Is now a good time to buy a house? It’s an evergreen question — always relevant — and it’s a highly personal question. Only you can answer whether or not it makes sense for you to buy a home...

Is now a good time to buy a house?

It’s an evergreen question — always relevant — and it’s a highly personal question. Only you can answer whether or not it makes sense for you to buy a home at any given time.

That said, the realities of unpredictable interest rates and the ever changing housing market will play a role in your decision. And, right now, those indicators are blinking red.

As of December 2022, consumer confidence is quite low according to Fannie Mae’s Home Purchase Sentiment Index. Only 16% of consumers believe it’s currently a good time to buy a house. So who’s right?

Is Now a Good Time to Buy a House?

As we approach 2023, the dramatic increase in housing prices we were seeing in 2021 has stalled. In fact, home prices have decreased for nine consecutive months, according to the National Association of Realtors. Not only that, but some experts believe the steady leak may become a stream and a collapse in prices is coming.

On top of that, fixed 30-year mortgage interest rates are hovering around 6.5% — as high as they’ve been in 20 years — though they did slightly decrease in November 2022.

When asked about the outlook for mortgage rates in 2023, eight industry insiders told Mortgage Reports they expected interest rates to run anywhere from 5% to 9% next year — quite a range that doesn’t necessarily make a future homebuyer brim with excitement.

Inflation could continue to push rates up, while a looming recession would likely cause them to drop. Ongoing inflation, Federal Reserve policies and impending recession fears make the near future of interest rates difficult to predict.

That said, if you’re set on buying a home soon, you have options. You just need to be prepared to take on that financial burden.

4 Questions to Consider Before You Buy a House

Ultimately, whether or not you should buy a home right now depends largely on how ready you are and your financial situation more so than market conditions.

Before buying a home — the single largest purchase most people will make — you need to have a solid financial plan in place. Here are some things to consider before making that purchase.

1. How Long Do You Expect to Stay in This Home?

The future isn’t always predictable — life happens after all — but you should have an idea of any major decisions that are in your near future.

Do you expect to get married? Do you plan on having kids in the next five to 10 years? How permanent is your current job situation? Do you want to be in that location long term?

If any of those situations are in flux, you might want to pause buying a home right now. That two-bedroom condo might get a little tight once you start having kids. Or the house you thought was a dream could become a financial weight around your neck when your company asks you to transfer to another city.

The best time to buy a house is when your life is fairly stable, both personally and professionally. That doesn’t mean you need to have everything perfectly set. But you should carefully consider the pros of buying the home versus the cons of possibly moving in the short term — and figuring out what to do with your house — because of life changes.

2. How Much of a Down Payment Can You Make?

Traditional wisdom has always said to make a 20% down payment in order to avoid private mortgage insurance. PMI covers the lender in case you stop making payments.

The current median sales price for a home in the U.S. is $379,100. That means to avoid PMI, a buyer would need to make a $75,820 down payment. For most buyers, that will require planning and some aggressive savings before making the purchase.

The more you put down, the less your mortgage will be — meaning lower monthly payments. So you would borrow $303,280 instead of a higher amount. Most lenders require a minimum down payment of around 3% to 5%, so you have that option if your budget allows for larger monthly payments (more on that later).

First-time home buyers typically have more options — with lower down payments and credit score minimums. These include:

FHA Loans: If you qualify, you might consider an FHA loan, insured by the Federal Housing Administration. These loans require just 3.5% down and credit score minimum of 580. Or if you’re able to put 10% down, you’ll only need a 500 credit score. VA Loans: Veterans Affairs’ loans are an option for qualified military members and veterans. They don’t require a down payment and usually come with lower interest rates. They might require a funding fee that can be rolled into the overall mortgage. USDA Loans: If you’re looking to live in a rural area, you may qualify for a loan from the U.S. Department of Agriculture. These loans require no down payment. You’ll need to live in a qualifying area though.Remember, the more you can manage to put down on the front end, the less debt you’ll carry over the course of your mortgage.

3. What About Your Credit Score?

Make sure you know your credit score well before you begin the process of buying a home. That one little number will greatly affect your loan options when it comes time to sign the mortgage.

