How to Write a Professional Business Plan in 10 Easy Steps During financial uncertainty, many of us press pause on our entrepreneurial aspirations. Wondering if now�s [�] The post How to Write a Business Plan in 10 Easy Steps...

How to Write a Professional Business Plan in 10 Easy Steps

During financial uncertainty, many of us press pause on our entrepreneurial aspirations.

Wondering if now�s the right time to start our business. Doubting our ideas and worrying about the what-ifs and maybes!�

A business plan removes the uncertainty and what-ifs from the equation. It validates our business ideas, confirms our marketing strategies, and identifies potential problems before they arise.��

Replacing our doubts with positivity, ensuring we see the complete picture, and increasing our chances of success.

Because you could be starting and running your own business. But you�ll only know for sure it�s the right move for you when you write your business plan.

Here�s everything you need to know to create the perfect business plan.

What is a business plan?

A well-written business plan contains the recipe for your new business�s growth and development.�

It�s your compass.�

It describes your goals and how you�ll achieve them by infusing the ingredients you need to turn your dream into a reality.�

Such as:

Your business plan is like a GPS, guiding your business to its destination for the next 3 to 5 years.�

Why is a business plan important?

Here�s the short answer.

A business plan enables you to convey your vision to those who can help you make it a reality.��

It does it in 2 ways:

A business plan does it by explaining who you are, what you are going to do, and how you�ll do it. It clarifies your strategies, identifies future roadblocks, and determines your immediate and future financial and resource needs.

Let�s look at what that means and why each part is important.

A business plan helps you evaluate your ideas

Do you have over one business idea or a range of products or services you believe you could bring to a single marketplace?�

If so, a business plan helps determine which is worth focusing on and where to apply your energy and resources by evaluating your idea�s possible market share and profitability before investing.

Clarifies your costs

Your chosen market determines your initial investment and future revenue. And it would be best if you knew those before you invest a dollar in your business idea.

With your chosen idea, your business plan can help you understand your set-up and running costs, the resources you�ll need, and the time it�ll take to get started.

It�s also where you�ll calculate your future sales and revenue goals to ensure they fit your budget and required breakeven point.��

And those are essential because every business needs a consistent cash flow to stay afloat!

Steers your business in the right direction

Your business plan guides you through every stage of starting and running your business.�

It acts as your GPS, giving you a course to steer. Ensuring your business stays on track, helping you achieve your goals every step of the way.��

Acts as your financial guide

As your new business grows, you might need to expand.�

But with expansion come big spending decisions, such as purchasing expensive equipment, leasing a new location, or hiring your first employees.

Your business plan�s financial forecast gives you a solid foundation to build on by clarifying when you�re ready to make those investments, ensuring you don�t overreach.

And when you are ready to employ staff, it helps you with that too!

Helps recruit the people you need

Your business is often only as good as its employees. A business plan helps you communicate your vision and pitch your dream to the best candidates. Building their confidence in your venture and encouraging them to join you.

It's essential if seeking a loan or investment

Do you need a loan from a bank or a venture capitalist/angel investor?

If so, you�ll need a business plan that shows your past and future financial trajectory so potential investors can evaluate your business� feasibility to determine whether you�re worth the risk.

It's an asset if you want to sell your business

Owners of legal entities, such as LLCs, can sell all or part of their business to raise funds for other business ventures or expand their existing ones.

A solid business plan with proven financial recordings and realistic forecasts based on current performance can make your business more attractive to potential investors.�

And it makes sense because when buyers understand your business model and its potential growth, they�ll see the value in it for them.��

All great reasons to write a business plan, don`t you agree?

Okay, here�s how you do it:�

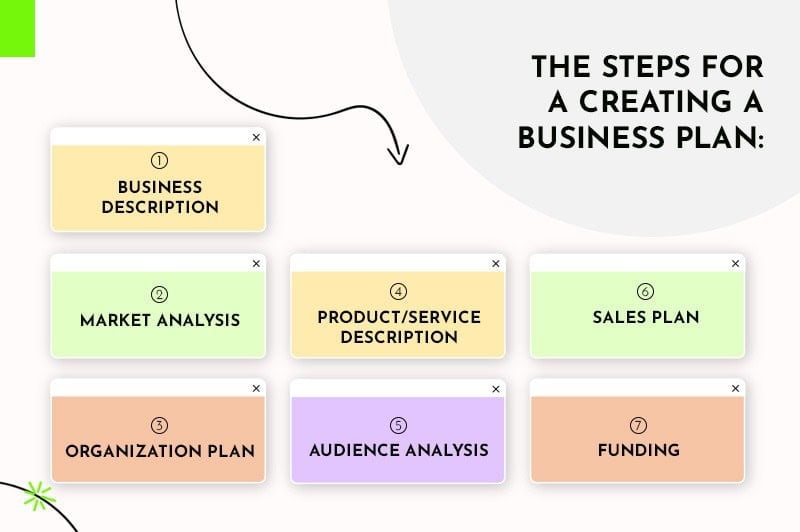

The steps for creating a business plan

Most business plan templates are similar, containing several steps for writing a conclusive plan. If you�re interested in a very short plan, we prepared a lean (one-page) version, including a template.�

The perfect business plan isn�t one or the other; it�s the plan that meets your business needs.

That said, every business plan should contain crucial elements and essential details. And a rhythm to your outline that encourages action, growth, and investors to read it from start to finish.

Our step-by-step guide, along with our template, will help you achieve both.�

But first, you must choose the style that works for you:

Pick a business plan format that works for you

You can tackle creating a business plan in different ways; one could be a long-form, more traditional approach or a one-page business plan that acts as a summarized road map.

