Business leaders often confuse pricing methods with pricing strategies, so it is important for us to distinguish sharply between the two. Pricing methods yield a price number as a finite output. These outputs can vary significantly, depending on the...

Business leaders often confuse pricing methods with pricing strategies, so it is important for us to distinguish sharply between the two. Pricing methods yield a price number as a finite output. These outputs can vary significantly, depending on the information sources used.

Pricing strategies demand that leaders look beyond prices – beyond the numbers – to take the entirety of their current and future market situations into consideration, rather than focusing narrowly on one input or one method to the exclusion of other information. Pricing strategies express intentions and offer guidance and direction. They are subjective and require astute judgment.

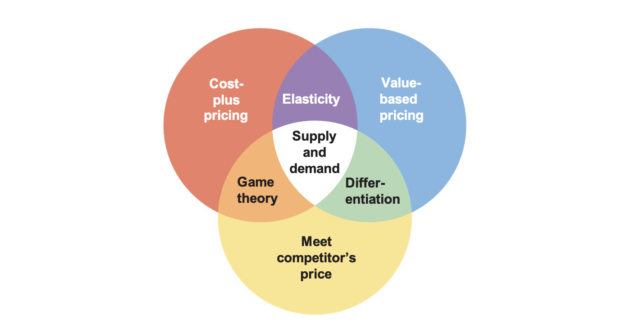

The next step in going beyond prices and developing a pricing strategy is to look at the combinations of the three information sources. Cost, com- petition, and value can generate important and more powerful insights in combination than in isolation. The intersections show the four natural overlaps that result in practical frameworks backed by large bodies of economic theory.

The frameworks at the respective overlaps – elasticity, differentiation, game theory, and supply and demand. Each of these frameworks can either facilitate or hinder strategic pricing decisions, depending on how business leaders apply them. Below we elaborate on the four frameworks at the intersections.

Price Elasticity: The elasticity framework lies at the intersection of cost and value, because cost and willingness to pay are the two inputs necessary to calculate an optimal price based on elasticity. Price elasticity provides a numerical answer to questions such as “What will happen if we raise prices by 5%?” or “How much of a price cut would we need to boost volumes by 10%?” because it captures the presumptive cause-and-effect relationship between prices and volumes. Changes in price alter a buyer’s perceived value derived from an offering. Incorporating cost information allows a leadership team to understand the financial consequences of those price changes.

Price Differentiation: This framework lies at the intersection of competition and value, because a company can differentiate prices relative to competitors and relative to its own products. This framework combines insights from the economic theories of price discrimination and behavioral science. Price discrimination refers to selling the same offer to different customers at different price points, either directly (first-degree price discrimination) or through discounts (second- and third-degree discrimination). We think this perspective is too restrictive from a practical standpoint. That is why our definition of differentiation is broader: the combination of price discrimination and behavioral science. In other words, differentiation means price variation and product variation. Behavioral science studies how customers choose among a company’s various offers. It has highlighted numerous biases that humans have when making such choices. These biases transcend and often contradict the numerical rationality of classical economics.

Game Theory: The game theory framework lies at the intersection of costs and competition, because a company only needs costs and competitor price information to define optimal prices in that framework. It applies primarily when a company’s prices depend on the pricing behavior of a few individual competitors whose offerings all have very similar value. In such circumstances, the game theory framework helps leaders make better-informed unilateral moves, because they understand the effects those moves will have on competitors and on their own company.

Supply and Demand: This framework lies at the intersection of all three sources of information. The market’s supply curve is, by definition, based on the costs, capacities, and prices of every competitor. The demand curve, meanwhile, is a function of either the aggregated willingness to pay of individuals or the value they derive. This framework tends to apply very well when costs, competition, and value have multiple significant and simultaneous drivers, with time usually the most important one.

Contributed to Branding Strategy Insider by Jean-Manuel Izaret and Arnab Sinha. Excerpted from their book: Game Changer: How Strategic Pricing Shapes Businesses, Markets, and Society with permission from the publisher, Wiley. Copyright © 2024 by The Boston Consulting Group, Inc. All rights reserved.

The Blake Project Can Help You Build A Bigger Competitive Future In The Strategic Brand Storytelling Workshop

Branding Strategy Insider is a service of The Blake Project: A strategic brand consultancy specializing in Brand Research, Brand Strategy, Brand Licensing and Brand Education

FREE Publications And Resources For Marketers