The market is saturated with insurance companies for all parts of your life: home insurance, auto insurance, life insuranceóheck, even pet insurance (which I highly recommend, by the way). Shopping for all these insurance policies can be stressful, especially...

The market is saturated with insurance companies for all parts of your life: home insurance, auto insurance, life insuranceóheck, even pet insurance (which I highly recommend, by the way).

Shopping for all these insurance policies can be stressful, especially when you want to compare quotes from multiple insurance companies. Thatís where Policygenius comes in. In our Policygenius review, weíll discuss what this independent insurance broker offers and the pros and cons of using the comparison shopping platform.

What Is Policygenius?

Life insurance companies like State Farm and Pacific Life and auto insurance companies like Geico and Allstate offer insurance policies from their specific companies. But if you work directly with one of these car or life insurance companies, you miss out on quotes from competitors.

Policygenius exists to make comparison shopping easier for you. The website platform is an independent insurance broker that is licensed in all 50 states and Washington, DC. Unlike similar insurance comparison sites, like Gabi and Insurify, which specialize in specific coverages like auto insurance and home insurance, Policygenius runs the gamut.

That means you can use the Policygenius insurance marketplace to shop for:

Term life insurance Whole life insurance Auto insurance Homeowners insurance Renters insurance Health insurance Vision insurance Pet insurance Long-term disability insurance Short-term disability insurance Identity theft insurance Long-term car insurance Travel insurance Jewelry insuranceSpecifically, Policygenius specializes in term life insurance, home insurance and auto insurance. This Policygenius review focuses on these three core elements of the website.

Policygenius has its headquarters in New York City (located at 50 West 23rd Street in the Flatiron district near Madison Square Park) and Durham, North Carolina (opened in 2019). According to the company, it has found insurance policies for more than 30 million people with over $75 billion (with a B!) in coverage since 2014, when two former McKinsey employees, Jennifer Fitzgerald and Francois de Lame, founded the company.

In addition to offering quotes for auto, home and life insurance policies, Policygenius acts as a library of information to help consumers make smart decisions about insurance. The site includes extensive resources for learning about life insurance, car insurance, etc., as well as calculators for determining how much insurance coverage you need.

How Much Does Policygenius Cost?

Like other insurance comparison shopping sites, Policygenius is free. Instead, the site makes a commission when you purchase coverage from an insurer through the site. While Policygenius canít get you discounts on insurance, it does show you a broad spectrum of major insurance companies so that you can find the best deal.

The cost of insurance will always vary based on the type of insurance, the amount of coverage, the deductible (if applicable), the risk factors (e.g., age and health for life insurance policies; driving habits for auto insurance policies; location for home insurance policies); and more.

One caveat: Policygenius works with some of the larger, better-known insurance companies. That means you might not see more affordable policies from some lesser-known insurance companies.

How Policygenius Works

Policygenius is fast and easy to use. The information required and the processes vary depending on the type of insurance you are shopping for. This Policygenius review focuses on the big three (life, home, auto), but using Policygenius to shop for travel insurance, pet insurance and others should yield similar results.

Hereís what the application process is like for the big three insurance products on Policygenius:

Shopping for Life Insurance with Policygenius

For many, life insurance is a foreign concept. But if you have children or share payments on a home with your spouse or domestic partner, you should start thinking about life insurance, just in case.

The latter scenario describes me, and Iíve been putting off shopping for life insurance for too long, so I was eager to get started. I just had no idea what I needed.

Thatís why I loved Policygeniusí design. When you click the ďLifeĒ link at the top of the website to get started on the life insurance policy quotes, it doesnít immediately throw you in. Instead, it takes you to an educational page about what life insurance is, who needs a life insurance policy and how much coverage you likely need.

Side note: Policygenius recommends getting coverage for 10 to 15 times your annual salary, and the term should at least be the number of years until retirement.

What I found to be most helpful using Policygenius for life insurance was the life insurance calculator. Just answer a few questions, and Policygenius will recommend ideal life insurance coverage for your needs.

When you are ready to get your life insurance quotes, just input a few values: age, gender, ZIP code, policy length and coverage amount. Policygenius will spit out monthly estimates for average, good and best health. (Be honest about your health: To finalize your life insurance, you will have to get a medical exam, so thereís no sense in lying about your medical history.)

