Vijay Boyapati, former Google engineer and author of “The Bullish Case for Bitcoin,” believes Bitcoin Spot ETF will reshape personal investments. The post Ex-Google Engineer: Bitcoin ETF will Reshape Personal Investment appeared first on Bitcoin News.

The landscape of investing is on the verge of a seismic shift, poised to break down barriers that have long hindered the average person from entering the world of Bitcoin. With the anticipation of Spot Bitcoin Exchange-Traded Funds (ETFs) gaining approval in the United States, experts and advocates foresee a groundbreaking change that could democratize investment opportunities. A Bitcoin Spot ETF could immensely simplify the path for individual investors.

Streamlining Investment with Bitcoin Spot ETF

Vijay Boyapati, a notable Bitcoin advocate, former Google engineer and author of the book “The Bullish Case for Bitcoin,” has been vocal about the transformative potential of Bitcoin ETFs. He envisions these ETFs as a gateway to simplify Bitcoin exposure, removing significant hurdles that have discouraged many from delving into the digital money.

Breaking Down Barriers to Entry

Currently, diving into Bitcoin ownership involves grappling with numerous challenges. Issues like custody, taxation complexities, and a lack of understanding about cryptography often deter potential investors. Moreover, the mandatory “Know Your Customer” (KYC) checks imposed when purchasing Bitcoin with fiat currency act as a formidable roadblock for new entrants.

Boyapati emphasizes that these obstacles significantly limit the number of potential Bitcoin investors, particularly given the asset’s inherent volatility. Overcoming these barriers demands time, effort, and a willingness to navigate complexities—a deterrent for many considering an investment in such a volatile asset.

PlanB, the mind behind the Stock-to-Flow model, indicated on social media that markets have not grasped the full importance of BTC ETF approval. Some perceive it as a ‘sell the news’ event or lack awareness.

The Promise of Bitcoin ETFs

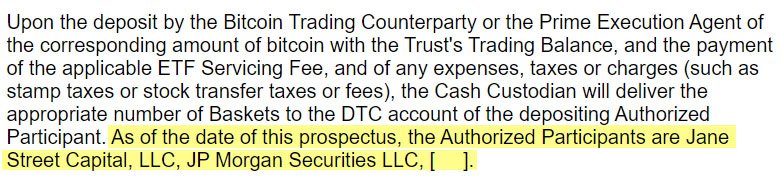

The potential approval of Bitcoin ETFs in the U.S. stands as a beacon of hope. It could revolutionize the investment landscape by offering a streamlined solution. These ETFs would allow various investors to seamlessly acquire Bitcoin using existing brokerage accounts, eliminating additional KYC/AML checks and providing a more accessible avenue for individual investors.

Boyapati’s insights shed light on the broader impact of Bitcoin ETFs on retail savings. He outlines how the removal of KYC/AML hurdles could unlock trillions in retail savings, easing the path for ordinary investors to gain exposure to Bitcoin.

The Power of Accessibility and Accumulation

Boyapati explains that the allure of Bitcoin ETFs lies in their simplicity. With a mere click, average investors could allocate a small percentage of their portfolio to Bitcoin without grappling with additional KYC/AML headaches. While a few percentage points might seem trivial individually, when aggregated across traditional financial institutions, the collective impact becomes staggering.

For many, Bitcoin ETFs could serve as their first true exposure to the digital asset. This ease of access, coupled with witnessing Bitcoin’s growth, is expected to cultivate a growing appetite for this new asset class among retail investors.

Grayscale CEO Shares Insights

On a similar note, Grayscale Investments’ CEO, Michael Sonnenshein, shared insights on CNBC’s “Squawk Box” on Dec 18, 2023.

He emphasized a $30 trillion U.S.-advised market eagerly anticipating a SEC-approved Bitcoin ETF, potentially sparking substantial Bitcoin investments. Sonnenshein discussed lobbying efforts and highlighted Bitcoin’s value rise due to economic factors, remaining optimistic about the ETF’s future. He addressed differing opinions on Bitcoin, emphasizing the evolving demands of investors seeking innovative technologies.

A Journey Down the Bitcoin Rabbit Hole?

Boyapati believes that as Bitcoin becomes a more significant part of an individual’s net worth, it inevitably draws them further into the Bitcoin ecosystem. This deeper engagement might lead many to realize the advantages of really owning Bitcoin versus an ETF.

What to Expect

The anticipation for Bitcoin ETF approval has gained momentum, with significant asset managers engaging with the US Securities and Exchange Commission (SEC). The decision date, set for January 10, 2024, has heightened speculation about the imminent approval of the first batch of ETFs.

The potential approval of Bitcoin ETFs stands poised to democratize Bitcoin ownership, making it more accessible to a broader array of investors. This transformative change could unlock trillions in retail savings, marking a significant chapter in the evolution of Bitcoin investments.

The post Ex-Google Engineer: Bitcoin ETF will Reshape Personal Investment appeared first on Bitcoin News.