It’s essential you have a dependable customer relationship management (CRM) platform for your bank. Without the right software in place, you’re risking not only mismanaged clients and lost revenue but also the security of sensitive financial information. I’m AJ—here...

It’s essential you have a dependable customer relationship management (CRM) platform for your bank.

Without the right software in place, you’re risking not only mismanaged clients and lost revenue but also the security of sensitive financial information.

I’m AJ—here to help. I’ve built my business (over the last decade) to a successful multiple seven-figure exit.

My mission is to help fellow business owners achieve success and financial freedom.

So, let’s break down this list of the best CRM for banks—guaranteed to help your business grow.

Stick around for some pro tips to help you decide!

After years of SBB testing, here is our list of the best CRM for banks:

Best CRM For Banks For Client Management: HubSpotBest CRM For Banks For Workflow Automation: Monday.comBest CRM For Banks For Ticket Management: EngagebayBest CRM For Banks For Lead Management: Zoho CRMBest CRM For Banks For Beginners: Less Annoying CRMBest CRM For Banks For Ease of Use: Insightly CRMHow Did We Test The Best CRM For Banking?

My team and I spent six months going in-depth on each CRM platform on this list.

Here’s what we looked at:

How We Objectively Test Each Platform:

AJ's got a knack for kick-starting businesses, putting them on autopilot, and setting them up for acquisition. Over the past decade, he's been right in the thick of things with hundreds of small businesses, helping them with just about everything under the business sun. If you need advice on software suites and choices? AJ's your guy.

We roll up our sleeves and dive into the top CRM features we think are pretty crucial for small businesses. Stuff like reports and analytics, options to customize your pipelines, and the ability to link up with other apps and services. We know what makes small businesses tick, so we know what features they need to get the job done.

Money matters, folks! When it comes to picking a CRM system, price is usually the deal-breaker. We give a big thumbs up if a provider charges $30 or less per user each month for their starter plan. Extra brownie points for throwing in a freebie plan or trial, options to scale up or down as needed, and the freedom to pay monthly or yearly. We're looking for flexability for small businesses.

We all know support is mega important when you're choosing a CRM platform. This is especially true for those smaller businesses or sales teams who can't afford to have tech wizards on their payroll. We put our detective hats on to see if these companies offer round-the-clock support, and we looked at the different ways you can get help. We're talking live chat (like, real-time convo), email tickets, a good old-fashioned phone call, and self-service tools (for the DIY-ers out there).

When you're in the business of picking a CRM, integrations are like the secret sauce that takes your burger from 'meh' to 'mind-blowing'. Imagine, all your favorite apps and tools, working together in perfect harmony, making your workflow smoother than a fresh tub of Nutella. When we review a CRM, we look at the integrations most SMB owners are looking for.

When you're reviewing a Customer Relationship Management (CRM) system, it's essential to pay close attention to its ease of use. After all, a CRM is as beneficial as its usability. A simple, intuitive interface saves you and your team a great deal of time and headache. When we're reviewing each CRM, this is a crucial aspect that we look for.

The importance of Mobile CRM cannot be overstated in today's digital age. It's essential for fostering strong customer relationships and managing business activities. Mobile access to CRM makes it possible for sales teams to update and access customer information in real time, improving efficiency and ensuring up-to-date data. Mobile CRM can have a massive impact on SMBs, so thoroughly testing it is essential for each one of our reviews.

HubSpot CRM: Best for All-In-One?

HubSpot

Learn More Today!Why We Picked HubSpot CRM?

HubSpot CRM is a fantastic all-in-one CRM perfect for any bank or financial institution.

Here are some notable features:

Tons of integrationsClient managementWorkflow automationMobile appReporting & analyticsHubSpot is robust, secure, and 100% free forever.

It’s tailor-made for financial institutions looking to grow (without anything falling through the cracks).

HubSpot CRM Features?

Managing customer relationships is crucial for banks.

