The most pressing issue today in improving quality of life for people around the planet is access to energy. Bitcoin mining can finance the build out of infrastructure to do that.

In many parts of the world, access to electricity is a luxury that we often take for granted. Sub-Saharan Africa (SSA), for example, faces a severe electricity deficit, with over 600 million people without power. This deficit leads to economic stagnation, reduced food production, poverty, and even civil unrest. The correlation between electricity access and economic growth is undeniable, and regions with less than 80% electrification rates consistently suffer from reduced GDP per capita. The challenge lies in expanding electrical infrastructure to these underserved areas, which is capital-intensive and often financially unfeasible for governments with limited resources. This is where Bitcoin mining is a potential solution that can offer a pathway to electrify regions that have long been without access to electricity.

Bitcoin mining has long been a subject of much controversy, with critics often focusing on its perceived environmental impact. However, beneath the sensational headlines and mainstream media narratives, lies a story of potential humanitarian benefits, and energy innovation. By harnessing stranded energy in remote locations, Bitcoin mining can provide a source of revenue for new power plants and thus support the construction of electrical grids.

Despite the ongoing mudslinging campaign against Bitcoin mining, knowledge of the importance of harnessing stranded energy for Bitcoin mining is slowly gaining traction. In fact, this is the story that is beautifully captured in the newly released and award-winning documentary, Stranded:A Dirty Coin Short by Alana Mediavialla Diaz, which showcases how Bitcoin miners in places like SSA ingeniously repurpose stranded power, breathing life into both Bitcoin and forgotten power infrastructures.

In this article, we will explore the overlooked positive aspects of Bitcoin mining, compare its energy consumption to other industries, and make a case for how Bitcoin mining could potentially incentivize the discovery of new sources of energy and the build out of new energy infrastructure.

What Is Stranded Energy Anyway?

Stranded energy refers to energy sources that exist in a location but are not effectively utilized or harnessed for productive purposes. It's essentially energy that is isolated or "stranded" in a certain location due to various reasons, like lack of infrastructure to transport it or a mismatch between the location of energy production and demand.

For instance, when new electrical grids are being developed, especially in remote areas, the energy infrastructure may be in place before the demand for it catches up. Which means that, until consumers are connected to the grid, the energy generated is more than what is immediately needed, making it “stranded” and ultimately wasted until more users connect. This is a huge problem that Bitcoin mining can help to solve, and this area in particular is one of the major benefits of mining that Stranded explored in great detail.

In an interview Alana highlighted how Bitcoin mining, by monetizing excess energy in regions lacking traditional demand, acts as a financial catalyst for constructing vital grid infrastructure, thereby changing lives and challenging our perceptions of energy's societal impact. She elaborated on this further by saying, “The concept of how a grid grows through demand, was not something I ever thought about. In the film i wanted to capture that it is a great privilege to have access to electricity and that mining is able to finance new grid infrastructure in places that have never had it before”

Take Ethiopia, for instance. It has the potential to generate more than 60,000 megawatts (MW) of electricity from “renewable” sources, but currently has only 4,500 MW of installed capacity. 90% of its electricity is generated from hydropower, with geothermal, solar, and wind making up the difference. However, the country still experiences acute energy shortages, with only 44% of its 110 million people having access to electricity. With projects like the Grand Ethiopian Renaissance Dam (GERD) under construction, which is projected to generate an additional 5,150 MW, the government expects to have a total of 17 000 MW of installed capacity in the next 10 years. The introduction of Bitcoin mining has the potential to fund these electricity infrastructure projects.

Dispelling Misconceptions About Bitcoin Mining

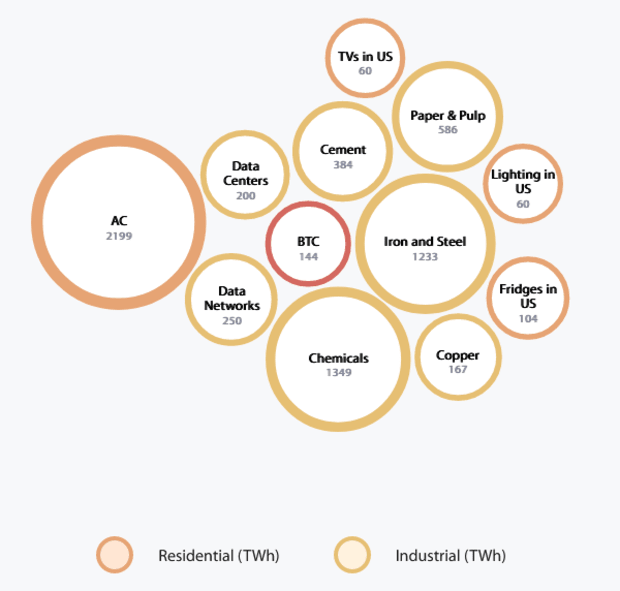

One of the most common misconceptions surrounding Bitcoin mining is the notion that it consumes an exorbitant amount of energy, exceeding the energy consumption of entire countries. Critics often point to reports suggesting that Bitcoin mining consumes more electricity than many nations, including Ireland, Nigeria, and Uruguay. The Bitcoin Energy Consumption Index by cryptocurrency platform Digiconomist estimates an annual energy usage of 33 terawatts, on par with countries like Denmark.

However, it's important to dissect this critique and place it in the broader context of energy consumption. While it's true that the Bitcoin network's energy usage appears significant, it's essential to remember that energy consumption itself is not inherently bad. This critique tends to presuppose that energy is a finite resource and that allocating it to Bitcoin mining deprives other industries or individuals of this valuable commodity.

In reality, energy is a vital and expandable resource, and the notion of one usage being more or less wasteful than another is subjective. All users, including Bitcoin miners, incur a cost and pay the full market rate for the electricity they consume. To single out Bitcoin mining for its energy consumption while overlooking other industries is a fallacy. As Alana also pointed out, “People hold as common misconceptions what the media commonly repeats about Bitcoin. Nobody is ever thinking about the energy consumption of the industries they interact with everyday.This is not a common figure that people know about things yet when it comes to Bitcoin, it sure is dirty because of all that energy consumption!“

Comparing Bitcoin To Other Energy-Intensive Industries

To put things in perspective, let's compare Bitcoin mining to some other energy-intensive sectors that often escape similar scrutiny:

I don’t know about you, but I cannot recall the last time I heard complaints in the media about the paper and pulp industry's high energy consumption. In order to counter the myths surrounding “the dangers” of Bitcoin mining and its energy usage, a nuanced understanding of energy consumption is required. While it's crucial to examine the environmental impact of any industry, singling out Bitcoin mining for criticism while overlooking other energy-intensive sectors is a flawed approach.

What Does The Future Hold?

Unlike any technology before it, Bitcoin mining incentivizes the exploration of cost-effective ways to harness energy, irrespective of geographic limitations or conventional energy constraints. This financial impetus could spark an energy revolution on a scale not seen since the Industrial Revolution, potentially propelling humanity to be a type I civilization. A view also shared by Alana, who when quizzed about her next film project said, “The next one is about what it will take us to reach a type 1 civilization using Puerto Rico as our underdog model that is undergoing major infrastructure change. It’s a pivotal moment in the island’s history and it can serve as an example to failing grids around the world.”

As economic incentives push Bitcoin mining to saturate the energy sector, a convergence is occurring. Energy producers are monetizing surplus and stranded energy through Bitcoin mining, while miners are vertically integrating to enhance competitiveness. In the foreseeable future the most efficient miners could become energy producers themselves, potentially inverting the traditional power grid model.

This is a guest post by Kudzai Kutukwa. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.