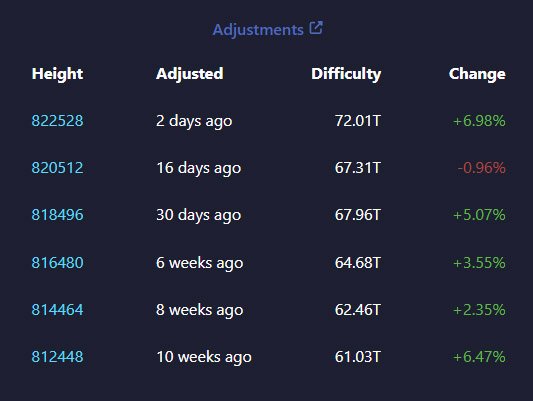

Bitcoin enters the new year with metrics in the green. Bitcoin hashrate and difficulty form new all-time highs. The post Bitcoin Heads Into New Year With Major Metrics in the Green appeared first on Bitcoin News.

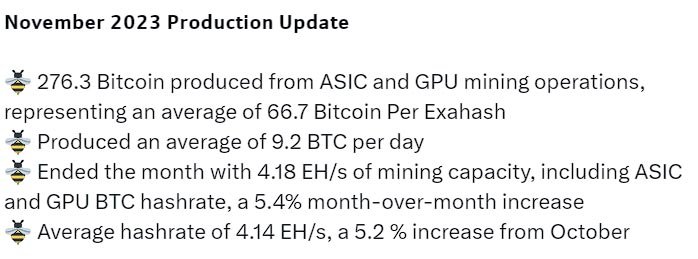

Bitcoin, the leading digital asset, has hit a monumental achievement in its mining operations, marking a historic rise in its mining difficulty, surpassing 70T for the first time ever, as reported by BitInfoCharts. This rise in Bitcoin hashrate and difficulty has sparked global attention, reflecting the escalating competition among miners and the imminent challenges faced by individual participants in the network.

Bitcoin difficulty chart — Source: BitInfoCharts

Bitcoin difficulty chart — Source: BitInfoCharts

Unprecedented Difficulty Surge

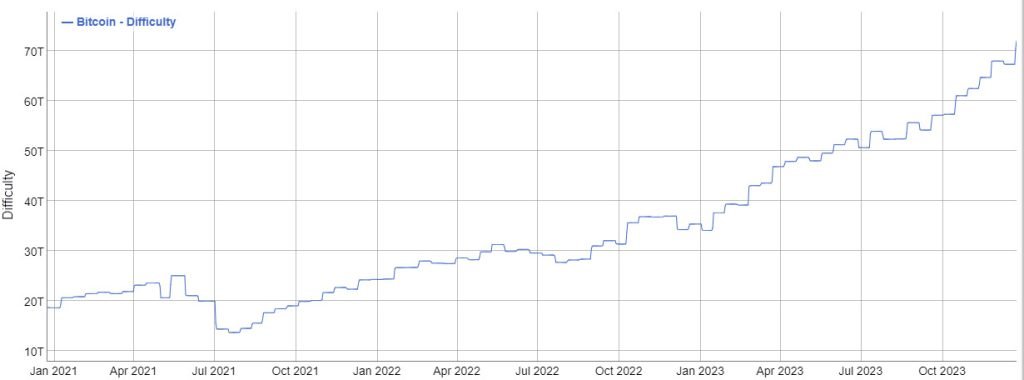

Recent data highlights an exceptional surge in Bitcoin’s mining difficulty, catapulting past 72 trillion at block height 822,528. This surge, a staggering 6.98% increase from the previous level, signifies a worldwide acceleration in mining activities. Miners are deploying increasingly powerful computing resources as they gear up for the impending halving event.

Historic chart of recent difficulty adjustments — Source: mempool.space

Historic chart of recent difficulty adjustments — Source: mempool.space

The recent block processing speeds, falling within the window of approximately 8 and a half to 9 and a half minutes, has been shorter than the protocol-dictated 10-minute average. The surge in hashrate shortened the time between blocks and has resulted in an uptick in mining difficulty again, causing an increase of 6.98% in difficulty. The upcoming alteration in Bitcoin’s difficulty is scheduled for January 5, 2024.

Currently, approximately 19 major mining pools (more than 1 Eh/s) participate in the BTC chain. Foundry USA has surged ahead recently, securing 159 EH/s, representing 29% of the total hashrate. Antpool, once the leader as previously reported by BitcoinNews, now holds 140 EH/s, totaling 26%. Together, these two pools control over 55% of Bitcoin’s hashrate as of December 25, 2023.

Another interesting metric to mention is miners’ earnings, which in December this year, exceeded past year fee earnings records.

In November, BTC transaction fees yielded miners $142 million, soaring to $267 million in December up until now. Total earnings, including subsidies and fees, now stand at $1.23 billion. With high-priority fees exceeding $15 per transaction, over 300,000 unprocessed transactions await confirmation, necessitating about 370 blocks to clear the backlog.

Bitcoin Hashrate: Skyrocketing Trajectory

Concurrently, Bitcoin’s hashrate, a measure of its network’s computational power, has witnessed an astounding ascent. Surpassing 545 EH/s over a seven-day average, the current hashrate stands at an impressive 601 EH/s as of December 25, corresponding to a difficulty of 72.01 T. Such exponential growth highlights the network’s robustness and its ability to attract substantial investments in mining infrastructure despite market fluctuations.

Bitcoin hashrate chart, as reported by HashRateIndex — Source

Bitcoin hashrate chart, as reported by HashRateIndex — Source

Impact on Miners and Anticipated Halving

This surge, however, presents challenges for individual miners who now face intensified competition, potentially leading to reduced rewards owing to the elevated computational power required for mining. Moreover, this surge precedes the much-awaited Bitcoin Halving, an event expected to cut mining rewards in half. This process, integral to Bitcoin’s deflationary mechanism, aims to control inflation and mirror the scarcity-driven appreciation akin to precious metals like gold.

Implications for the Future

As the industry braces for this imminent halving event, the landscape of Bitcoin mining is poised for significant changes. The impending reduction in rewards could fundamentally alter the dynamics of mining operations and influence Bitcoin’s future trajectory.

Next Bitcoin halving is scheduled to happen around mid-April 2024 — Source

Next Bitcoin halving is scheduled to happen around mid-April 2024 — Source

While the network’s resilience and its capacity to allure substantial investments remain evident, individual miners face a competitive landscape. Miners are currently engaged in an epic battle to secure as many bitcoin as they can in the little time left before the block rewards are cut in half. The countdown to the halving event underscores the need for adaptability among miners to navigate the evolving landscape of Bitcoin mining.

The post Bitcoin Heads Into New Year With Major Metrics in the Green appeared first on Bitcoin News.