbase has been consistently advocating for legislation like FIT21 that would create clear rules for the industry and consumers here at home.”

The Coinbase executive noted that discouraging Americans from using digital assets puts them at a disadvantage to other countries, as in the case of semiconductors and mobile phone technology. Shirzad noted that “keeping emerging and foundational technology in the U.S. is a national security requirement, and her efforts to drive digital asset innovators offshore are a mistake of historic proportions.”

Coinbase has been going head-to-head with the United States Securities and Exchange Commission (SEC), pushing for clear regulations in the rapidly growing digital asset industry. Interestingly, the agency dismissed a rulemaking petition filed by the exchange, stating that the “existing laws” are sufficient.

SEC Chair Gary Gensler remains certain of the fact that most digital assets, excluding bitcoin, are securities. Congressman Patrick McHenry called the SEC’s denial of Coinbase’s petition “shameful.”

The post ‘Revolving Door Politics’: Coinbase Responds to Sen. Warren appeared first on Bitcoin News.