HubSpot CRM simplifies this process, allowing you to manage your client’s entire lifecycle—from prospecting to customer retention.

With HubSpot, you can easily achieve the following:

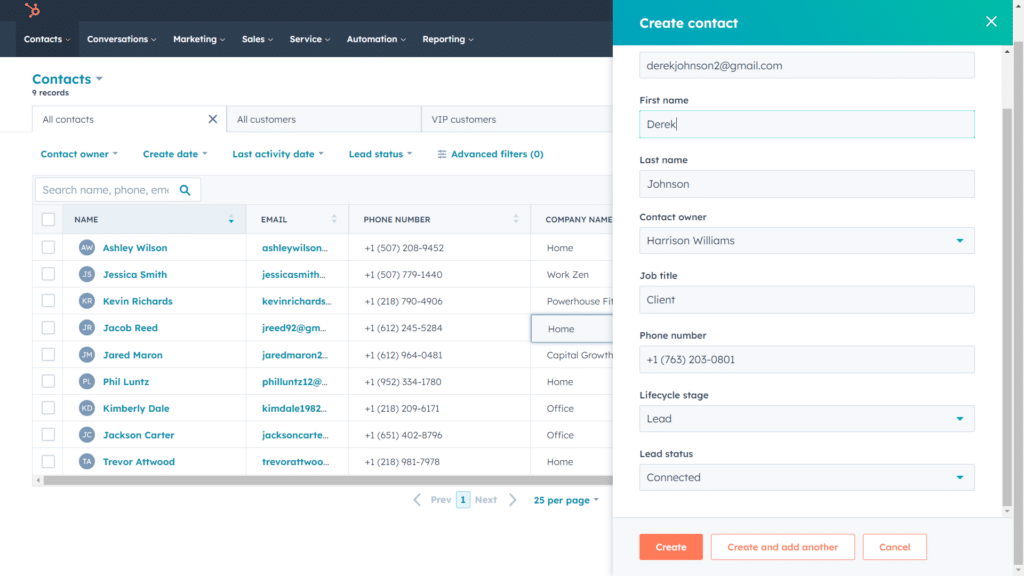

Create custom fieldsAssign tasks to team membersTrack meetings, calls, & emailsStore all client data in one locationAdding a new contact is as easy as clicking “create contact” and filling out a few fields (pictured below).

Within each card, you can easily view and edit the following info:

NameOwnerJob title Phone & emailLifecycle stage Lead statusNotes & tagsAttachmentsCustom fieldsAs you can see, there’s a ton of information in each card, but HubSpot manages to keep all this data well-organized and just a click away.

