In this article, BlackRock Bitcoin ETF and its current stage are analyzed, as well as asset manager's recent moves and what it means for investors. The post BlackRock Prepares for Bitcoin ETF With $10M Cash Seeding appeared first on...

As the Bitcoin market continues to evolve, major financial institutions like BlackRock are making significant strides in introducing Spot Bitcoin Exchange-Traded Funds (ETFs). Here’s a breakdown of BlackRock Bitcoin ETF and its current stage, as well as asset manager’s recent moves and what it means for investors.

BlackRock Bitcoin ETF Plans

BlackRock, the world’s largest asset manager, has been making waves in the Bitcoin space with its plans to launch a Spot Bitcoin ETF. This move aims to provide investors with direct exposure to Bitcoin, unlike futures-based ETFs that deal in derivatives contracts.

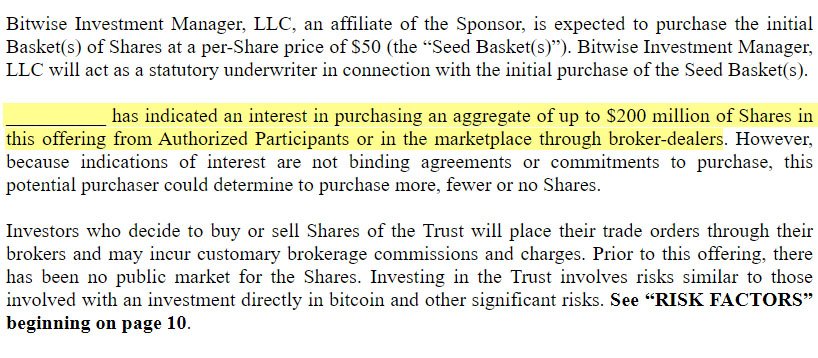

In its recent filing with the U.S. Securities and Exchange Commission (SEC), BlackRock outlined its strategy to seed its proposed BlackRock Bitcoin Trust with $10 million. This significant investment marks a departure from its initial $100,000 seeding, signaling a 100x commitment, and the firm’s serious dedication to this venture.

It is stated in the most recent filing:

“On January 3, 2024, the Seed Shares were redeemed for cash and the Seed Capitol Investor purchased the Seed Creation Baskets, comprising of 400,000 Shares at a pre-share price of $25.00 […] Total proceeds to the Trust from the sale of the Seed Creation Baskets were $10,000,000,”

Bloomberg analyst James Seyffart noted on X that BlackRock had revised its S-1 document after engaging in discussions with the SEC the prior day concerning its Spot Bitcoin ETF submission.

He added:

“Looking like Blackrock is *planning* to make moves on Jan 3rd. They’re seeding the ETF with $10 million.”

He also stated that he is seeing a lot of hype “building too much,” highlighting that this is not the final or approved document yet.

Bitcoin ETF Seeding Round

BlackRock’s ETF plan involves purchasing Bitcoin through a Seed Creation Basket, creating the necessary foundation for the ETF’s launch. BlackRock’s approach showcases a shift toward the spot model, offering a different investment avenue for those seeking direct Bitcoin exposure.

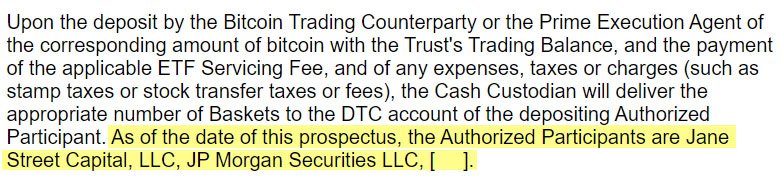

Bloomberg’s Eric Balchunas noted BlackRock’s plan to inject $10 million into its Bitcoin ETF as a significant increase from their initial $100K seeding. He highlighted the SEC’s AP naming requirement, and suggested SEC favors cash creation model adopters for approvals.

He added:

“This is no easy last step, and may keep some from starting gate. AP agreement + cash creates = approval.”

Spot Bitcoin ETF Details and Impact

The Spot Bitcoin ETF proposed by BlackRock is designed to mirror the performance of Bitcoin based on the CME CF Bitcoin Reference Rate. Unlike futures-based ETFs, this fund will hold actual Bitcoin, allowing investors direct access to the digital asset’s movements.

This initiative from BlackRock, with its extensive experience in managing assets and pioneering ETFs, signifies a broader acceptance of Bitcoin by institutional investors. It aims to attract investors preferring direct Bitcoin exposure over futures contracts, potentially diversifying the market.

Addressing Regulatory Hurdles and Market Speculations

BlackRock’s journey toward a Spot Bitcoin ETF hasn’t been without challenges. The SEC’s concerns regarding market manipulation, fraud, and regulation have been persistent obstacles for such ETFs. However, BlackRock’s proactive engagement with the SEC and its revised strategy demonstrate efforts to navigate these concerns.

Related reading: SEC Gets Its Way: Revised BlackRock Spot Bitcoin ETF Allows Cash

Market speculations surrounding the launch date and potential impact have been rife. Analysts anticipate a launch shortly after regulatory approval, hinting at a possible shift in the industry dynamics upon its introduction.

The Broader Landscape of Bitcoin ETFs

BlackRock’s move isn’t isolated in the ETF space. Several other Bitcoin-related ETFs, both futures-based and physically backed, are in various stages of approval or already available in the market. These ETFs offer different investment approaches, catering to diverse investor preferences.

As BlackRock pushes forward with its Spot Bitcoin ETF plans, the landscape of Bitcoin investments is poised for a significant transformation. The potential approval and subsequent launch of this ETF could open doors for more institutional participation in the Bitcoin market.

While uncertainties remain regarding regulatory approvals and market impacts, BlackRock’s strategic steps underline a pivotal moment in the evolution of Bitcoin investment vehicles. Investors eagerly await the outcome, anticipating a possible game-changer in the Bitcoin market.

The post BlackRock Prepares for Bitcoin ETF With $10M Cash Seeding appeared first on Bitcoin News.