Bitwise Bitcoin ETF made waves recently, as the index fund manager announced a staggering $200 million seeding. The post BitWise Bitcoin ETF Takes the Lead With $200 Million Seed appeared first on Bitcoin News.

Bitwise, a prominent digital asset index fund manager, made waves with its filing indicating a staggering $200 million seeding for its Bitcoin Spot Exchange-Traded Fund (ETF).

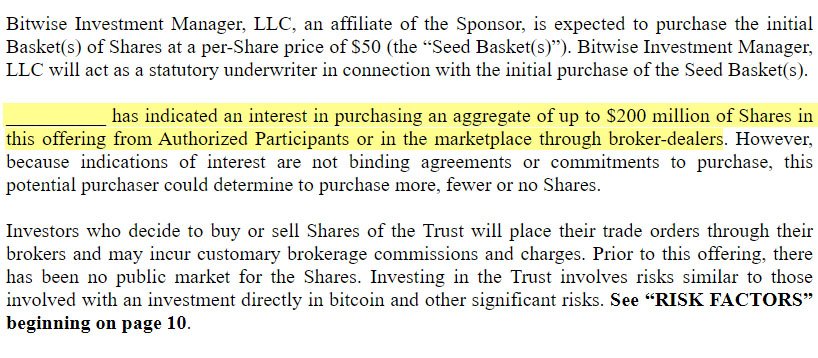

Bitwise Bitcoin ETF latest S-1 filing announced $200 million seed — Source

Bitwise Bitcoin ETF latest S-1 filing announced $200 million seed — Source

Bitwise Bitcoin ETF Takes the Lead in Seeding

The race for Bitcoin Spot ETFs has reached a fever pitch as major players reveal their strategies and financial commitments in recent filings submitted to the U.S. Securities and Exchange Commission (SEC).

Bitwise’s substantial backing surpasses BlackRock’s $10 million contribution, signaling a strategic advantage for Bitwise in the initial stages of the competition. While Bitwise hasn’t disclosed its authorized participant yet, this financial commitment positions them as a frontrunner in the ETF landscape.

Bloomberg analyst Eric Balchunas highlighted:

“Bitwise S-1 has been filed and it looks like someone (I wonder who) is going to seed $BITB with $200m.”

Fierce Competition and Strategic Moves

The flurry of S-1 filings from industry giants like BlackRock, Fidelity, and others underscores the escalating competition. These filings highlight various strategies aimed at enticing investors, including fee structures and authorized participant disclosures.

Fidelity, for instance, showcased a remarkably low fee structure at 0.39%, while Invesco Galaxy took an aggressive stance by waiving fees for the first six months and the initial $5 billion in assets. These fee strategies reflect a keen awareness of the competitive landscape, with each contender vying to attract early investors.

Balchunas noted:

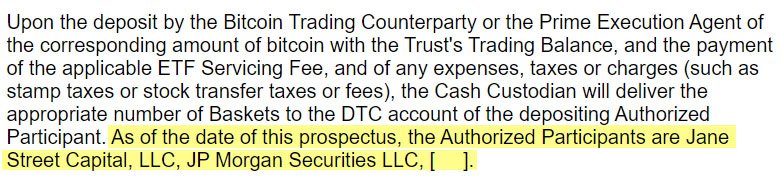

“Fidelity’s S-1 in as wow, it included its fee which will be 0.39%, by far lowest so far, also names Jane Street as AP. Fidelity is officially ready to party.”

He also stated that this “fee war” is normal in the world of ETFs, which might be something odd and incomprehensible for digital asset exchanges.

The competition is not limited to SEC filings and fees, but has also extends to ad campaigns. Major players like Bitwise and Hashdex have already unveiled advertisments for their Bitcoin ETFs, trying to attract investors and outpace the competitors.

Revised Filings and Authorized Participants

Invesco Galaxy, WisdomTree, and Fidelity strategically disclosed their authorized participants in their amended S-1 filings. Invesco Galaxy chose Virtu and JPMorgan, while WisdomTree and Fidelity entrusted Jane Street Capital. Notably, WisdomTree remained firm on maintaining in-kind share creation and redemption, signaling potential regulatory discussions in this evolving landscape.

Industry Dynamics and Market Interest

Bitwise’s undisclosed participant expressing interest in purchasing up to $200 million in ETF shares adds intrigue to the competition, emphasizing the significant financial backing and market interest these contenders are generating. However, the lack of named authorized participants in Bitwise’s filings remains a point of interest in the ongoing race.

As the SEC reviews these filings, regulatory scrutiny looms over the industry. The resignation of Barry Silbert from Grayscale’s board amid an SEC investigation involving the Digital Currency Group introduces a regulatory dimension to the race, potentially impacting the fate of these ETF applications.

Outlook and the Anticipated Approval

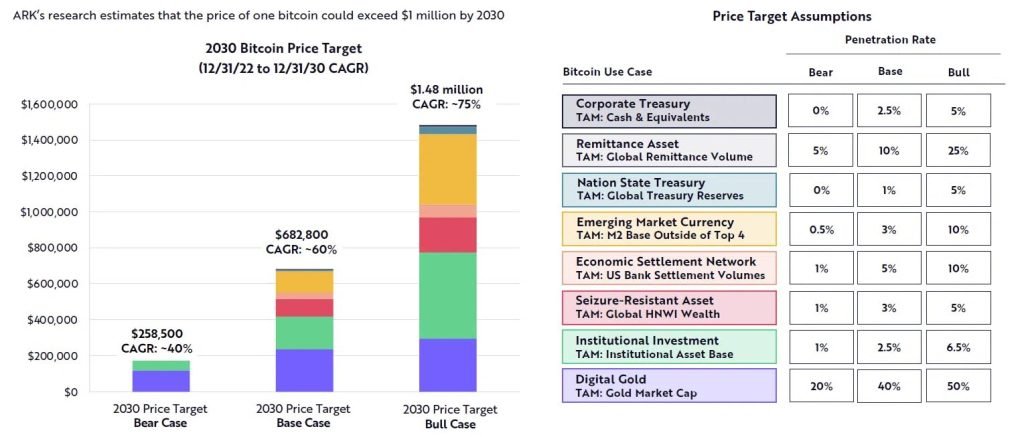

The anticipation surrounding ETF approvals continues to grow, even as Bitcoin’s price remains relatively stable. Market observers expect the SEC’s decision on outstanding Spot Bitcoin ETF filings by January 10, 2024, with potential trading set to commence shortly after. The outcome of these approvals is likely to shape the future trajectory of Bitcoin markets, especially in light of the upcoming BTC halving event scheduled for April 2024.

The ETF race remains dynamic and closely watched, with each filing and strategic move shaping the evolving landscape of digital asset investment opportunities.

The post BitWise Bitcoin ETF Takes the Lead With $200 Million Seed appeared first on Bitcoin News.