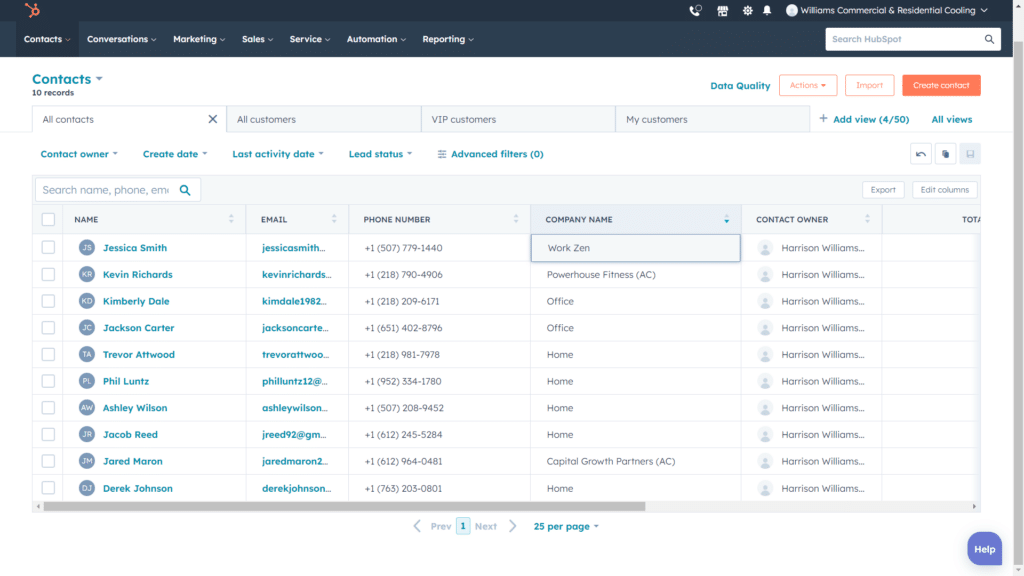

Once you’ve input your data, you can easily view everything from HubSpot’s client dashboard (shown below).

This dashboard is fully customizable, allowing you to add essential metrics for your bank.

The nitty gritty: HubSpot offers some of the best client management capabilities in the game.

It’s perfect for banks of any size looking to streamline their processes and improve customer relationships across the board.

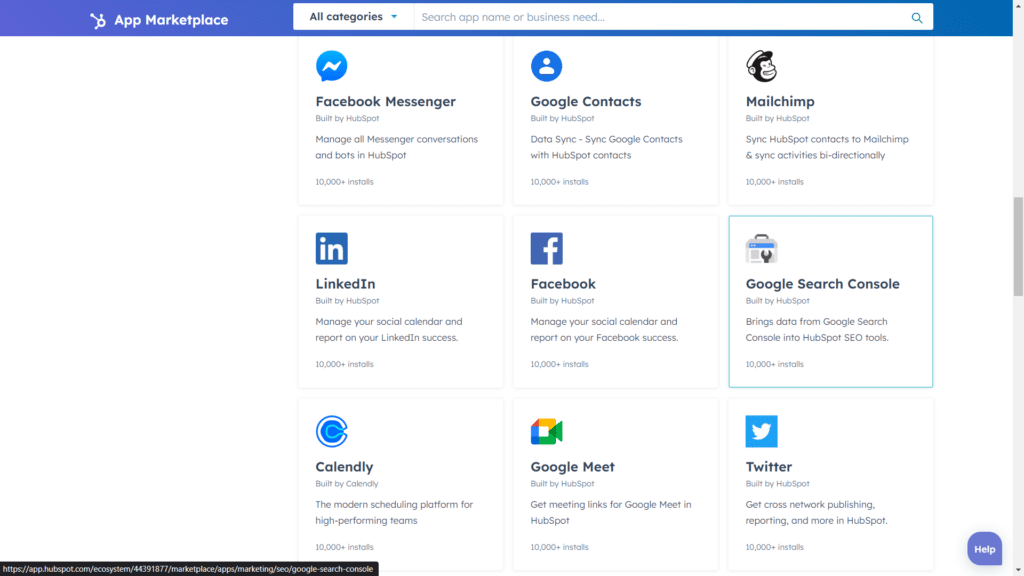

HubSpot reigns supreme when it comes to integrations.

The banking CRM software boasts more than 300 native integrations on its App Marketplace (shown below), making it a top choice for banks.

Here are a few of our favorites for banking:

QuickBooksMailChimpDocuSignCalendlySurveyMonkeyWith one-click integrations, you can quickly install and use any of the above apps.

Plus, HubSpot offers a fantastic pairing with Zapier, allowing for over 6,000 additional integrations.

The need to know: If you need an integration, there’s a good chance HubSpot has it.

With HubSpot CRM, you can automate repetitive tasks to save time and increase efficiency.

This is especially useful for banks and financial institutions that deal with a high volume of client interactions.