Traditional business plans use a standard, industry-expected structure, with each section written in great detail. They require a lot of research because businesses often use them to gain investment, and they can be anywhere from 10 to 50 pages long.�

A one-page business plan uses a similar structure but summarizes each step by highlighting the key points.�

You can write a one-page plan in an hour and use it as a personal blueprint for running your business or as a guide to writing a future traditional plan.

Here are the core component that create a great business plan:

1.�An executive summary

2.�Your company�s description

3. Market analysis

4. Management and organization outline

5. Products and service description

6. Target audience analysis

7. Marketing and sales plan

8. Financial funding request�

9. Financial projections

10. An appendix

1. An executive summary

The first section of your business plan�s an executive summary that tells anyone reading in simple terms what your business is and why you believe it�ll be successful.

It�s the most crucial part of your plan because anyone reviewing it often decides whether to continue reading based on what�s in your executive summary.

Your executive should contain your mission statement (why you�re starting your business). A product/service description. Your leadership team and financial information.

Even though the first thing people read is your executive summary, it�s the last section you write.�

The next step is about you:

2. Your company's description

Here you sell yourself and your business by telling readers why you�re starting your business and know it�ll succeed.

You must be realistic, business-like, and detailed.��

Begin by explaining who you are, what you plan on doing, and how you�ll do it. Describe your future market, your target audience, and why they need your product/service.�

Elaborate on your unique selling point (USP) and how your competitive advantage will ensure your success.�

Describe your team, highlight their skills and technical expertise, and if you`re a brick-and-mortar business, discuss your location and why it�s right for your target audience or logistics.�

Now your market:

3. Market analysis

A great business idea is only as good as its future marketplace. Enter a declining market with an insufficient or uninterested audience, and you�ll be toast.

Choose one on an upward trajectory with people you understand and need your product, and you�ll be in business.�

That makes your market analysis a crucial step in your business plan outline. Here�s where you identify your target audience, competitors� performance, strengths and weaknesses, and whether the market can sustain your business needs.

Your market analysis should include the following:

4. Management and organization outline

Step 4 is where you tell readers how you�ll construct your business and who�ll run it.��

Describe your business�s legal structure, whether you�re a sole proprietor intending to form an LLC or a limited/general partnership with dreams of incorporating an S or C corps.�

Include your registered business name and any DBA brand name you have. And any member�s percentage ownership and managerial duties per your operating agreement.

And consider using a chart to show who runs what section of the business. Explain how each employee, manager, or owner�s experience and expertise will contribute to your venture�s success. And if you have them, include your team�s resumes and CVs.

5. Products and service description

Now you must get technical about what you plan to offer.

List your products or services and explain how they work. If in the development stage, describe the process and when you�ll be market ready.

Include the following product/service information:

Your product and service description brings you to those who matter most. Your target audience:

6. Target audience analysis

The target audience section of your business plan is the most important one to get right. After all, your customers are your business. And the better you know them, the easier it�ll be to sell to them.�

To gain a clear picture of your ideal clients, learn about their demographics and create a client persona.

Those include:�

You need your target audience�s demographics to create a branding style that resonates with them. To build marketing strategies that engage their interest. And to identify where to spend your advertising dollars.

Target market�s persona in place, your next step is to describe how you�ll reach and sell to them:

7. Marketing and sales plan

Your marketing plan outlines your strategies to connect with and convert your ideal clients.�

Here�s where you explain how you�ll reach your audience, describe your sales funnel, and develop customer loyalty to keep customers.

Your business plan doesn�t require your complete marketing/sales plan but should answer basic questions like:

8. Financial funding request

This step applies if you require funding to start or grow your business.

Similar to the marketing plan step, including your entire financial plan is unnecessary. However, you�ll need to answer specific questions to explain how much investment you require and how you�ll use it.

The following financial funding outline will suffice:

Start-ups that need investment must rely on something other than past sales and balance sheets. Here, you�ll need to use financial projections to persuade lenders you�ll generate enough profit to repay their loans. And that investors will get a worthwhile return.�

9. Financial projections

Your goal is to convince potential lenders or investors that your business will make enough profit to repay any loans or fulfill your equity promises.

Depending on your loan requirements and market, these projections can vary from 3 to 5 years.�

Financial projections aren�t an exact science; you�re forecasting the future! However, accuracy is essential (meaning your projected numbers must add up correctly). And while your goals should be positive, they must also be realistic.

What to include in your financial forecast:

Be specific with your projections and ensure they match your funding requests. And if you have collateral to put against a loan, include it at the end of your financial projections to improve your chances of approval.�

Also, consider using charts and graphs to tell your financial story, as visuals are great for conveying your message.

10. An appendix

Use your appendix to list and provide supporting information, documents, or additional materials you couldn�t fit in elsewhere.

If the appendix is lengthy, start it with a table of contents.

What to include:

Conclusion

Financial uncertainty shouldn`t stop you from following your dreams. In fact, recessions are often the best time to start a business.�

And your business plan is one of the main things that can help you make your dream of owning a business a reality.

Take it one step at a time, do your research, and use your business plan to remove the uncertainty of the unknown.�

Because then you�ll know if the time is right to start your business.

Disclaimer

This portion of our website is for informational purposes only. Tailor Brands is not a law firm, and none of the information on this website constitutes or is intended to convey legal advice. All statements, opinions, recommendations, and conclusions are solely the expression of the author and provided on an as-is basis. Accordingly, Tailor Brands is not responsible for the information and/or its accuracy or completeness.

The post How to Write a Business Plan in 10 Easy Steps appeared first on Tailor Brands.