The standard magic number required for conventional loans is 620. Anything between 670-739 is considered “good.” Between 740-799 is considered “very good.” And anything above 800 means you have “excellent” credit. The better your credit score, the better your loan options and interest rates will be.

Non-conventional loans will require higher credit scores. One example is a jumbo loan, which typically requires a credit score of around 700. There are ways to buy a house with a lower credit score though.

If you’re looking at buying a home in the near future, it’s incredibly important to make sure you understand where your credit score is and how you can improve it over time.

There are plenty of ways you can actively work on improving your credit score — everything from making on time payments, applying for credit selectively and even asking for a credit limit increase but not using it.

4. Is Your Budget Ready?

The median mortgage payment is $1,100, according to American Housing Survey data. That number can vary, of course, based on where you live, how long your mortgage is, your down payment and interest rate.

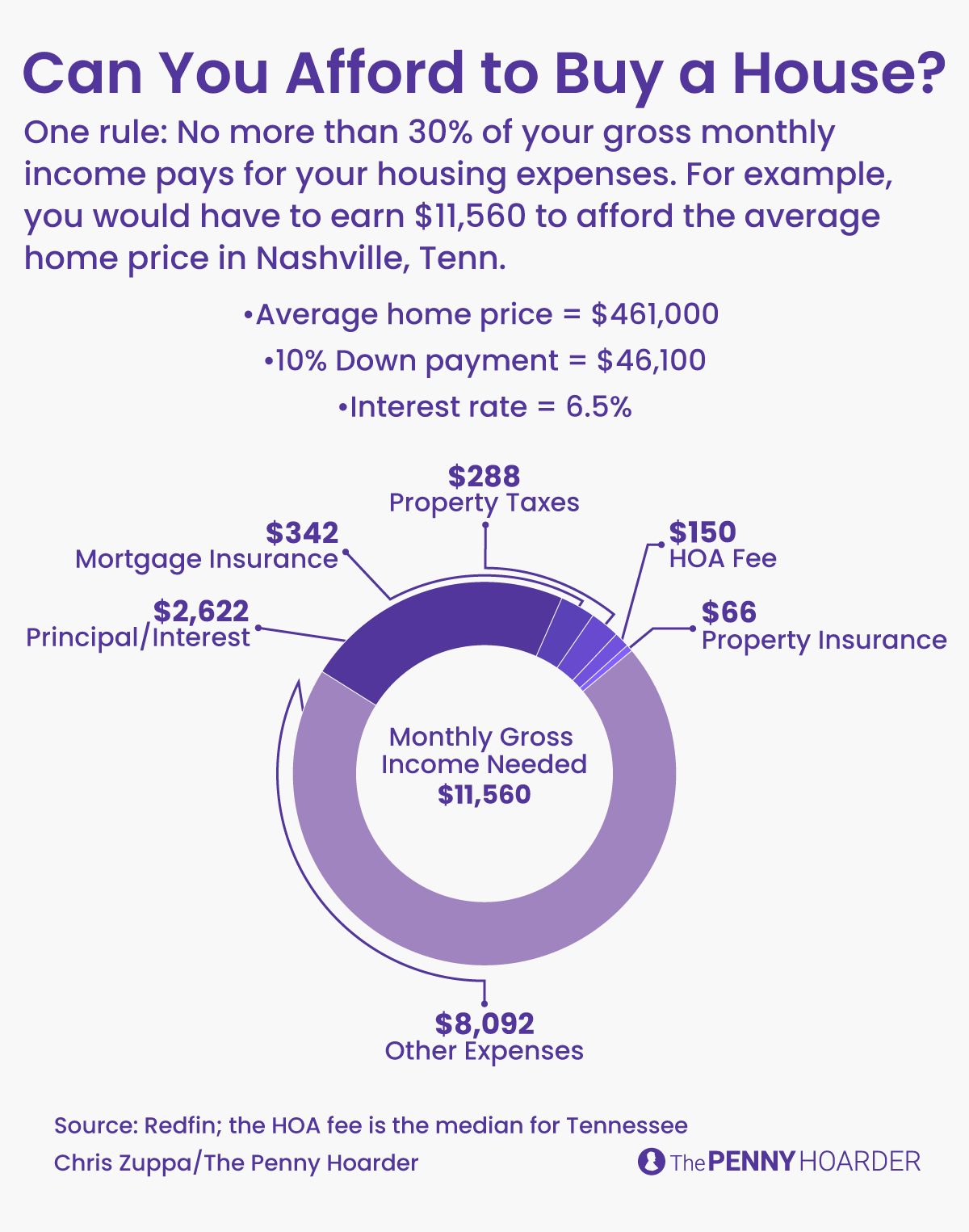

But if only that was all you were expected to pay. It’s easy to forget all the other fees that get tacked on to mortgage payments. You’ve got taxes, insurance and maybe HOA fees and mortgage insurance — and then there’s all the ongoing maintenance and other monthly expenses that come with owning a home.

How to See If You Can Afford a House

Let’s use an example. We’ll say you live in Nashville, Tennessee — a prospering real estate market, but not out of control. As of now, the average cost of a home in Nashville is $461,000.

We’ll also say you live in a homeowner’s association — and, fortunately enough for you, Tennessee has the fifth lowest HOA with a median of $150 per month.

We’ll assume you have good credit and can get the average interest rate right now at 6.5%.

And we’ll finally assume you can manage a 10% down payment on a 30-year mortgage.

Last, that credit score is also good enough to get a decent PMI rate of about 0.99%.

Let’s run the numbers.

The mortgage payment: A $461,000 purchase price with a 10% down payment ($46,100) brings you to a $400,000 mortgage. Including principal and interest, that comes to a $2,622 monthly payment. But that’s just the beginning. The taxes: Your Nashville zip code — and its corresponding property tax — will cost you about $288 per month. The insurance: Homeowner’s insurance runs about $66 per month. The HOA fees: And we’ll tack on the median Tennessee HOA monthly payment of $150. The PMI: Then there’s PMI, which you’ll need to pay since you’re making a down payment of less than 20%. Your PMI rate of 0.99% comes to a $4,104 annual premium, or $342 per month. Keep in mind, once you reach that 20% equity number, you’ll no longer need to make this payment. If you made this standard payment every month, never paying extra, that would take just under eight years.So, all said, you’re actually paying $3,468 a month for your $400,000 mortgage — $846 of which is simply added on after principal and interest.

