Spot Bitcoin ETFs have the potential to significantly overshadow the entire $50 billion digital asset-related funds. The post Spot Bitcoin ETF to Surpass All Digital Asset Funds: Report appeared first on Bitcoin News.

Spot Bitcoin ETFs, poised for approval in the United States, have the potential to significantly overshadow the entire $50 billion digital asset-related funds.

Spot Bitcoin ETF vs. Other Digital Asset ETPs

As anticipation builds for the United States Securities and Exchange Commission’s potential approval of Spot Bitcoin ETFs in early 2024, analysts are exploring the potential implications. According to recent findings from BitMEX research, the current global landscape for digital assets Exchange-Traded Products (ETPs) comprises around 150 products, amassing a total of $50.3 billion in assets under management.

This diverse range of ETPs encompasses both Spot and futures funds, typically mirroring the performance of Bitcoin as the leading digital asset.

Bitcoin Will Dominate Digital Asset ETPs

Bitcoin’s dominance in the realm of digital asset ETPs is evident, commanding a substantial total value of $35.4 billion for Bitcoin ETFs alone. Key contributors to this impressive sum encompass the Grayscale Bitcoin Trust (GBTC), boasting assets amounting to $27,077.4 million, and the Proshares Bitcoin Strat ETF (BITO), securing assets totaling $1,645.3 million. Notably, Grayscale’s Bitcoin Trust, the largest ETP on the list, is actively pursuing conversion into a Spot ETF.

Diversifying beyond Bitcoin, the list contains the expansive landscape of digital asset ETPs. The Grayscale Ethereum Trust (ETHE) stands out prominently within this category, holding assets valued at $6,861.8 million.

Extending beyond individual digital assets, BitMEX listed a spectrum of products linked to blockchain technology and various thematic ETFs. The Equity Products Subtotal registers at $2,648.7 million, featuring noteworthy entries such as Amplify Transformational Data Sharing (BLOK) and Valkyrie bitcoin miners ETF (WGMI).

Within the list of 150 digital-asset funds, the top 20 ETFs garnered the most significant volume of investment, with a total of $1.3 billion flowing into them throughout 2023. Notably, BITO, launched during the bull market in October 2021, captured the highest individual inflows, marking an additional $278.7 million in 2023.

What Analysts Believe

This data presents an intriguing scenario for understanding how Spot Bitcoin ETFs might impact existing ETPs, potentially reshaping investor preferences within the digital asset space. Analysts predict that the SEC’s potential approval of a Spot Bitcoin ETF, with speculations pointing to January 10, could lead to a doubling of investments in digital asset ETPs.

Bitwise, a prominent digital asset investment fund, projects Spot Bitcoin ETFs to become the most successful ETF product. It forecasts an impressive $72 billion in assets under management within the next five years—more than doubling the existing market.

A more conservative estimate from global fund manager VanEck suggests around $2.4 billion could flow into Spot Bitcoin products in Q1 2024.

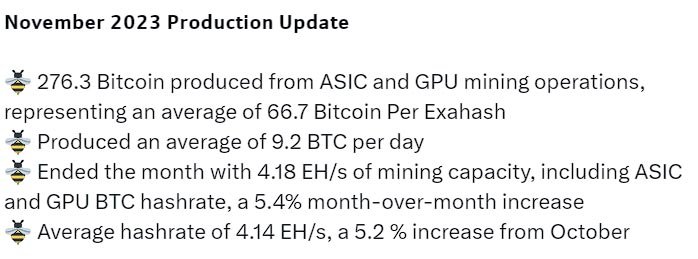

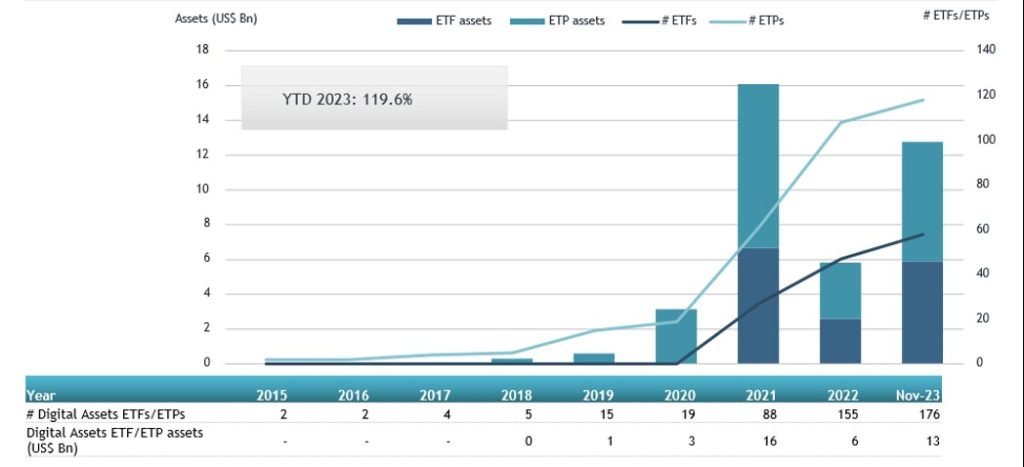

The enthusiasm surrounding Spot Bitcoin ETFs reflects a broader institutional trend in digital asset investments. ETFGI’s report on December 21 disclosed year-to-date net inflows of $1.6 billion into digital asset ETFs globally, with $1.31 billion added in November alone. According to the data, the assets invested in ETFs and ETPs listed globally have soared 119.6% in the first 11 months of 2023.

Global digital asset ETFs and ETPs asset growth as of November 2023 — Source

Global digital asset ETFs and ETPs asset growth as of November 2023 — Source

The imminent approval of Spot Bitcoin ETFs in the U.S. marks a transformative moment for the digital asset landscape. With the potential to surpass 150 digital asset ETPs, these ETFs are poised to reshape investor preferences and contribute to ongoing institutional adoption.

The post Spot Bitcoin ETF to Surpass All Digital Asset Funds: Report appeared first on Bitcoin News.