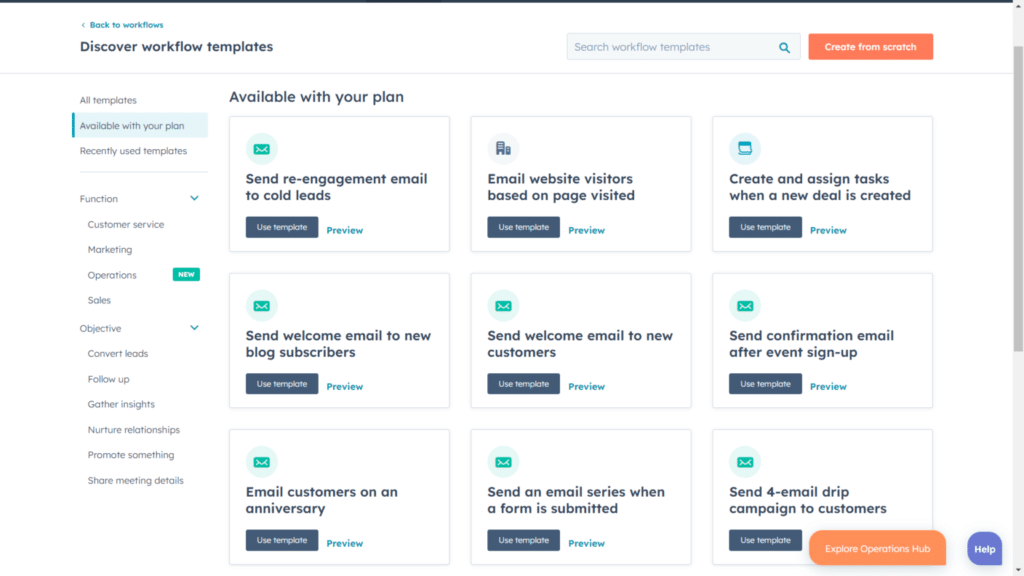

HubSpot provides helpful pre-made automation templates (screenshot below) to hit the ground running with complex workflow automation.

These make it easy to get started with no coding knowledge necessary!

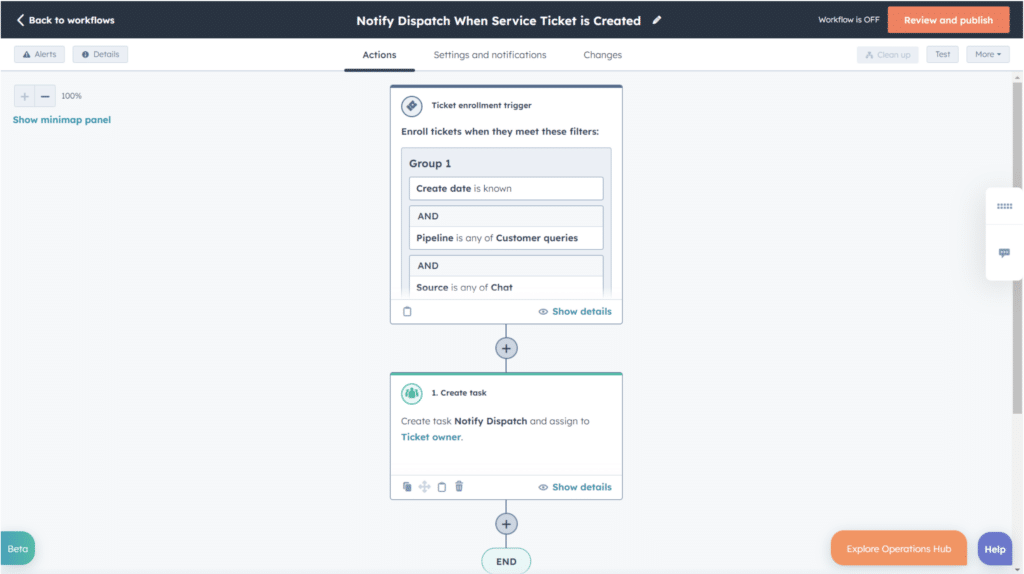

HubSpot also lets you create custom automation with its visual workflow builder.

Here’s how the builder looks (to give you a better idea).

