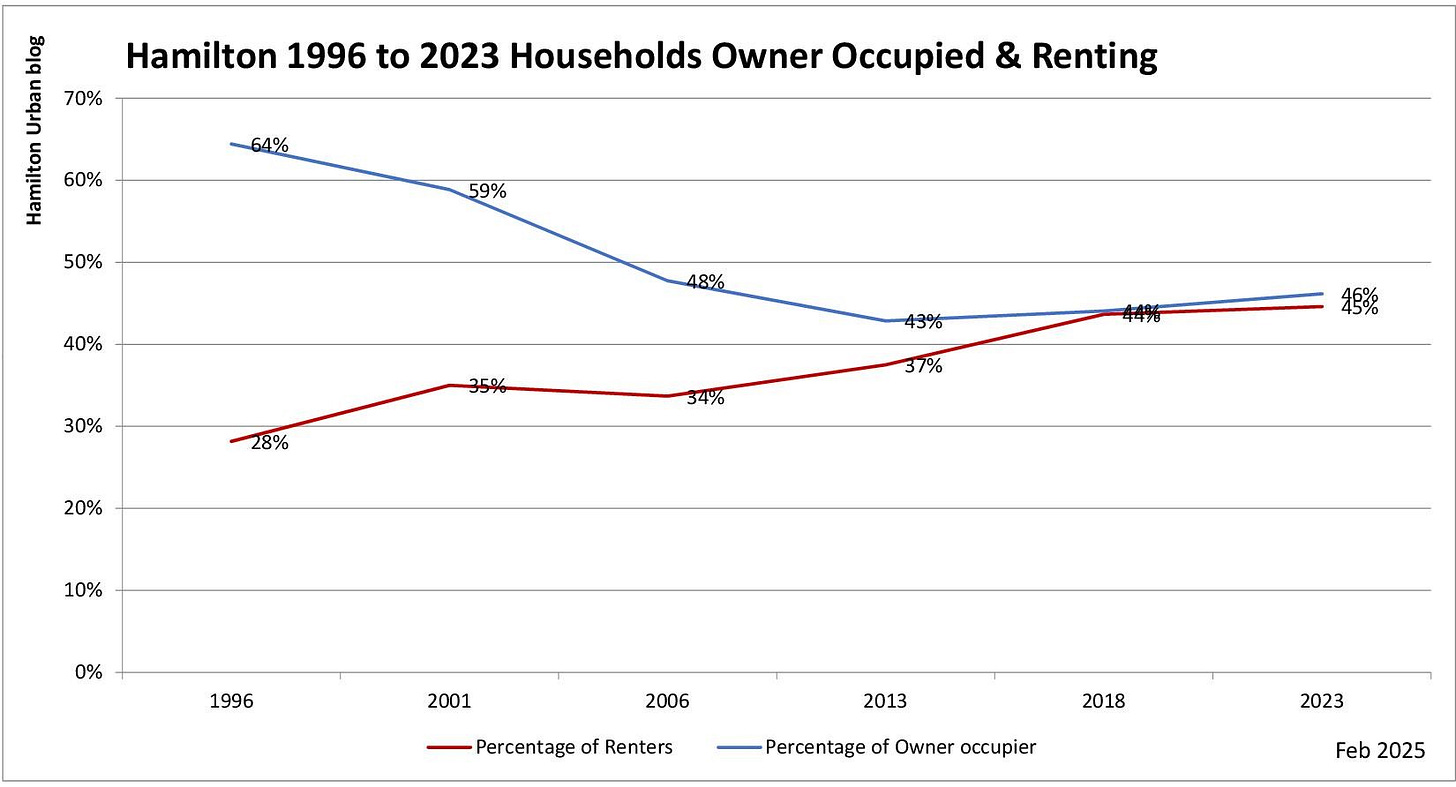

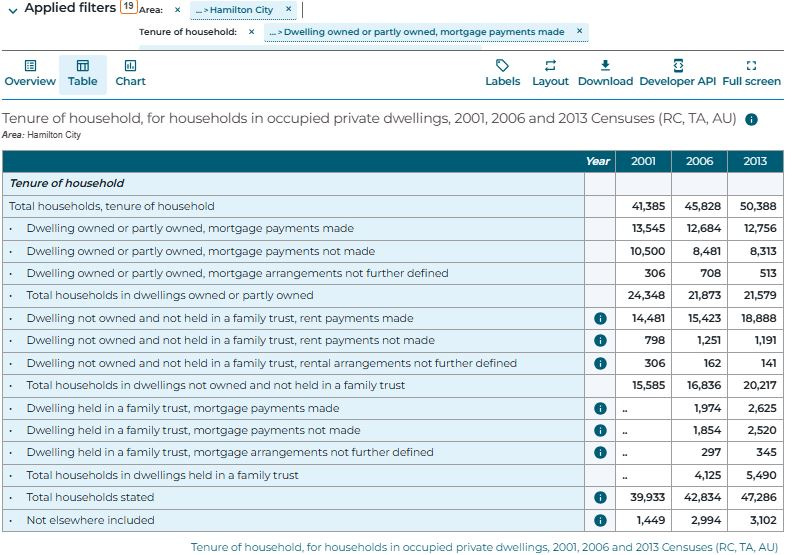

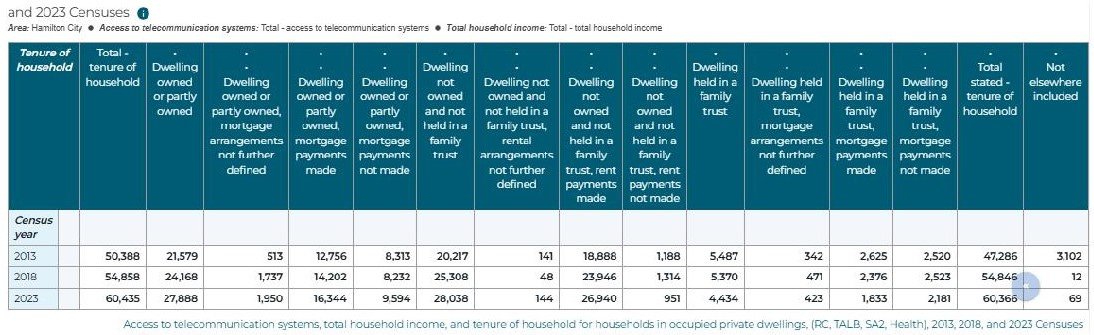

Hamilton’s census 2023 rate of 46.1% for owner-occupied homes is very low by international standards.

Hamilton’s census 2023 rate of 46.1% for owner-occupied homes is very low by international standards. In the table below only Switzerland at 43.9% has a lower owner-occupied rate. The fact that 44.6% of Hamilton’s homes are rental housing is also very high by international standards. Again, Switzerland at 56.1% and Germany at 46.6% are higher (Table below). In the UK, ‘[in] Wales based on the 2021 census, 66.4% of households own their homes and 33.6% rent, and in Northern Ireland, 65.2% of households own their home and 34.8% rent. In Scotland, 58% of dwellings are owner-occupied and 38% of dwellings are rented (based on 2020 figures)’ (link *Full Fact).

* Full Fact - Do more people rent or own their home? Feb 2024

Hamilton, with 45% of its population living in rental housing, is high going by the list above. At city level more extreme examples can be found, for example in ‘Vienna, where public housing accounts for nearly 60 percent of the housing stock’ (link France24), about 85% of Berliners rent their homes, (link Reuters), in Paris 65% of residents rent (link The Standard) and in London ‘31% were private renters in 2022/23, and 21% were social renters [making a total of 52%]’ (link *Full Fact).

Reuters - Berlin's renters face more misery as housing crisis deepens – Nov 23

All communities need a level of rate / tax-payer subsidized housing, but when cities think passing such housing to non-council / government agencies will reduce long-term cost, they are mistaken. For example, in Berlin before ‘the 1989 fall of the Berlin Wall the city had a housing glut that lasted decades .... Both West and East German governments poured money into building accommodation, reflecting the city's place at the centre of competing Cold War systems. It was a divided city and the whole of Berlin was subsidised ... In 2004, the City of Berlin sold its indebted social housing unit and more than 65,000 apartments, to Goldman Sachs and private equity firm Cerberus’ (link Reuters), and ‘now has a vacancy rate of less than 1%’ and with Berlin having had rent controls ‘New construction hardly makes sense for many