Policygenius offers policy lengths ranging from 10 years to 40 years and coverage amounts ranging from $100,000 to $10 million.

After clicking the orange ďCompare QuotesĒ button, youíll be taken to a ďLetís get startedĒ screen that asks you where you are in your search for life insurance. On this page, you can also see some of the major life insurance companies that Policygenius works with, including Pacific Life, Principal, Protective, AIG and Prudential.

Next, youíll provide a few more personal details, like marital status, employment status, whether you have kids, your retirement savings, etc. Then youíll add in basic info like gender, date of birth, ZIP code, citizenship status and annual income. Finally, youíll need to provide some health details, including height, weight, tobacco use and medical conditions.

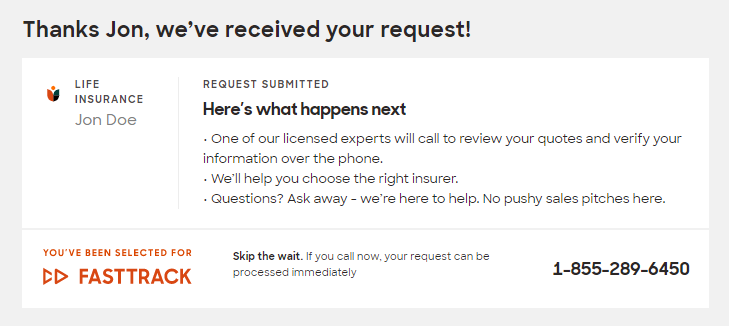

With this information, Policygenius will find quotes for you. But to see the quotes, youíll finally have to hand over your contact information, including your email address, phone number and address. By providing your phone number, youíre giving a Policygenius life insurance agent permission to call and talk to you about next steps.

If you are selected for FastTrack, you donít have to wait for an insurance agent to call. Instead, you can call immediately to begin the process.

At no point in this process was I shown any quotes. In looking at another Policygenius review, I noticed that the reviewer received quotes in her dashboard immediately after providing her info. I attempted multiple quotes for multiple scenarios, in multiple browsers, over multiple days. Still, no quote. Just a prompt to call for more information or wait to be called. I can only guess that Policygenius updated its process since her review.

It makes sense that you might not immediately see quotes. Unlike car insurance and home insurance comparison shopping platforms, where you can see your quotes right away, term life insurance and whole life insurance can be a bit more complicated, hence the questions over the phone with a live insurance agentóand the eventual medical exam.

Because I wasnít ready to commit to a life insurance company during this review, I didnít move forward with calling an agent through FastTrack. (I also used my handy fake 555-555-5555 phone number, so I never received a call from their end.)

Shopping for Home Insurance with Policygenius

Shopping for home insurance using Policygenius is even easier. Policygenius promises the process takes just three minutes. My iPhone stopwatch clocked me in at a cool two minutes and 15 seconds.

Donít own a home? Policygenius also offers renters insurance policies.

Shopping for Auto Insurance with Policygenius

Unlike sites like Gabi, Insurify and The Zebra, which require an abundance of information (or potentially even your login info to your current auto insurance company), Policygenius kick-starts your search for auto insurance with just a few inputs: current insurance status, number of vehicles, homeownership status, age and ZIP code.

The downside? With such limited information, Policygenius doesnít actually provide you with ready-made quotes. Instead, it provides you top choices, but youíll have to do the legwork on each recommended insurerís site to get your actual quote.

While Policygenius makes the most sense for life insurance, I find Gabi and Insurify to be superior for car insurance.

Shopping for Home and Auto Insurance at the Same Time

One cool feature about Policygenius is that, when you go to shop for home or auto insurance, the site automatically recommends that you shop for them together, as youíll find better deals when bundling. If youíre not interested, you have the option to bypass this ó but with a graphic as cute as the one below, why would you?

Using Policygenius for Other Needs

In addition to whole and term life insurance, home insurance and auto insurance, you can use Policygenius for travel insurance, pet insurance, renters insurance, health insurance and more. Outside of insurance, Policygenius provides wills and trusts for as little as $120. The site also features plenty of financial advice for taxes, retirement, mortgages, investing and more.