Here are some use cases for HubSpot’s automation for banks:

Automatically send a welcome email to new clients when they sign up for an accountAssign tasks to team members based on specific client actionsSend reminders for upcoming loan payments or credit card statementsUpsell or cross-sell products and services based on a client’s financial behaviorThe bottom line: HubSpot provides top-notch automation capabilities to help you make tedious tasks a thing of the past!

HubSpot CRM Pricing?

HubSpot CRM offers a free plan in addition to three paid plans:

Free Plan – Free ForeverStarter CRM Suite – $30/MonthProfessional CRM Suite – $1,335/MonthEnterprise CRM Suite – $5,000/MonthCheck out our in depth HubSpot pricing guide!

HubSpot CRM Pros and Cons?

Monday.com: Best For Workflow Automation

Monday.com

Learn More Today!Why We Picked Monday.com

Monday.com is a work management platform and a CRM in one convenient package.

The CRM powerhouse is known for its stellar workflow automation capabilities, making it an excellent choice for banks and financial institutions looking to streamline their business processes.

Here are some impressive features for banks:

Task & project managementLots of integrationsClient managementLead managementCustomizable workflow automationMonday.com is highly customizable, allowing you to tailor your workflows to fit your bank’s specific needs (as you scale).

Monday.com Features?

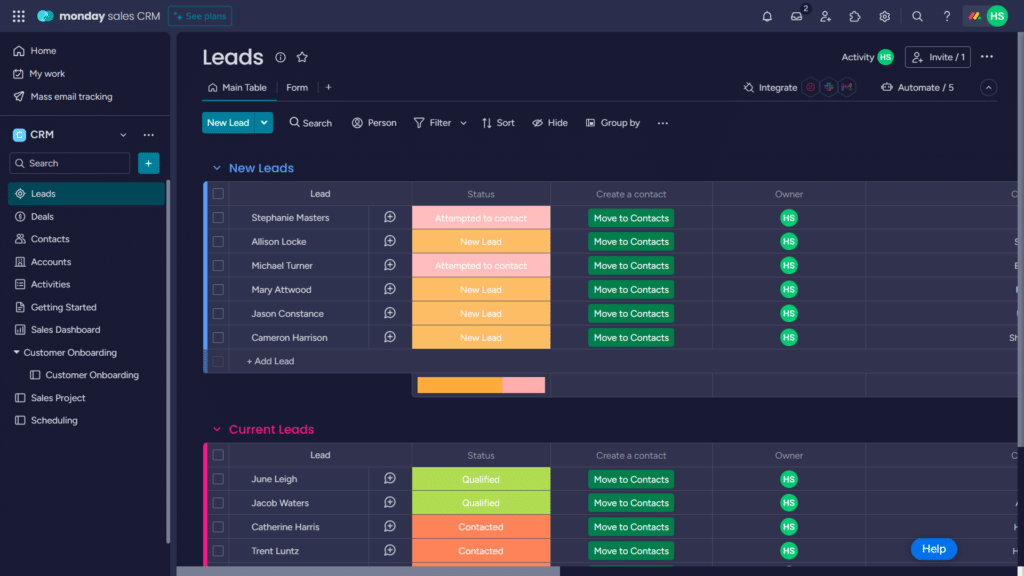

Great lead management can make or break a financial institution.

Monday.com makes it easy for sales teams to track leads, automate follow-ups, and nurture potential customers.

Here are some lead management features offered by Monday.com:

Lead scoring Automatic lead nurturingLead assignment & notificationsCustomizable lead workflowsCheck out a sneak peek of Monday.com’s lead management in action.

The color-coded status labels make it easy to keep track of leads and know what stage they’re in (at a glance).

Our takeaway: Regarding lead management, Monday.com delivers in a big way.

If you want to streamline and automate your lead management, look no further than Monday.com.

