In a recent filing on December 27, bankrupt cryptocurrency exchange FTX unveiled its repayment plan, triggering customer outrage and discontent. The plan, which values customers’ digital assets at the time of FTX’s collapse, offers a value significantly lower than...

In a recent filing on December 27, bankrupt cryptocurrency exchange FTX unveiled its repayment plan, triggering customer outrage and discontent. The plan, which values customers’ digital assets at the time of FTX’s collapse, offers a value significantly lower than prevailing market prices.

FTX Under Fire

The filing by FTX stated that the repayment plan aims to make substantial progress towards confirming a Chapter 11 plan and returning the value of the assets to customers and other creditors.

However, the unique nature of these Chapter 11 cases, involving claims based on digital assets, has posed challenges in determining fair and reasonable values for these unliquidated claims.

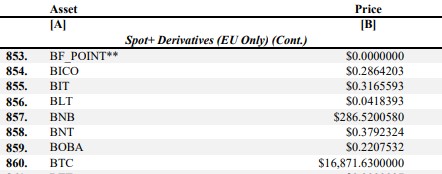

According to the filing, to estimate the value of the digital assets owed to customers, FTX compiled a data set that included coin and token prices from Coin Metrics, a widely used source of price-related information in the cryptocurrency industry.

In addition, the filing states that adjustments were made to account for factors such as orderly liquidation of assets, non-marketable assets, and equity-like assets.

However, as reflected in the Digital Assets Conversion Table, the proposed valuation has left customers dissatisfied, particularly due to the significant discrepancy between the proposed values and current market prices.

For example, Bitcoin (BTC) is valued at $16,871.63, approximately 61% lower than its current price of $42,800. Similar discrepancies exist for other assets such as Ethereum (ETH), Solana (SOL), and Lido (LDO), which FTX values at $1,258, $16.247, and $1,176, respectively.

FTX Customers Rally Against Repayment Plan

The news of the repayment plan has caused discomfort among customers who stand to lose substantial value on their holdings.

Many customers have voiced their concerns and frustrations, stating that the proposed valuation would significantly disadvantage them. Some customers have sought guidance on how to file objections or reject the FTX repayment plan.

FTX has set a deadline of January 11 for customers to object to the repayment plan. If customers disagree with the proposed valuation, they are encouraged to take the necessary steps to voice their concerns within the specified timeframe.

As the bankruptcy case of FTX progresses, customers and industry observers await further developments and potential resolutions to address the concerns raised by customers regarding the repayment plan and the valuation of their digital assets.

It remains uncertain what further actions customers will take to secure the expected repayment for their assets held on the now-defunct exchange. The response from the company to these claims and their plans for the next steps of repayment are yet to be seen.

Currently, the native token of the exchange, FTT, is trading at $3.1047. Over the past 30 days, it has experienced a significant decline of more than 26%, with a further decrease of 8.6% in the last 24 hours.

Featured image from Shutterstock, chart from TradingView.com