What We Like About Policygenius

Overall, I had a very positive experience with Policygenius. Hereís what I liked most about the site:

Itís truly a one-stop shop. While life insurance is the siteís bread and butter and auto and home insurance are also top options, the site truly has everything: from pet insurance to wills to financial advice to travel insurance to health insurance. Itís easy to use, especially with access to live insurance agents. Insurance policies can be confusing; itís nice to have access to Policygeniusí live agents to help out. Even better, these agents donít make commission, so they arenít incentivized to upsell you on coverage you donít need. Itís not a lead-generation site. Policygenius is not affiliated with any insurance companies, so it has no bias in the quotes it provides. It truly shows you the best deals. On top of that, Policygenius only works with companies with an A- financial rating or better, so youíre only seeing top-tier insurers. The calculators and educational content are a hallmark feature. These resources make Policygenius more than just an insurance marketplace. Itís a library of content so you can become a better-educated insurance consumer. Itís a company with values. Whether for appearances or for true moral decision-making, Policygenius puts an emphasis on diversity in its hiring practices, as advertised on its Careers page. In addition, Policygenius offers great employee benefits and makes the Golden Rule part of its mission statementĖtreating employees and customers with the utmost respect at all times. Plus, they love dogs and encourage employees to bring them to the office. Thatís a plus in my book! Itís highly reviewed. Weíll touch on customer reviews of Policygenius below, but I was happy to see that customers have high praise for Policygenius across review sites. Theyíre easy to contact. Policygenius is open seven days a week from 9 a.m. to 9 p.m. ET via phone and has live chat agents 24/7.What We Donít Like About Policygenius

Overwhelmingly, I loved the platform and service. However, there were a few things I discovered while conducting my Policygenius review that Iíd love to see improved:

The auto insurance quotes arenít really helpful. While I loved providing minimal information toward my car insurance quote, the results werenít really helpful. I still would have needed to go to multiple insurersí websites and complete my quotes there. Iíd rather see rough estimates to compare on the Policygenius website. It can take a while for life insurance policies. Because life insurance can be a little more complicated, you need to talk with a live agent, which could mean waiting for them to call. You may even need to provide proof of a medical exam to lock in your premiums. On average, getting your life insurance policy could take about four to six weeks. This really slows down what is meant to be a fast, digital experience. Itís not designed for true introverts. One of the reasons I love to buy insurance online nowadays is because I donít have to talk to agents. Like any true older millennial, Iím old enough to know what it was like to have to order food, make travel plans and, yes, buy insurance over the phone, but young enough to know how much easier it can be to do it all online. Not to mention, Iím pretty shy, so I love when I donít have to talk to a stranger on the phone. Unfortunately, Policygenius is really built around you needing to eventually talk to a live agent, one way or another. You donít see the full spectrum of insurance companies. I mentioned that Policygenius only works with top-tier insurance companies. Generally, I see this as a good thing. But if youíre really using Policygenius to find the cheapest policy, then youíre at a disadvantage, as your quote results wonít show you more affordable policies from less-than-stellar companies. I would argue that you probably donít want to work with said lower-tier companies, but if poor customer service and shady business practices donít bother you if it means lower prices, Policygenius may not be right for you.Customer Reviews

Policygenius is very well liked in the market. The company currently has 4.66 stars out of 5 on the Better Business Bureau (BBB) website, based on 149 reviews. Itís got a comparable 4.7 stars out of 5 on Trustpilot based on 1,921 customer reviews. Reviewers compliment Policygeniusí customer service, ease of use and transparency.

The Bottom Line

Policygenius is a great resource for learning about life insurance, car insurance, auto insurance and more. Itís also a great place to actually start the process of shopping for life insurance. I recommend other sites over Policygenius for auto insurance, but for life insurance policies specifically, it may be the best in the business.

Policygenius is known for its leading customer service, its easy-to-use platform and its online calculators. If youíre starting the purchasing process for life insurance, I highly recommend giving Policygenius a shot.

Timothy Moore is a market research editing and graphic design manager and a freelance writer and editor covering topics on personal finance, travel, careers, education, pet care and automotive.†

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.