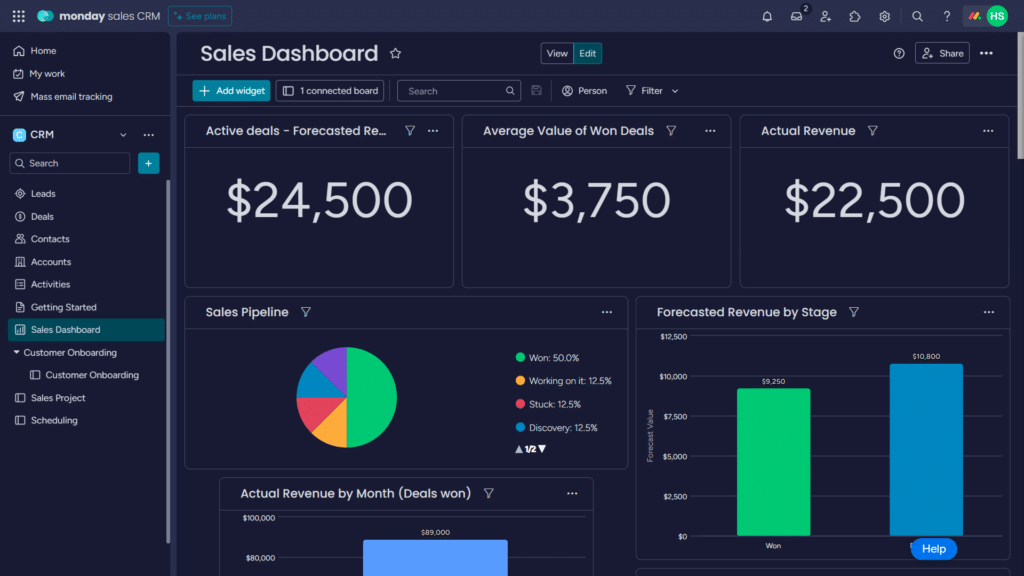

If you’re running a bank and not keeping track of your key performance indicators (KPIs), you’re leaving money on the table.

With Monday.com, banks can quickly track progress and uncover opportunities for improvement.

Here’s what Monday.com has to offer in terms of reporting and analytics:

Customizable dashboards & reportsAdvanced filtering & sorting optionsReal-time data updatesEasily exportable reportsTeam analyticsHere’s a quick look at a Monday.com sales dashboard.

The visual layout and real-time updates make it easy to stay on top of key metrics and make data-driven decisions.

Plus, Monday.com’s drag-and-drop interface makes it easy to customize your dashboards to focus on the metrics that matter most to your bank.

The final verdict: The sky’s the limit when it comes to visualizing and tracking data with Monday.com.

Whether you’re a small community bank or a large financial institution, their reporting and analytics feature is sure to impress.

Automation is crucial to running a successful bank.

With Monday.com’s customizable workflow automation, you can automate repetitive tasks and efficiently integrate your processes.

Here are just a few ways your bank can benefit from workflow automation with Monday.com:

