Bitcoin’s price has been rallying aggressively, breaking past several resistance levels with ease. Yet, the market is once again consolidating, and a correction might be on the cards. Technical Analysis By TradingRage Bitcoin Price Analysis: The Daily Chart On...

Bitcoin’s price has been rallying aggressively, breaking past several resistance levels with ease. Yet, the market is once again consolidating, and a correction might be on the cards.

Technical Analysis

By TradingRage

Bitcoin Price Analysis: The Daily Chart

On the daily chart, the price has clearly been bullish over the past few weeks, making higher highs and lows. Yet, the rally has seemingly come to a halt, and the price is moving sideways above the $40K mark.

While the $40K level is holding firm, a deeper correction might occur, and the price could drop to $38K or even toward the 200-day moving average, located around the $32K mark.

However, as the market is yet to make a lower low and the relative strength index is indicating that the momentum is still bullish, BTC could still reach the critical $48K resistance level before beginning a significant correction.

Source: TradingView

Source: TradingView

The 4-Hour Chart

Looking at the 4-hour chart, it becomes clear that the price has been forming a triangle pattern above the $40K mark. If the pattern gets broken to the downside, a drop toward the $38K level could be expected.

On the contrary, a bullish breakout would likely result in a surge toward the $48K level. The relative strength index has also recently risen above the 50% threshold, signaling that a bullish breakout might be more likely.

Source: TradingView

Source: TradingView

On-Chain Analysis

By TradingRage

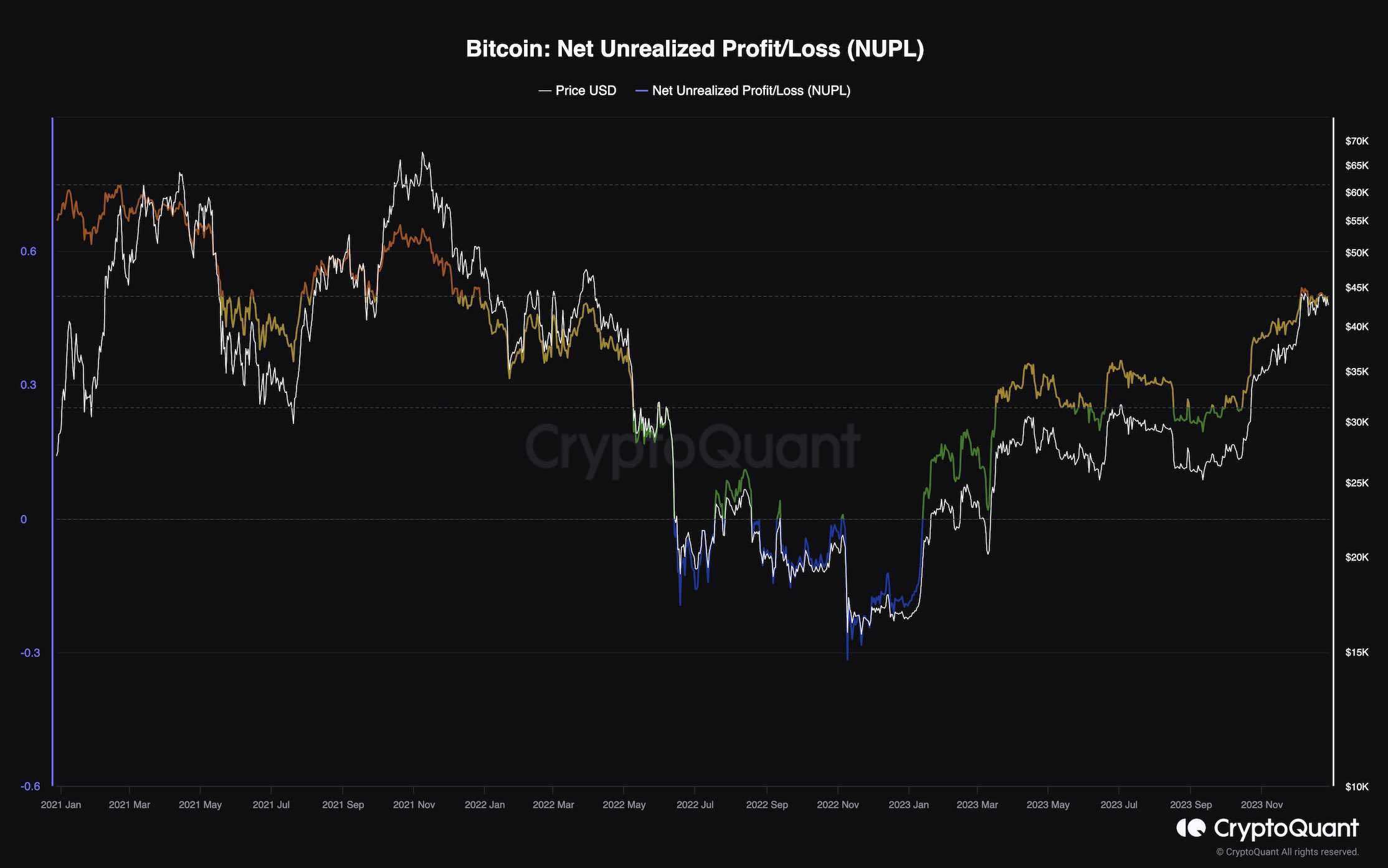

Bitcoin NUPL

Bitcoin’s price has been rapidly rising over the last couple of months, making investors hopeful that a new bull market is on the horizon. Analyzing the on-chain metrics can provide helpful insight into whether that is the case or not.

This chart demonstrates the net unrealized profit/loss (NUPL) metric, which measures the amount of unrealized profits or losses of all market participants. It is evident that following the recent surge in price, many investors are now holding their coins in profit.

This is a logical sign of a bull market. However, the metric has already entered the region previously seen on the last all-time high. This might lead to a profit realization by investors, and subsequently, the resulting supply can push the price back lower. Therefore, while Bitcoin might be on its way to making a new all-time high, this might not be a good time to enter the market as a correction may occur in the short term.

Source: CryptoQuant

Source: CryptoQuant

The post Will Bitcoin Drop Below $40K or is a Major Bounce in Play? (BTC Price Analysis) appeared first on CryptoPotato.