The question is, prospective Nashville homeowner, do you have $3,468 of flexibility in your current budget? (Keep in mind that you’ll have to pay for maintenance and repairs too on top of that.)

If not, right now is probably not the best time to buy a house.

It goes without saying, although we are now saying it, that your numbers could vary greatly where you live. A home in New York or San Francisco will cost much more than one in Nashville, while a home in the rural Midwest would cost much less. (A Midwest state might even pay you to move there.) Property taxes and HOA fees can also vary greatly based on where you live.

The point of this exercise is to show how you need to know exactly what you are getting into before jumping into a massive purchase like a home.

But What About Interest Rates?

All that to say what is true now might not be true five years from now, or even next year. As we approach the end of 2022, interest rates on a 30-year mortgage are pushing 7%. In 2015, they hovered between 3% and 4%. And at the beginning of 2021, they were as low as 2.7%.

If you’re set on buying a house right now, even with the higher interest rates, you can always refinance once rates drop – and history tells us they most certainly will drop.

For our $400,000 example, you would pay around $800 more per month with a 6.8% interest rate over a 3.8% rate. That’s a huge difference, and it’s something to keep in mind as you’re determining if now’s the right time.

So Is It a Good Time to Buy a House?

Based on what many experts are saying, as well as how the general public feels about the housing market, it’s probably not the best time to buy. We’re definitely in a seller’s market right now.

But as you’ve seen, a lot of variables are at play in how you can make that decision. Most buyers right now aren’t comfortable as home values and interest rates are so high. But your situation may be different.

Home prices are always changing. Interest rates are always adjusting. What we’ll see this time next year could be drastically different from what we’re seeing now.

Know your budget. Know your credit score. Understand how much of a down payment you can make, and the impact it will have on your monthly payment. And simply be realistic about your current life situation and how that could impact where you live in the near future.

Robert Bruce is a senior writer for The Penny Hoarder.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.