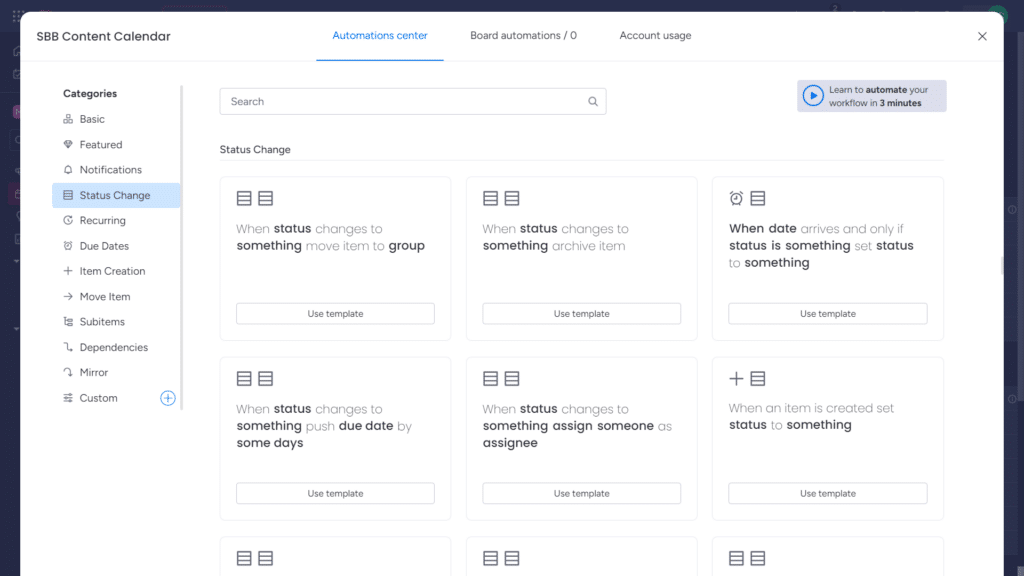

Automatically assign tasks to team membersGet email notifications for new leads or opportunitiesSet automatic reminders for upcoming appointments or deadlinesCreate custom workflows to streamline processes, like loan approvals or account openingEasily integrate with other tools & platforms for a seamless workflow across your banking operationsMonday.com takes the guesswork out of automation with its pre-made automation templates (screenshot below).

These beginner-friendly templates make it easy for banks to get started with workflow automation without any coding knowledge whatsoever.

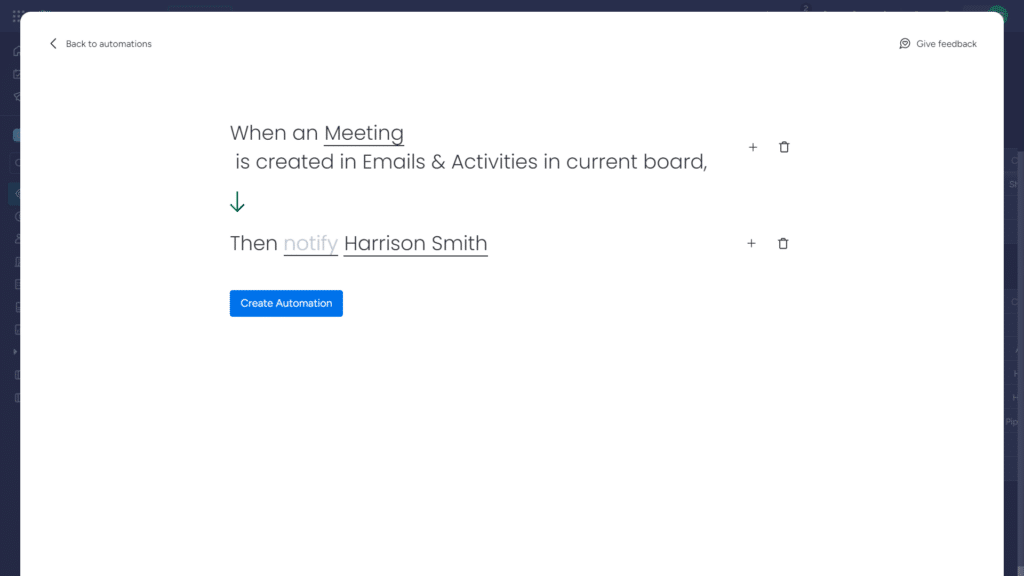

Monday.com also offers a unique automation creation interface, which allows you to create complex automations with just a few clicks.

Here’s how this feature looks in action.

Simply create a “When/Then” statement and add in your desired actions to automate your workflow.

The process takes less than 5 minutes—leaving you feeling like a tech genius!

The breakdown: Monday.com makes it easy to stay ahead of the curve regarding automation.

The customizable workflows and automation capabilities are unmatched in the CRM market, making Monday.com a top pick for banks and financial institutions.

Monday CRM Pricing?

Monday.com offers four paid plans in addition to a free plan.

These include the following:

Free – Free ForeverBasic – $10/MonthStandard – $12/Month Pro – $20/Month Enterprise – Custom PricingTake a look at our extensive Monday.com pricing guide!