At KeyeStrategies, we get the challenges entrepreneurs face when planning for the future of their business. You understand–all too well–the effort that goes into creating a successful business. So, it should be no surprise that a successful transition–whether selling...

At KeyeStrategies, we get the challenges entrepreneurs face when planning for the future of their business. You understand–all too well–the effort that goes into creating a successful business. So, it should be no surprise that a successful transition–whether selling all or part of your business or passing it on to an heir–also requires significant work. Most potential sellers understand that hard work is required to complete a sale, but did you know that empathy is also a crucial component? More specifically, understanding the “why” behind the buyer’s desire to acquire your business.

Buy-Side vs. Sell-Side Due Diligence

It’s important to realize that the buy-sell process is difficult for both parties, and due diligence is crucial for a successful sale from both the buyer’s and seller’s perspective. By putting yourself in the shoes of your buyers, you can identify their pain points and motives behind wanting to buy a business like yours. An exit plan will most likely succeed when it accommodates everybody involved, including your buyers. If you come to the table prepared to address your buyer’s concerns, you can remove any doubts or second-guesses holding the deal back. Before diving into the specifics of due diligence, the first step is understanding the differences between due diligence on the sell and buy sides.

Sell-Side Due Diligence

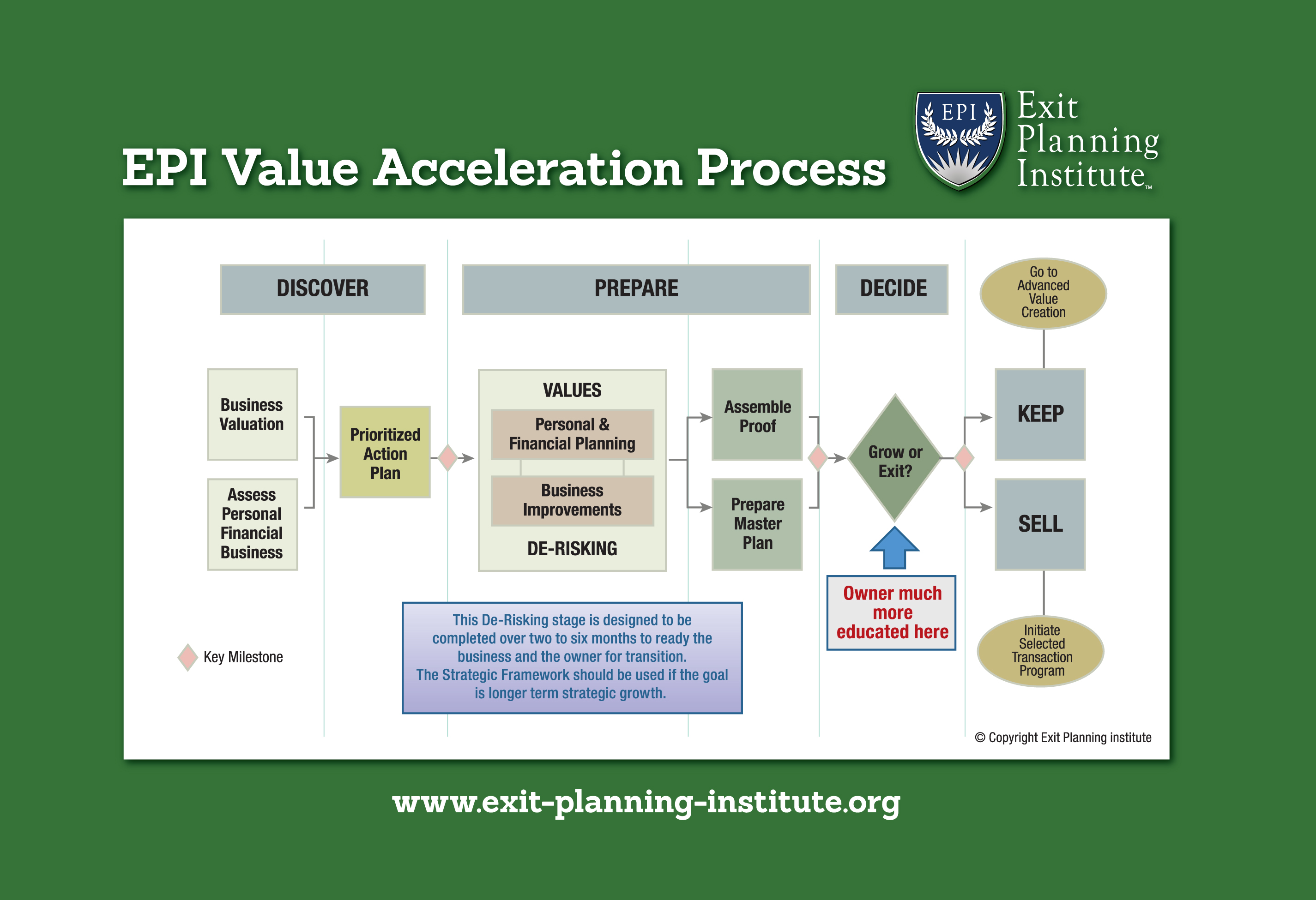

When I work with business owners who want to sell their business, one of the pivotal issues we encounter is how to execute “sell-side due diligence.” It’s more important than ever for sellers to establish trust with potential buyers from the earliest stages of the buy-sell process. Sell-side due diligence (sometimes called seller due diligence) refers to the process business owners take to prepare their business for a future sale. This includes building a comprehensive exit plan, arriving at an accurate valuation, and articulating the growth potential of your business for buyers, among other things. KeyeStrategies works closely with business owners to help them be diligent on the sell side, as it forms the foundation of a business sale. Without it, it’s impossible to successfully sell your business to a reputable seller at a fair price. Most of our programs focus on the sell side since a sale is doomed without proper preparation.

Buy-Side Due Diligence