projects these days, because with 5,000 euros per square metre and 4% interest, someone has to finance it ... the bank, say ... come back when you've done the calculations again, because you can't even earn/pay the interest from the rent’ (link Reuters). In Paris - ‘by 2035, the city aims to ensure that 40 percent of its housing stock is public, with 30 percent dedicated to social housing’ (link France24).

Housing crises are centuries old: in the 1880s – 1890s Germany’s ‘would-be reformers had to face the fact that they were calling into question the ability of the free and private market to house the poor decently’ (p.145**) ... ‘the most popular solution of the day was the non--profit building society ... It was generally acknowledged that they had had no great impact on the housing shortage (p.147**) ... authorities, pressured the city[cities] into guaranteeing the loans that it provided to non-profit building societies ... [other incentives] included reduced taxes as well as zoning advantages for small houses, land sales to building societies, and a municipal mortgage program (p.160**) ... [The city of Ulm] decided that neither private non-profit nor for-profit companies were capable of providing decent housing ... in 1894 [it decided to] borrow money to finance the construction of sixteen duplex houses with gardens that would then be offered for sale ... During the following twenty years the city continued to build and sell additional houses (p.171**) ... In selling them the city always reserved the right to buy them back – a right it was prepared to exercise if a house became the object of speculation’ (p.172**).

**Urban Planning and Civic Order in Germany, 1860—1914: by Brain Ladd - Chp5 - The “Housing Question” and the “Social Question” p.139-185

The greatest risk to future rate / tax payers happens when large numbers of people reach retirement age and are still paying a mortgage or renting. At this point the banks and landlords become dependent on the tax payer to fund the housing they provide. Many of these people do not have the option to buy ‘licence to occupy’ housing as provided by corporates such as Bupa and Summerset ... without Government (via tax payer funding) guaranteeing end of life funding.

Posts on 2023 Census - median incomes, Age, Density, Renting, Home ownership

Snap shot of Census Data

End