Buyers are as important to your sale as anyone else in the exit planning process. You’d be surprised how many prospective clients want help with exit planning so they can sell their business – without having a clear idea of why they want to sell. Many are burned out from years of doing the “same old, same old.” It’s been so long since they had fresh ideas about how to make their business thrive that they assume there isn’t anywhere to go but into retirement. However, just as it’s important for you to understand the story behind the sale so you can go into the exit planning process confident that you’ve made the right decision, your buyers also want to hear your story.

Buy-side due diligence refers to the research and investigation of the sale from the buyer’s perspective. Buy-side due diligence is often data-driven and carried out professionally by third-party experts and professionals within the acquiring business. The goal of your buyers is to ensure that the deal is in the best interest of their business. This includes understanding the qualitative aspects of the sale, not just the quantitative (data-driven) parts.

Solving the Problem for Your Buyer

If you’re considering selling your business, can you articulate why? It’s important that you can, not just because it will help you build your exit plan. Prospective buyers will look very closely at your reasons for exiting your business. If they think you are leaving because the business has stagnated or reached the peak of its potential for growth, you won’t be in the best bargaining position. You need to explain your exit in terms that will put your business in its best light. The story behind the sale is just as important as the numbers and data. Tell your story in a way that proactively answers these questions before the buyer even asks them. This will show that you’re prepared and in tune with the strategic position of your business relating to the sale.

Do Your Due Diligence & Prepare for the Sale

One of the best ways to ensure buyer confidence when you put your business on the market is to do your due diligence as a seller first before the buyer begins looking at your business. You must put yourself in the position of your potential buyer and ask: What would I want to see if I were considering acquiring this business? What would convince me that there are no hidden liabilities to this transaction that will cause trouble in the future?

At KeyeStrategies, we consider both the buy-side and sell-side when building an exit strategy with our clients. This maximizes preparation and generates confidence that will carry over to the negotiation table. If you’re ready to dive into the exit planning process, reach out to Julie and schedule a free 20-minute call with her. It’s never too early to start preparing–the sooner, the better–so reach out to KeyeStrategies today and get started on the path towards a business transition you deserve.

The post What Is Buy-Side & Sell-Side Due Diligence? appeared first on KeyeStrategies.